How to use CRM to grow and retain membership in an unfriendly economy

Technology, changing consumer behaviors, and growing fintech competition are driving significant changes across the financial services industry. As they fall under increasing pressure to preserve profits and their deposit base, credit unions need new tools and strategies to retain members and add new accounts.

The key to deepening relationships and acquiring new accounts

In recent years, new technologies, rising consumer expectations, and competition from fintech have radically altered the banking landscape. Credit unions now operate in a completely different market than they did a decade ago, with rapid innovation and new market players disrupting the status quo.

While banking technologies have continually evolved over the past two decades, the COVID-19 pandemic increased the drive to digital banking. Many credit unions know they are falling behind, and half of banking executives admit they are only beginning their digital transformation journey.

However, rising interest rates and deteriorating economic conditions in the past year have compounded these challenges, pressuring margins and balance sheets.

The imperative to deepen relationships and make the most of current members is more important than ever. Competition from fintech is growing, and consumers have new options for mortgages, auto loans, and money management with companies that use faster and more agile technologies.

One in three (37%) U.S. consumers are likely to switch banks in the coming year, and many are looking to fintech companies for solutions when their credit unions or banks don’t provide them.

Another concern is that half of young consumers said they would be willing to switch to a banking solution offered by one of the tech companies.

CRM: A must-have tool to unlock member insights

While financial institutions now have more data than ever, they struggle to convert it into actionable insights. In this environment, a CRM is no longer optional but a necessary tool to unlock member insights.

These tools organize member information and put it in a format to help credit unions identify new opportunities, improve cross-selling and upselling, automate marketing outreach, and scale personalization across their operations.

By one estimate, the banking CRM software market will reach $24.1 billion by 2028. However, many well-known, big-box CRMs don’t meet the needs of banks and credit unions.

One of the primary problems is that these tools have generic workflows and reporting processes that don’t align with a credit union member’s unique and lengthy lifecycles. These CRMs can also be complex, challenging to customize and don’t easily integrate with other solutions.

Finally, big-box CRM providers offer little assistance, and many credit unions lack the talent to manage them.

A new approach to CRM

A CRM tool must be accessible and easy to use and implement. To support CU operations, it should offer usable applications for all departments, including credit, lending, finance, risk management, and consumer and business banking.

A well-designed CRM enables a credit union to identify the “financial moments of truth” throughout an account holder’s journey. These insights can help the credit union predict when a member is on the cusp of a milestone in their life, such as getting married, buying a home, saving for college, or investing for retirement.

Such insights offer upsell and cross-sell opportunities and enable credit unions to reduce risk by identifying when a member may fall into financial hardship. For example, if data indicates a member has $20,000 sitting in a savings account earning little yield, the credit union may be able to point the member to a high-yield CD.

On the other hand, CRM insights may reveal a member had two late payments in the past six months and recently disabled their auto-pay. This information enables a credit union to potentially pre-empt default by offering a skip-a-pay or refinancing options.

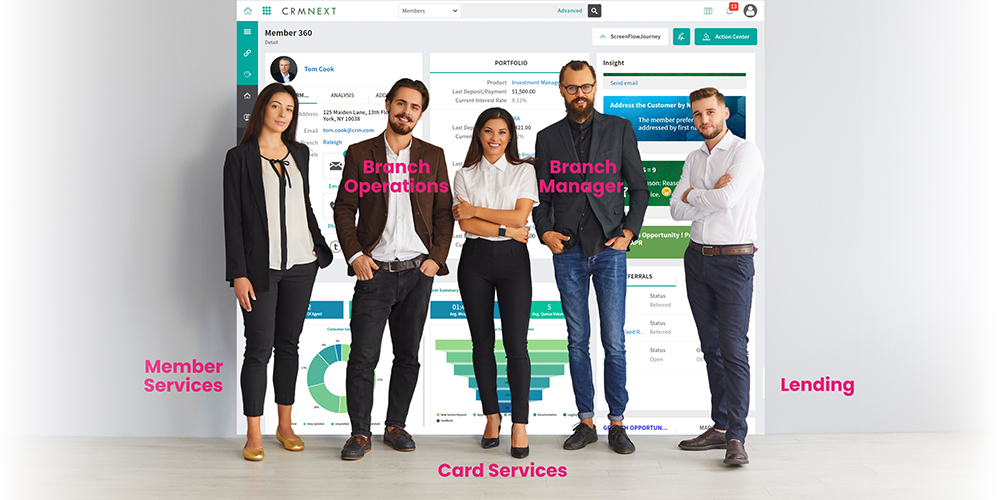

To succeed with this strategy, a CRM needs to deliver actionable insights for all areas of the credit union, from lending and wealth management to credit card services.

Doing this across all channels, including branches, contact centers, and digital banking, enables credit unions to easily connect the dots with actionable insights. CUs can then create offers, better position their products, enhance the relationship, and position themselves as a trusted provider and partner.

CRM = Strategy + Process + Technology

As an instantly deployable solution, CRMNEXT offers a 360-degree view of account holders to maintain and grow relationships. An intuitive dashboard lets the C-suite and front-line leadership see things like tracking records, member profiles, account warnings, and membership relationships. Every role is configurable, and all insights are visible in one location, offering a single source of truth for the entire institution.

Watch an interactive demo and experience the ultimate credit union CRM for yourself.

Please select a valid form