How much longer can you get away with ignoring the deposit rate environment?

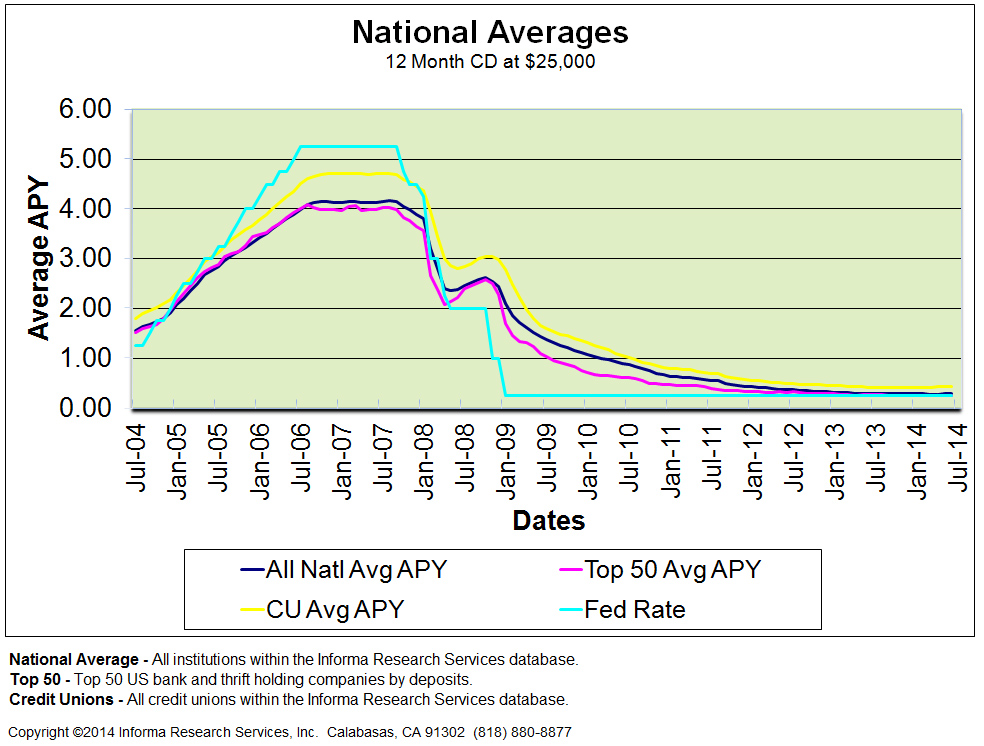

Looking at national average rates offered by financial institutions over the past 10 years, credit unions have consistently offered higher deposit rates than the biggest banks in the country. However, the spread between banks and credit unions varies. The practice of credit unions offering better rates and lower fees to their members is a competitive difference that your members have come to depend upon. Maintaining this advantage is vital and is likely to be a challenge in a rising rate environment. Reinforcing the “credit union advantage” is an important message as banks prepare to launch a deposit acquisition strategy. Even more important, is that the advantage is truly maintained and can be counted on by your members.

It seems like forever since financial institutions gave a tremendous amount of thought to pricing their deposit products. This malaise has lasted for at least five years and sometimes it seems like things may never change. But is that true, or does it just feel that way? Has everyone become bored with their deposit products, or is it just you? And what will happen when things begin to change? Will you be ready with the right offers to keep your members with you?

It is also important we realize that the world is much different than in previous rising rate environments. Your members are far more comfortable accessing financial services through the Internet and their mobile devices, and even looking to non-traditional financial services solutions. There is even greater competition for a share of your members’ wallets.

The sharpest decreases in deposit rates occurred in the two years following August 2007. By August 2009, the decrease in deposit rates had become a slow, yet steady, decrease which continued for the next four years. Each week, rates would inch down a little more.

Can this trend continue? Can deposit rates drop further? Perhaps not. Since June of 2013, the national averages on deposit rates have remained virtually unchanged. It looks like deposit rates have finally hit the floor; a long-hoped-for event for most savers.

As expected in a low rate environment, certain deposit products that are advantageous to savers in a rising rate environment are not being promoted. Over the last five years, the number of indexed money market products has dropped over 20% and the number of CDs with “bump rate options” has dropped about 25%. During this time, advertising spend for deposit products slumped as well. The number of newspaper deposit advertisements overall dropped 36% from a high in October 2008 to a low on January 2013.

But things seem to be changing. Since the beginning of 2014, deposit product newspaper advertisements are up over 30%. This is occurring even though the rate environment hasn’t improved. With rates still stagnant, certain institutions have begun promoting their deposit products. The number of newspaper advertisements has grown significantly.

I don’t believe this is simple optimism. Our deposit researchers have seen evidence of certain large banks preparing for a time when deposit rates finally begin to rise. Deposit product managers at certain financial institutions are looking at historical trends and putting together pricing strategies for a rising rate environment. On the other hand, many banks seem to have become complacent, lulled by this drawn-out low rate environment.

Is planning for the rising rate environment urgent? The deposit rate environment is not volatile and your members have low expectations of deposit rates, at the moment. But keep in mind that not everyone is sitting on their hands. Now may be your opportunity to plan your strategy. When rates start to move up, many institutions will be ready to act because they planned ahead. Your members have patiently waited for an increase in deposit rates. At the first sign of movement, many of these depositors may jump at the chance to improve their rate situation. Don’t be left scrambling for market rate information while your members are packing their bags for more compelling deposit options offered by your competitors. Now is the time to get your plans made and your troops ready.