CUNA witness: Access to financial services is vital for business

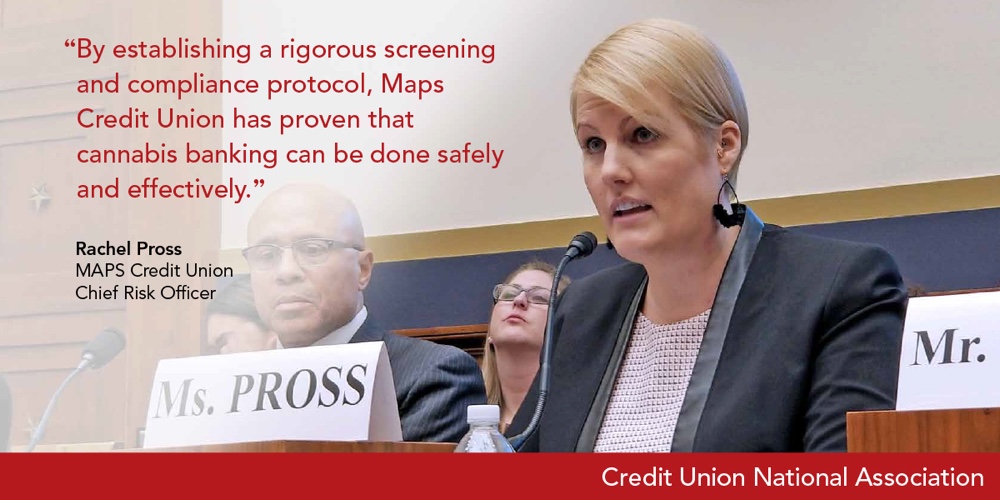

Maps CU Chief Risk Officer Rachel Pross testifies before the House Financial Services subcommittee on consumer protection and financial institutions Feb. 13.

Maps CU Chief Risk Officer Rachel Pross testifies before the House Financial Services subcommittee on consumer protection and financial institutions Feb. 13.

Allowing legal, cannabis-based businesses to receive mainstream financial services comes with challenges, but also community benefits, CUNA witness Rachel Pross told a House subcommittee Wednesday. Pross, chief risk officer at Maps CU, Salem, Ore., testified before the House Financial Services subcommittee on consumer protection and financial institutions on access to financial services in places where cannabis is legal.

After Oregon voters decided in 2014 to legalize recreational cannabis (medicinal cannabis having been approved in 1998), Pross said Maps’ board conducted “extensive research and risk analysis” before voting to serve cannabis businesses.

She said the reasons were twofold: 1) to serve the underserved; and 2) to enhance the safety of the community by getting large amounts of cash off the streets.

“Today, we bank approximately five hundred state-sanctioned cannabis businesses. That makes our program one of the largest in the U.S.,” she said. “In terms of safety, statistics show that cash-only businesses increase the risk of crime. This is especially true in the cannabis sector given the lack of access to basic financial services…in the past two years, we have received over $500 million in cash deposits from cannabis businesses. That’s $500 million removed from Oregon’s sidewalks that used to be carried around in backpacks and shoeboxes by legitimate, legal business owners.”

continue reading »