Five strategies for reinventing your credit union during the crisis

As leaders, we all feel torn right now. We yearn for normalcy and to be able to do what has worked for us previously. That could be the annual planning retreat, regular in-person and virtual board meetings, lots of internal meetings with staff and partners, and fostering an organizational culture that rewards results and celebrates milestones. But wait, we’re still in a crisis, right? Should we be focused on “mission-critical” priorities or should we be talking about how our world has changed and then move with speed to reinvent the way we do business?

I recently read an article in the Harvard Business Review by David Lancefield titled, “How to Reinvent Your Organization in the Middle of a Crisis.” Its relevance was striking to me personally and as I think of what credit unions are going through right now. Our leadership teams and staff are all working in a unique environment that, for most of the country, is exacerbated by terrible winter weather conditions. Literally and figuratively, we may feel a bit “hunkered down.” And yet, we can’t afford to be complacent in such a fiercely dynamic and competitive environment. As we come out of the cold dark winter, we should have aspirational plans that build us up and grow together.

So what does it mean to reinvent our organizations, even though we are still in the middle of a crisis? It means that, now as we see the end of winter coming, and as we look for some calm after the storm, we should pivot to become more strategic about the important priorities that lie ahead – armed with learnings that make us more resilient for future challenges.

Lancefield suggests five strategies for building a more resilient organization post-COVID. I add my perspectives related specifically to credit unions and credit union organizations. The five strategies are:

- “Call Time” on the Crisis

- Refresh Yourself and Others

- Take a New Look at the Landscape

- Act on the Learnings

- Deliver on Your People Promises

The first strategy of “calling time on the crisis” suggests that at some point we acknowledge that the pandemic isn’t going to have a neat and tidy ending. There will long be lingering issues associated with employee and member health, finding the right balance with work from home policies, the speed with which credit unions capitalize on more remote service delivery and achieving a better understanding of how members want their service needs met.

All of this requires that we call “time on the crisis” in terms of a hard pivot toward the implementation of steps to deal with these very real forces that will require a reinvention of the current business model.

Rob Bava, CEO of Michigan-based Community Choice Credit Union recently let his staff know, that despite the challenges of the pandemic, 2020 was one of the best years ever for the credit union. Early on, he also let his team know that one of his personal goals was to help every one of them keep their jobs. This healthy dose of positive perspective is helping Community Choice get on with business despite the stresses of the crisis.

Communicating this perspective might include four elements: Recognition, Honesty, Aspiration, and Commitment.

- Recognition: Community Financial Credit Union CEO, Bill Lawton says, “When our members and communities are hurting the most, that’s when credit unions shine the most. That’s when we can make the biggest difference.”As leaders, we need to show gratitude for the sacrifices and difficulties endured by our team members and in some cases, for the trauma and grief they’ve experienced. Some of them have lost family members and friends to the pandemic. And while health care workers are worn down by the health impact of the virus, credit union frontliners can become exhausted by the financial stresses of the membership that they are trying to heal and help with. Leaders throughout the credit union need to call out and recognize the unsung heroes and applaud the extraordinary work being done.

- Honesty: Every week I interview credit union leaders like Al McMorris, CEO of Vibe Credit Union. We talk about organizational culture and leadership priorities. Allan has made a career of making honesty, transparency and a caring leadership style part of his organizational culture. I hear repeated calls for authenticity and empathy as the most important leadership traits and the emphasis on creating a sense of family at the credit union where everyone has each other’s back.

- Aspiration: Leaders like Vickie Schmitzer of Frankenmuth Credit Union know how to inspire. She says, “When you’re part of something good, and you believe it in your soul, and you pass it on to others, it’s just something that takes off like wildfire.” That sounds so endemic to the credit union way of doing business. But as CEOs try to shed the label of “super CFO” during financial restructuring, it’s so important to also project transparency and sensitivity to how people are feeling. Credit unions are in a unique position to give employees reason to aspire to contributing to the greater good of those whom they serve.

- Commitment: Tiffany Ford, CEO of University of Michigan Credit Union says, “Each team member, each person needs to know, that from the very top of the organization, they are valued.” Leaders now need to commit to acting on the lessons from the crisis, developing new norms, and preventing unnecessary practices from the pre-crisis period from creeping back in. Creating a cross-divisional team to assess lessons learned and practices that can be institutionalized for efficiencies and for working together better is so important now. CU Solutions Group has set up a Working Together Better task force that will look at operational efficiencies, improved meeting practices, smart use of technology and the design of future facilities and meeting processes. We hope to learn a lot from our team to help us reimagine our future organization.

Backing up this communication with actions that signal a de-escalation of the crisis is also important. This might entail changing up the composition of the leadership team in order to bring in more strategic expertise or diversity, perhaps reducing the frequency of meetings, and placing a greater emphasis on the reinvention of our business model. Inviting input on these issues and following through can send strong signals to the team that we’re moving past the crisis with confidence.

A second important strategy for reinvention is to refresh yourself and others. The CEO and leadership team need to find “moments of decompression” and find ways to share the workload more widely. This might mean restarting an exercise and diet regimen, delegating more, or being judicious about taking on new initiatives. It really means focusing energy and time on focusing on the highest-impact activities. And this has to cascade through the credit union.

Starting with the leadership team and then through monthly one-on-one coaching chats, the whole organization should be asking at least these three questions according to Lancefield. They are: 1)how are you feeling; 2)What do you need to replenish your energy and perform at your best; and 3)what do you need from the team or elsewhere (for example additional training or improved communications) to do this?

The CEO and leadership of the credit union need to be more committed than ever to employee well-being as they pivot to take on a post-COVID work environment that will almost certainly include a hybrid work from home model that is accompanied by a new set of employee wellness challenges.

