Inflation and how it impacts your credit union

Things have been good economically for so long it’s hard to imagine a time when they weren’t. Even in the face of a devastating global pandemic, asset prices performed well and delinquencies and defaults have trended in the right direction.

As a result, demand continued to outpace supply. Demand for building materials and contractors became so high that work wasn’t getting done. Demand for vehicles is so high that their values have started to appreciate! What we’ve recently seen is a general increase in the price of goods and services and a fall in purchasing power, commonly known as inflation.

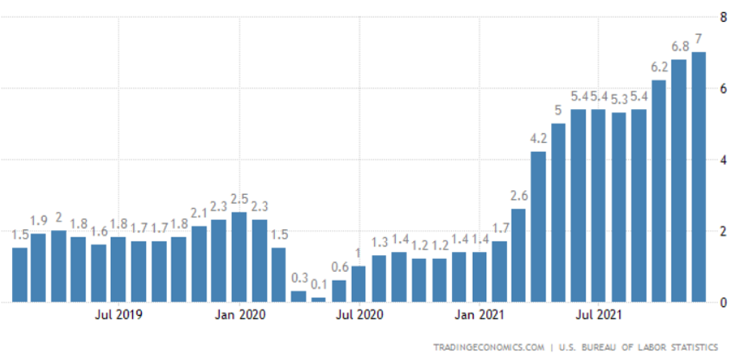

Inflation hasn’t been much higher than 2.5% over the past 10 years, but rose dramatically in 2021, hitting 7% in December. That’s the highest it has been since June of 1982.

When inflation gets high, The Fed commonly raises interest rates in order to reduce demand and manage inflation. Last year we told you 5 Reasons Why the Real Estate Market Will Continue Trending Upward. One of those reasons was low interest rates.

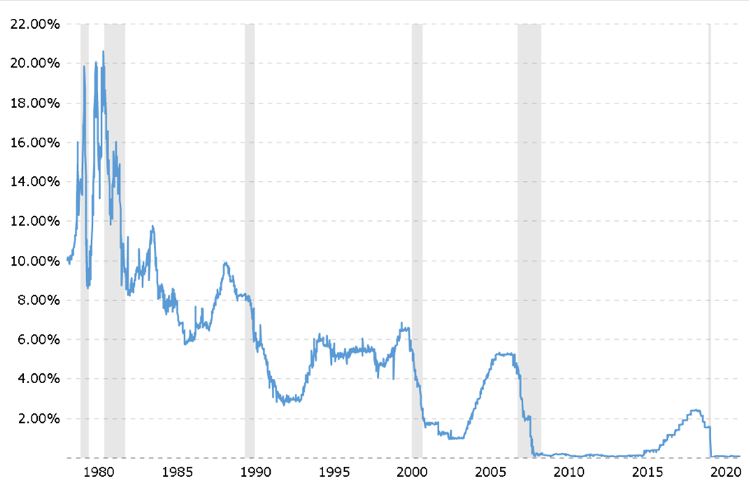

According to Freddie Mac, interest rates in June of 1982 were 16.7%! Historical Federal Funds Rates are below.

Fed Funds Rates have not been above 2.5% since the onset of the great recession. Long story short, interest rates have been very low for a very long time.

So what happens when interest rates increase, anyways ?

Current Fixed Rate Borrowers Stick Around

Your current fixed rate borrowers are sitting on a great deal! An interest rate that they wouldn’t be able to get in a current market. As a result, they’re less likely to refinance, and even less likely to sell their house and move. This means less attrition of fixed rate loan portfolio balances that need to be replaced with new loans.

The Catch: You might not want them to

While you’re losing fewer loans to refinances, you’re foregoing the opportunity cost of making loans in the current higher interest rate environment. If you have fixed rate assets (loans) and variable rate liabilities (shares and borrowed funds), you’ll be negatively impacted in a rising interest rate environment because you’re paying more for your liabilities, but not receiving any more interest on your assets.

Borrower Purchasing Power Declines

Let’s use an example. Let’s say I make $100,000 per year and can put 25% ($2,083.33/month) of that towards my 30-year mortgage. If my interest rate is 3%, I can afford a $494,000 mortgage. At a 5% interest rate, I can only afford a $388,000 mortgage. That’s over 20% less!

Credit Risk on Variable Rate Payers Increases

Conversely, let’s say that I’m a variable rate payer in that same example. A rate bump from 3% to 5% would increase my $2,083.33 payment to $2,653! If I can only afford 25% of my salary to allocate towards my mortgage, my income will need to increase to $127,300 to cover that gap.

If members can’t come up with the extra dough, they’re at higher risk of default.

Situations like these are what make scenario analysis so important. Let’s walk through a scenario

- In an effort to manage a 7% inflation rate, The Fed implements monetary policies raising mortgage rates 2%.

- The payment shock experienced by variable rate payers pushes them into default and their house is foreclosed on.

- When the house is sold, the ‘average’ buyer can now afford 20% less than they could previously.

Now imagine that in addition to the reduced purchasing power, we have foreclosures resulting from payment shock increasing the supply of homes. Not to mention, new constructions completing as a result of the previous rapid appreciation of the home market.

Impacts from scenarios like these are ones you want to plan for proactively regardless of macro-economic conditions. You should be answering questions like:

- Is our balance sheet structured to absorb the impacts?

- At a macro level, do we have sufficient capital, or are there concentrations of credit risk under the most vicious economic pressures?

- At a micro level, which variable rate borrowers do we think will have the largest payment shock when their rates change? Is there anything we can do proactively to reduce that risk?

Credit unions have a reputation for providing members affordable financial products in all economic environments. By understanding what can go wrong when things get tough, you put yourself in a position to continue making good loans and serving your members when they need it most.