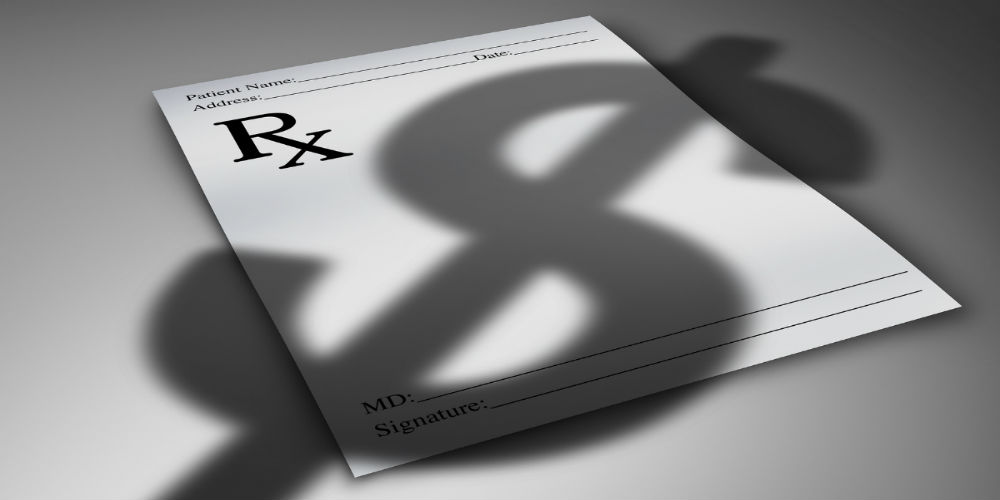

Credit unions a cure for medical debt?

In the credit union world, we hear a lot about credit card debt, mortgage debt, and student loan debt. There seems to be a constant stream of articles about how to get yourself out of these kinds of debt, but while those are important issues, there is little to no talk about the leading cause of bankruptcy in the United States; medical debt.

According to a 2012 health insurance survey by the Commonwealth Fund, 75 million people or 41% of working aged adults experienced medical bill problems. The same survey found that 48 million or 26% of working age adults had a medical debt or were paying off a medical bill over time.

What exactly is medical debt? Well, it’s a personal debt incurred for medical services or for medical products which may be owed directly to a healthcare provider like a doctor’s clinic or hospital, or to an agent of the provider.

People who have medical debt often have no idea where to start, or are so afraid of their debt that they just avoid dealing with it.

In a study conducted by NerdWallet in 2013, they found that, “While we are quick to blame debt on poor savings and bad spending habits, our study emphasizes the burden of health costs cause widespread indebtedness. Medical debt can completely overwhelm a family when illness strikes.”

This information demonstrates just how many people around us may have medical debt controlling their lives. It presents a dire need for credit unions to meet their members where they are in life, and to understand that they may be experiencing broader financial problems because of medical debt.

Credit union staff are in prime position to help their members resolve the financial burden of carrying medical debt. It’s time we get the discussion going about this leading cause of bankruptcy, and work together to understand how we can better serve our members.

This is the sole purpose for the National Credit Union Foundation creating a Medical Debt Toolkit, a free resource guide for credit unions. It provides the necessary tools for credit union staff to identify medical debt issues, and to help members decrease or resolve his/her debt.

This toolkit reinforces the credit union philosophy of people helping people. Helping a member through medical debt can and will change their life.

By keeping purpose constant, credit unions can continue to set themselves apart from other financial service providers. As long as we continue to put the member first, we can strive to help our members achieve financial freedom from issues such as medical debt.