A third strategy for reimagining the organization is to take a new look at the landscape. This sounds like Strategic Planning 101, but it may be more important than ever given the significant sea-shift that we’re experiencing. Perhaps most important in this process are the learnings regarding credit union member financial services preferences. Post-pandemic, consumers may be more demanding of excellent remote service delivery quality for example. Credit unions should be looking at artificial intelligence products that help reduce call center and branch wait times. Mobile banking, websites and remote borrowing processes need speed and improved user experience more than ever.

Relatedly, finding tools to help monitor and improve member experience represents an investment that credit unions will simply need to make.

Some of the planning questions that will need to be addressed include:

- Where can you best use your strengths and capabilities to meet members’ changing needs?

- What would you have to believe in order to do this? (i.e., getting team engagement and understanding of the key strengths)

- What would you need to do in order to enable this (i.e. investments in technology and training)?

- How much of a change in strategies and capabilities systems will this represent?

- What will you need to stop doing in order to create bandwidth for the new priorities?

- Where are you now most exposed in terms of risk management, including business retention risks and what will you need to do to mitigate those risks.

In reassessing the landscape, credit unions should always look beyond their member and community service priorities. For instance, striving to support broad-based vaccinations by encouraging members and employees to participate, represents a societal need that has external implications for the speed of the economic recovery. What must the credit union do to support this? Another example might be the understanding of the unique needs of urban areas and financial inclusion and then acting to position the credit union to better meet those needs.

The fourth strategy for reinvention is to act on the learnings. I mentioned that CUSG is trying to assess what we must learn from the crisis to better position ourselves for the future. For credit unions, as consumer-facing service providers, this is even more important.

This process should be one where we communicate effectively with our team members using a diverse SWAT team of people with different skill sets, roles and backgrounds. They could work to help the organization understand questions like:

- When we were at our best, what were the success drivers?

- Which activities do we struggle to do well?

- Where are the obstacles?

- Which capabilities are we missing?

- Where are we most vulnerable now in terms of strategy, people, systems and processes?

- What can we learn from our competitors?

- What did our members and customers tell us, directly and indirectly? (i.e., what matters most in our product suite and member support?)

Engaging in a facilitated process that gathers this information and identifies themes, will help the organization codify and act upon important learnings as we pivot to the future.

The fifth strategy for reinvention is to deliver on people promises. As I meet with credit union leaders, I hear about the importance of honesty, transparency, empathy, listening skills and authenticity. Some leaders have these traits naturally and others work hard to cultivate them. But delivering on the promise of a more human organization should be a top priority for all leaders.

The Harvard Business Review article suggests that this might require at least three important shifts: Moving from initiatives to intervention; from representation to belonging and from mental health support to prevention.

For example, rather than just launching a DEI initiative like our CUSG DEI Impact Team, the organization should walk the talk by changing the way it recruits, develops and rewards people and communicates these changes to staff.

On moving from representation to belonging, professor Ludmila Praslova wrote, “If diversity is being invited to the party and inclusion is being asked to dance, then belonging is being able to reveal that you can’t dance – and still being included.” As a really bad dancer, I can relate to that analogy.

Many credit unions have established support programs for staff suffering from mental health issues, offering counseling helplines, apps and toolkits for team members. This is a best practice that we should all invest in. But now, more proactive measures should be taken as a preventative action by improving workload management, improved coaching processes and better communication skills by managers.

In the end, the message here is that credit unions and support organizations can, and must look beyond the pandemic by employing these five strategies, or your own unique variation of them, to position for the future.

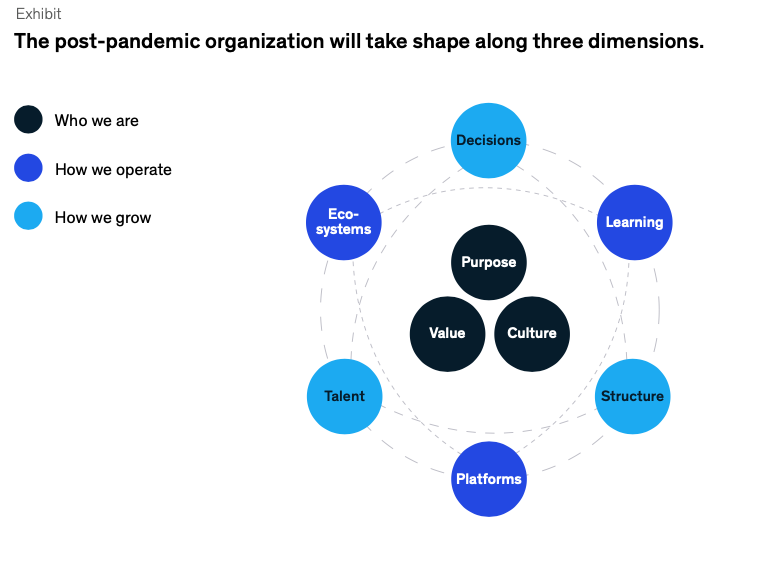

Another great framework for this is described in a McKinsey & Company Quarterly article called, “Reimagining the post-pandemic organization” published in May of 2020. That article suggests a simple framework for reinvention by focusing on, 1)Who we are; 2)How we operate; and 3)How we grow.

For credit union leaders and the teams they lead, now is the time to address these simple core questions with strategies like the five laid out in the Harvard Business Review article:

- “Call Time” on the Crisis

- Refresh Yourself and Others

- Take a New Look at the Landscape

- Act on the Learnings

- Deliver on Your People Promises

I plan to do the same at CU Solutions Group as we look with hope and opportunistic eyes to the future.