Why credit unions are turning to automation to fill staffing gaps

Credit cards and auto loans which are typically high volume and low balance drove the 31% rise in delinquency last quarter (NCUA: Credit Union System Performance Data: 2023Q2). Today, it takes a large number of staff to manage servicing, collections and risk associated with rising delinquencies. To make matters worse, credit union executives are on a hiring treadmill with no end in sight for specialized roles like collections agents.

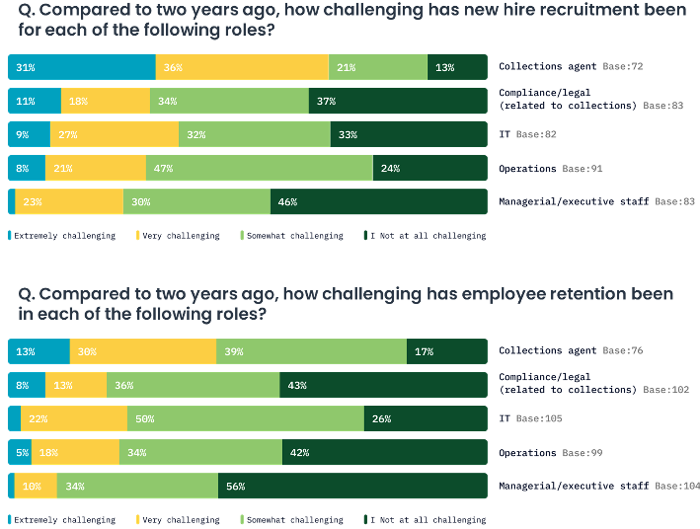

67% of financial institutions report that recruiting collections agents is very or extremely challenging (Transunion).

Now, more than ever, credit unions are turning to automated channels to better manage their portfolios – without compromising the high-quality, personalized service they’re known for. To proactively manage rising delinquencies without hiring large numbers of staff, credit unions are looking inward to:

- Standardize programs and related eligibility rules to reduce call backs, back-office steps and routine tasks. Manual processes like these are like sand in your loan servicing process.

- With processes streamlined, establish methods for members to access proactive hardship assistance 24/7 through digital banking.

- Point all channels (social media, website, statement messages, etc.) to digital banking to reduce member requests in different places that eventually are serviced by the same specialized operations team.

What’s driving the need for hiring now?

Credit union members are facing a financial squeeze evidenced by a stark rise in average credit card debt and stubborn inflation which is diminishing their purchasing power. Wages remain stagnant, struggling to keep pace with escalating living costs, while soaring home prices add another layer of economic strain affecting both current and aspiring homeowners. This multifaceted financial stress underscores the need for strategic intervention by credit unions to help alleviate the monetary pressures rippling through all tiers of credit union membership. While there have been some recent macroeconomic bright spots, higher interest rates, inflation, and dwindling savings are soft spots that could accelerate the delinquency tipping point.

All financial institutions are feeling the pressure

In 2022, Transunion conducted a study of 120 financial institutions particularly around collections and found that collections related roles are among the hardest to hire and retain in the industry. Consider the two diagrams below.

It’s clear that between rising volumes and staffing crunches, credit unions have no choice. It’s time to streamline processes and implement automations in default and loss mitigation.

Three steps credit union lending teams can take to reduce hiring needs

- Review and optimize your servicing and collections processes: Use a diagramming application to flag where multiple handoffs occur and where manual steps and data entry happens. Challenge the status quo. Be open to changing the process if the new approach gets answers to members faster and relieves your back office staff of menial tasks without adding risk.

- Automate loss mitigation processes and offer programs that normally require a phone call in digital banking: Members are demanding digital access for all their banking needs. Adding a form to a website seems like the fastest path, but that task still ends up in the back office to fulfill. With streamlined processes and one set of eligibility rules for hardship programs, moving the entire process to digital banking becomes much easier. The goal should be enabling members to apply, get an answer and sign the agreement, if any, completely online.

- Get the word out with the goal of keeping members out of collections: Credit unions are very good about proactively telling members when they are eligible for new products and services. The same tactics should be applied to communicate the availability of hardship assistance. This is especially true when members are current. Assistance is normally handled only by the collections department and members don’t learn about the programs until their accounts are in collections.

The best way to manage delinquency and keep members out of collections is to ensure they never become delinquent.

Credit unions can make information about available assistance programs and their qualification criteria readily available on the website, within online banking, in the disclosure section of monthly statements and in on-hold messages all pointing members to the online banking channel.

Don’t forget to arm branch staff with assistance information as well. Being able to chat informally to members regarding their options can only increase a member’s comfort around their financial situation and empower them to take charge.

Once programs have been standardized and defined and members know what is available, it only makes logical sense to offer automated assistance as an add-on to your current online banking platform. This approach offers members privacy and simplicity for managing sensitive financial matters, while also reducing the manual support typically needed from credit unions during calls or branch visits.

Informed members who choose to select assistance through online banking automation can do so 24 hours a day, 7 days a week, without waiting for an agent to become available in the call center or for a back-office specialist to process the request.

Conclusion

It is crucial for credit unions to aid members and protect their loan portfolios as the economy continues to be volatile. With staffing challenges front and center, credit unions can reduce planned headcount by empowering members to manage their repayment struggles themselves. With front-line and back-office employees free from tedious and time-consuming tasks, they will have more time to devote to one-on-one interactions with credit union members.

By investing in technology and establishing consistent processes and proactive communication strategies, credit unions are not merely managing but effectively countering staffing and retention hurdles – and protecting their portfolios.