Contactless took off – but it’s not too late to catch up

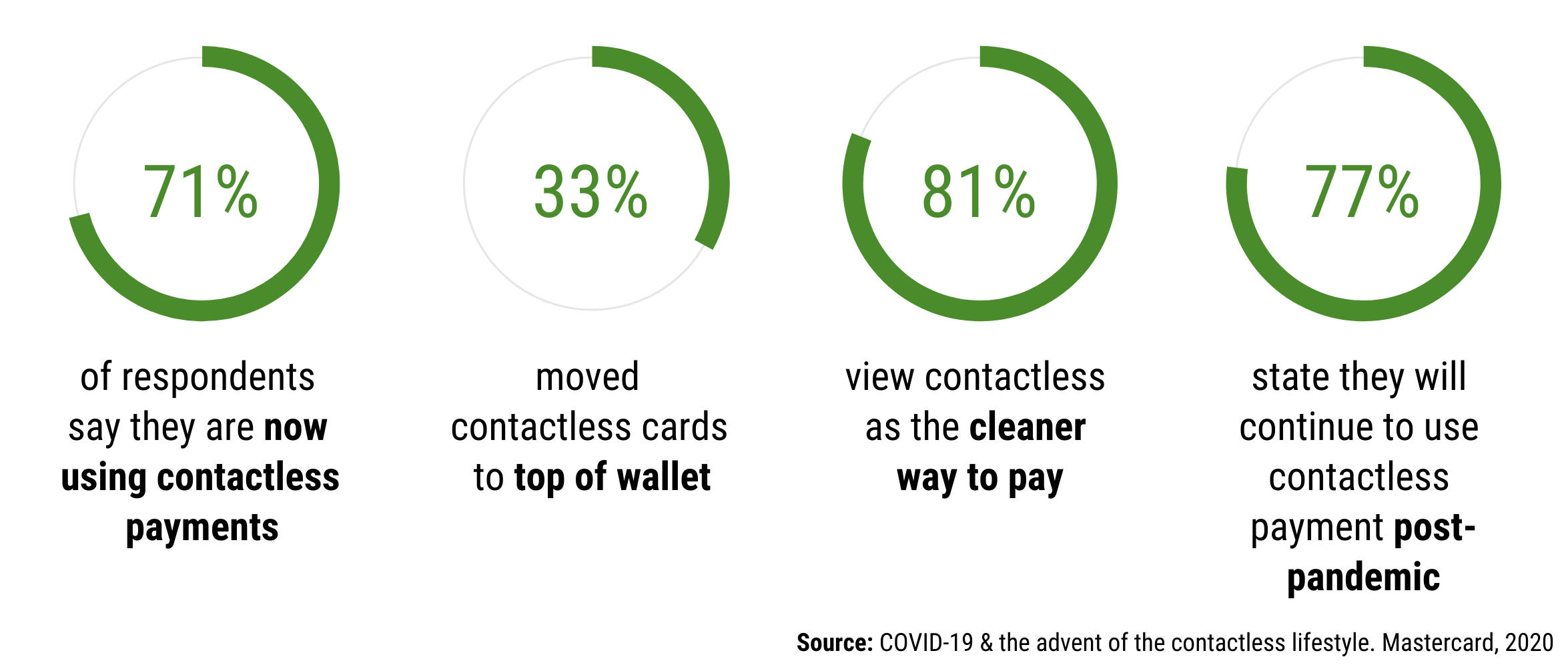

During our recent webinar, New Contactless Payment Trends and Best Practices, we covered how contactless trends are shaping in light of accelerated contactless adoption expectations from consumers. Until 2020, we have been focusing on contactless transactions growth by emphasizing functionality and speed. With the impact of Covid-19 and increasing health concerns around any type of physical interactions, consumers increasingly wanted a quick and contactless way to pay for the goods and services they are purchasing. As a result, contactless transactions grew more than twice as much than other card present transactions. 71% of consumers now say they use contactless payments, viewing contactless as a trusted and cleaner way to make their daily purchases.

With adoption of contactless, US issuers with active contactless portfolios saw 10% to 16% lift in cardholder spend. This is due to the convenience and the tapping habit that is formed. A recent Mastercard study found that cardholders who tap at more than 2 times in the first month of activation continue to use contactless long term. In turn, habitual tappers spend up to an additional 25% per month in incremental spend compared to non-habitual tappers. Contactless drives top-of-wallet behavior through an improved customer experience at checkout with its ease, convenience, trust, and safety.

During the webinar we also asked participants whether their organization issued contactless, and if not, why. 41% of respondents said they haven’t started issuing contactless, 20% relied on mobile contactless, and 30% stated less than 1/10th of their portfolio is contactless.

continue reading »