Five keys to a strong complaint management program

by: Rebecca Drebin

Complaint management used to be so simple. Perhaps your institution looks back fondly on the days when complaints were usually over the phone about a billing issue. But in this day and age, customers, members, and even employees have a cornucopia of complaint outlets, such as Facebook, Twitter, Yelp, and of course, the CFPB’s complaint database or even your institution’s own website. In this era of prolific information sharing, consumers are complaining in more ways than ever before. That’s why every institution needs an effective response system. Here are five key points to assist financial institutions in accomplishing this task.

1. Perform a Risk Assessment

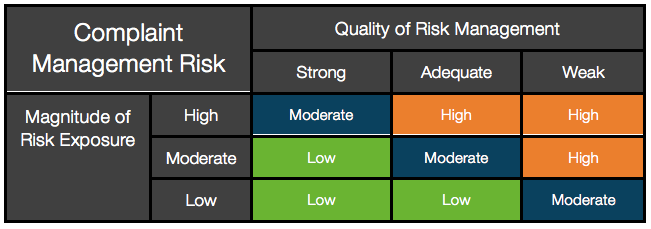

Every institution needs to—as we like to put it—know who they are. It’s important to know where your institution already stands relative to complaint management. This includes understanding your overall risk profile based on assessments of both your magnitude of risk exposure and your quality of risk management (see Figure 1). The gap between the two is your residual risk. It’s impossible to overemphasize the importance of a risk assessment. If, after evaluating these factors, you discover that your institution’s residual risk is high, you will need to focus on developing strong complaint management procedures. If your residual risk for this area is low, either your program is already working well, or you have a lot of happy customers or members. If the latter is true, it’s still a good idea to work on developing a sound complaint management policy, because in this day and age, it doesn’t take much to send a customer or member on the warpath.

2. Discover Expectations

Secondly, before you can really start to improve your policy, it’s important to know what’s expected from both examiners and consumers. This means you need solid, up-to-date knowledge of regulations, and a knowledge of which parts of these regulations examiners focus on. For example, when you’re creating your Complaint Management Policy, it can be a good idea to take a look at the CFPB’s examination guide, so it incorporates preferred practices that your institution would ideally have in place.

continue reading »