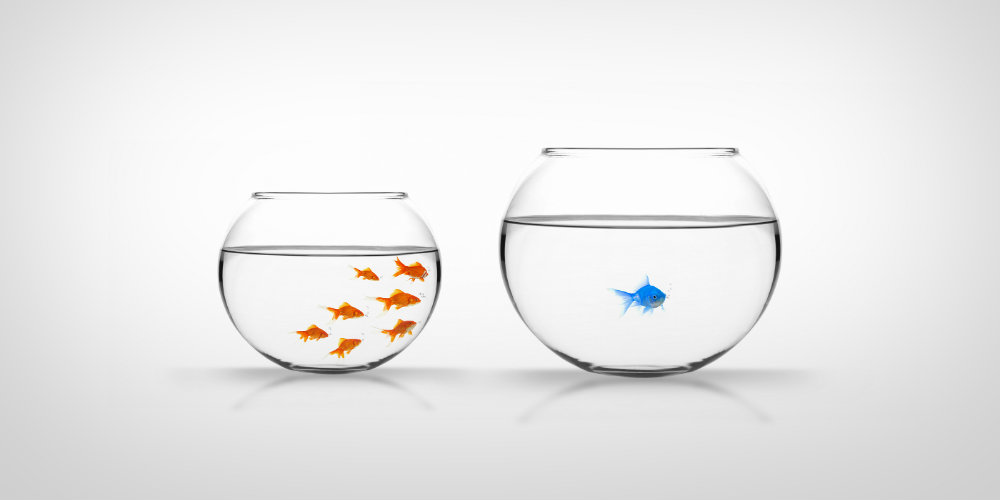

How small credit unions can compete

A recent study done by Filene showed that in order for credit unions to stay relevant and competitive, they need to maintain asset growth rates that at least match the economic growth of the U.S. It is commonly known that the growth of assets generally helps credit unions to keep up with regulatory and operational costs, but how can small credit unions develop a strategy to stay competitive?

According to Filene1, the growth factors for assets are the following:

1. Paying higher dividends

- Deposit rates that are 1% higher than banks increase asset growth by 1.12% on average.

2. Adding core products

- Adding two loan and deposit product types (out of 12 core ones) increases asset growth by 1.04% on average.

- A core product could be a new share draft account, credit card, mortgage product, business loan, IRA or a money market account.

3. Increasing marketing expenses

- Increasing marketing expenses by just 0.1% of assets increases asset growth by 0.79% on average.

- The impacts of marketing on growth are largely consistent across most asset size ranges.

According to the study, increasing branch expansion exponentially helps small credit unions because it will allow them to cover more areas of the communities in which they serve. Nevertheless, it is important to proceed with caution because a moderate return of assets is necessary to maintain a simultaneous condition of growth. Every credit union is special and unique, which makes it critical to target the designated field of membership and provide better services.

Small credit unions have a great advantage over large ones when it comes to decision making, policy change, and the creation of core products due to their close teams and their flexibility to adapt to change. In addition, small credit unions can develop the right product for businesses and members due to their specific niche of service for the community. By studying what businesses and people around the community need, and by having the capacity to create specific products to satisfy those needs, it will be possible for outsiders to become aware of the relevance of credit unions in the community.

To accomplish the set goals, it is imperative for credit unions to have an engaged staff that understands the mission and goals of the institution where they work, a policy of shared books with staff (asset size, balance sheets, membership growth), and the proper technology capacity (core processor, security, etc). In this way, credit unions will efficiently executive and adequate the needs of the members they serve. Growth will not happen overnight, but it will gradually happen with the right execution plan in place.

Reference: