Data is the critical component for improving member experience

Credit union leadership clearly understands the business model that has worked in the past is not the formula for success into the future. Yet, community financial institutions are continuing to have a difficult time adopting data analytics into marketing decision making. This is especially true for smaller institutions.

More than 4,000 credit unions (of the total 5,637) are less than $100 million in assets and often lacking in financial and human resources. For them the use of big data, artificial intelligence, advanced analytics and cognitive computing are not just buzzwords tossed around by vendors and consultants. More than half (54%) of credit union leadership surveyed by Market Force stated these were strategic objectives for 2019, but this is just a pipe dream for smaller credit unions, which are already declining in members, loans and savings. Or is it?

As consumer preferences shift with the demographic landscape and new service delivery options expand with technology, credit unions are increasingly challenged to build the right core competencies to create a more seamless member experience. One of the misconceptions by the leadership of these institutions is that the solution is simply a plug-in for their existing organizational structure and culture. The strategy has to focus on creating a relevant member experience, increasing member longevity and relationship depth (and revenue), which means every aspect of your organizational structure and culture needs to support this objective.

To face this challenge, credit union leaders need a more complete picture of their members: who they are, their motives for using their institution, their service preferences and what they need from you now and in the future. This data supports long-term, strategic decisioning, as well as providing a foundation for more effective member acquisition and better service to existing members.

Research published in 2017 by the Financial Brand indicates that less than 9% of financial institutions under $1 billion in assets do not have any type of formal member analytics functionality. Based on our own informal survey, less than 5% of credit unions with less than $500 million in assets have a data strategy. So, the question remains: How can leadership in smaller credit unions access a member analytics platform that supports member insight and the cultural and organizational evolution that supports a more member-centric business model?

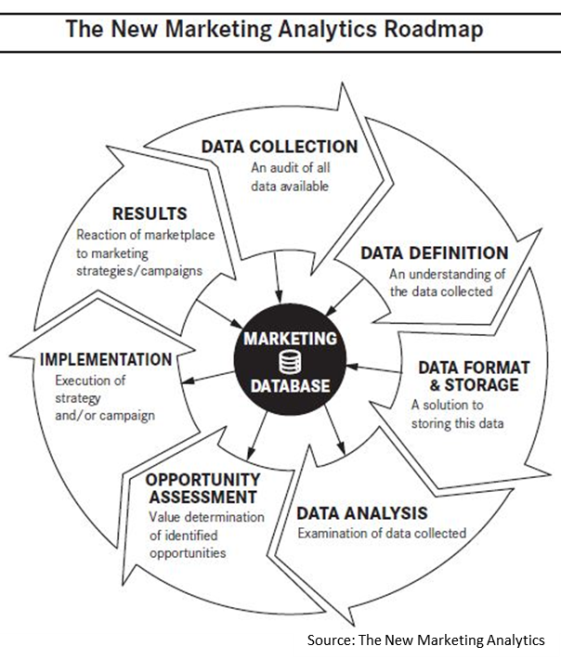

Credit unions embarking on data analytics programs require a strong implementation plan to ensure the analytics process works for them. Projects of this scale are often difficult for smaller credit unions to get started. The New Marketing Analytics Roadmap, the illustration, is a basic project and process template for managing your resources and setting expectations for a project of this scale.

- Data Collection — An audit of all data available. Finding and identifying every source of data – member-related or not – is the first step on the road to making data work.

- Data Definition — An understanding of the data collected. Make sure to understand all the parameters of the information uncovered and match up.

- Data Format and Storage — A solution to storing data. Enterprise-wide data is traditionally stored in relational databases, which are structured in tables that can join with other tables in a carefully defined way.

- Data Analysis — Examination of data collected. Apply statistical techniques to evaluate and refine data to spot trends. Distinguishing between data that has value and data that is not useful.

- Opportunity Assessment — Value determination of identified opportunities. As your team creates a list of possible solutions, this step will evaluate each possible solution on the basis of ROI and match it to strategic goals.

- Implementation — Execution of strategy. Resources, budget, success criteria and timing have all been established. Now the work begins, including a hands-on approach to using data and growing this capability in a more organic manner.

- Results — Reaction of marketplace to marketing strategies/campaigns. As implementation progresses, adjustments to the strategy are made based on unforeseen consequences.

As you proceed through the template the process will become much more personalized based on your objectives and the credit union’s core competencies. Following this general process can provide direction and a general framework for evolving your organization into a more member-centric business model. Buy-in from all member departments and leadership is critical for success. Remember progress might be slower than management would like, but it will be real change that fundamentally evolves your organization.

Co-Authored by: Sarah Snell Cooke is principal at Cooke Consulting Solutions, a communications and business development firm serving business partners in the community financial institutions market. She has 20 years of experience in the credit union community, more recently as publisher and editor-in-chief of Credit Union Times, leading the publication to two consecutive years of record revenue and profits. Cooke also serves as secretary of the board at $487M APL FCU and is co-chair of the DC Sister Society of the Global Women’s Leadership Network. Cooke holds an MBA and a Bachelor of Arts in political science with a minor in journalism.