Coronavirus destroyed your credit union’s marketing budget. Here’s what to do about it

Part of a marketer’s job is to be creative. It is equally, if not more important, for credit union marketing to help the credit union reach its strategic goals through creative ideas.

That has always been the case but heading into 2021, it’s critical for marketers to understand and be able to demonstrate just how important a role they play in a credit union’s ability to thrive.

But wait, there’s more.

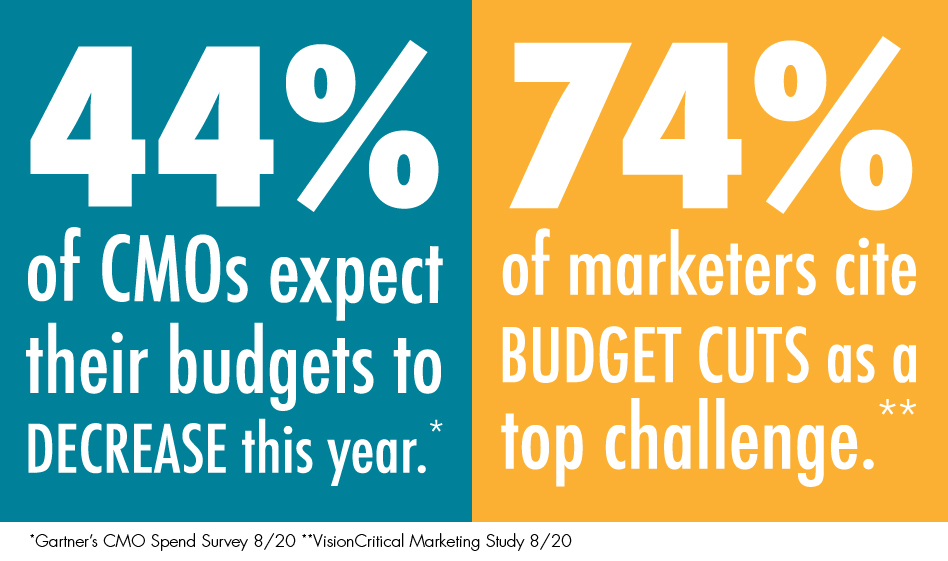

Not only will expectations of marketing be high, but also pressure to perform spectacularly with fewer resources to accomplish those goals. Before the finger pointing begins (CFO says marketing is an expense, and marketing says CFO is a cheapskate), let’s get one thing straight: Marketers must have a top-level understanding of balance sheets and income statements to perform their jobs effectively.

When citing specific brand metrics to the leadership team or board, marketers must be able to clearly demonstrate why they are important to the credit union’s overall success, measured as loan growth, membership growth or other KPIs the credit union leadership designates. In conference speaking engagements, I often ask credit union marketers what the most important brand metric is and why. Too often I get a vague answer such as, ‘We want to move the needle,’ or ‘We want brand recognition,’ that doesn’t connect back to financial success. If it didn’t convince me, it won’t convince the CEO or CFO why their role and marketing budget is necessary to the credit union’s future growth.

Before cutting your marketing budget, consider these three pivots to your strategy:

- What are you doing about business development? Have you replaced in-person SEG visits or community events with a virtual form of engagement? Good news! Virtual events will cost less both in time and resources. Challenge your marketing team to get creative. Members Credit Union has been hosting virtual parties that feature financial education, prizes, and brand engagement opportunities. Don’t give up on business development. Just get creative in how you are engaging with members (and potential members.)

- Get social. Now is the time for your marketing team to take your credit union’s social media strategy beyond National Taco Day posts linking back to your credit union’s car loan rate promotion. From the same Gartner survey cited above, 56% of marketers surveyed have increased investment in organic social and 39% have increased their spend in paid social. Take advantage of social media to share a specific message at the right time. As many branches remain closed and the ability to engage with members in-person is limited, let your social media content fill the void. Find opportunities to humanize your brand and encourage members to build a relationship with your credit union. Build community. If content marketing has not been a part of your marketing plan, it must be in 2021.

- Change your sales and marketing funnel. This is something we spend a good deal of time on during credit union strategic planning sessions. Develop a better handle on where your credit union’s leads come from to properly invest your limited marketing dollars for the best return to the credit union. If you haven’t clearly identified your legacy and ideal member, understanding exactly how and when to reach them in their decision making process, you’re just throwing spaghetti at the wall and hoping it sticks.

Successful marketers work hand in hand with the financial brains of the leadership team to save their budgets and grow their credit unions the best they can during times of economic hardship. You’re on the same team!

If your credit union’s marketing isn’t hitting the mark, leaving you frustrated and overwhelmed, maybe your strategy needs a reset. Doing the same thing over and over and hoping for different results just doesn’t make sense economically, intellectually or emotionally. Your Marketing Company has spent more than a decade partnering with strategically focused credit unions using a unique, time-tested action plan that brings clarity and breaks down barriers, leading to growth and the realization of your goals.

Let this be the opportunity you’ve been looking for to break out and grow.