Does your credit union need a digital marketing assessment?

You go to the doctor for three reasons:

- You hurt (Pain)

- You need a yearly physical (Preventative maintenance)

- You are following up per the doctor’s orders (Ongoing treatment)

Depending on the reason for your visit, the doctor may run a variety of tests.

If you are in pain, the doctor picks, pokes, and prods while asking probing questions to get a better understanding of what is hurting you.

If you visit the doctor for preventative maintenance, he will run a various set of tests and ask different questions to make sure you are healthy. Sometimes during these visits, the doctor may discover you have a problem you were not aware. And because you caught the problem early, it may be less likely to give you trouble down the road.

Finally, you visit the doctor to follow up. When you are in pain or when doctor finds a problem that, when left untreated, could lead to a greater problem, the doctor prescribes treatment for you. And sometimes, this treatment requires additional visits to ensure the treatment is working as prescribed.

Don’t wait until it hurts

While we should visit the doctor at least once a year for an annual physical, that is not always the case.

Sometimes we think we are healthy. We eat right. We exercise.

Other times, we think we are just too busy with life or lack the knowledge about the importance of an annual checkup.

Overconfidence, or lack of awareness, can end up hurting us more in the long run because many times, we only see a doctor when we hurt or have pain.

And by that time, irreversible damage may have already been done. Delaying a professional opinion could also extend the treatment and cost more than if the problem was caught earlier through preventive maintenance.

Digital marketing hurts credit unions

With our focus on credit union digital marketing strategy, we find digital marketing has become an internal painpoint. Credit unions are hurting as executives realize the traditional marketing and acquisition business model built around branches and broadcast is no longer applicable for evolving consumer buying behaviors.

For example:

- The average consumer visits a branch only 3.2 times per year (Bank 2.0).

- 88% of millennials want to avoid visiting a bank branch (Chime Card).

- 50% of consumers report searching exclusively online for financial services products (Filene).

- Most prospective customers in the branch have also shopped online (Filene).

- 74% of bank customers consider their banking relationship to be transitional rather than relationship drive (Accenture).

- 70% of consumers research a checking account online before applying (Filene).

- 61% of consumers research a mortgage online before applying (Filene).

- Consumers are typically first drawn to a specific product before settling on the right bank or credit union (Filene)

- The average consumer takes 30-45 days, if not longer, when making a decision to open an account. And during this time period, they use nine different resources in their decision-making process (Google ZMOT).

- Consumers are five times more likely to buy when education comes first as opposed to a direct product offer (Next Media).

How healthy is your digital marketing?

Like visiting the doctor, credit unions contact us for help with their digital marketing for three reasons:

- They hurt (Pain)

- They need a yearly physical (Preventative maintenance)

- They are following our recommendations (Ongoing treatment)

Through our primary and secondary credit union digital marketing research, we have found 70% of banks and credit unions DO NOT have a defined digital marketing strategy. And without one, credit unions will be blindly navigating through their digital marketing journey.

Furthermore, the average score of banks and credit unions who have taken the CU Grow Quick Digital Marketing Assessment is 24% out of 100, far below a passing grade.

Want to find out how you compare to other banks and credit unions?

Take about five minutes to complete the CU Grow Quick Digital Marketing Assessment.

We will then follow up to share your CU Grow Digital Marketing Score and show how it compares to other banks and credit unions.

11 key strategic planning questions to ask yourself

Once you take the CU Grow Quick Digital Marketing Assessment and receive your Digital Marketing Score, ask yourself the following questions as you plan for a new year:

- How does your digital marketing compare to other banks and credit unions?

- Have you defined your digital marketing goals?

- Have you established an appropriate budget required to achieve your digital marketing goals?

- How do your consumer personas and market segments go beyond basic demographic data?

- How do you differentiate yourself from others who promote “great rates and services?”

- What staff and processes are needed for you to achieve your goals for growth?

- What digital journeys have you documented to guide consumers through their buying cycle?

- What marketing technology platforms do you need to achieve your goals for growth?

- What process do you use to produce digital stories that emotionally connect with consumers?

- What distribution channels do you need to communicate with your key consumer segments?

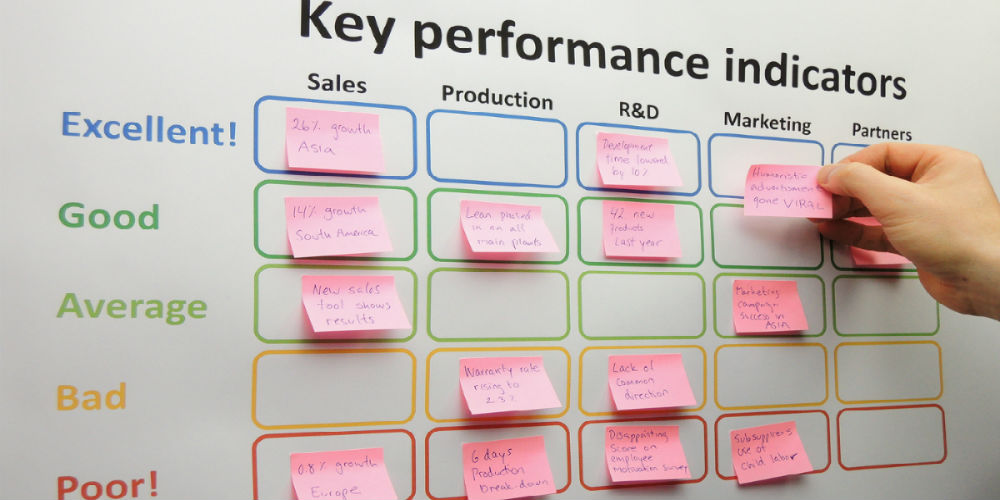

- How do you quantify digital marketing success with KPIs tied back to your goals for growth?