Navigating the impact of COVID-19 by being the compassionate banking alternative

The longer our nation progresses through its COVID-19 response, the clearer the expected long-term impact is coming into view. CO-OP Financial Services has detailed at least three payments trends that we see on the horizon – migration from debit to credit, the need to be prepared for increased account delinquency and fraud, and digital, contactless payment adoption. In each case – in fact, in the crisis itself – we also see an opportunity for credit unions to shine as the compassionate banking alternative for members in their hour of greatest need.

We built the CO-OP ecosystem with exactly this intention – to help you be there and be more for your members regardless of the situation; to help you be agile, flexible and speedy. In our own case, we have exhibited these qualities in the past month by moving 80 percent of our staff to working remotely, met a 100 percent increase in call volume at our Contact Center; and maintained uptime through both technological investment and a workforce highly motivated to sustain our clients now more than ever.

Four Phases of Strategic Planning

Through CO-OP’s work with leading consultancy EY, we have begun to center our thinking on the four phases of strategic planning for COVID-19 impact as outlined in their Pandemic Crisis Response report: Respond, Sustain, Recover and Transform.

While many aspects of daily life will change as a result of COVID-19, credit unions must continue to be the compassionate and people-over-profit financial institutions that members need. Earning trusting, loyal primary financial relationships at scale in a post-COVID-19 environment will hinge on how well a credit union supported its members during key moments of the crisis; and on how well that dependability migrated and evolved as the pandemic impact subsided.

Therefore, as you plan and respond to the economic impact of COVID-19, consider using this framework as a blueprint to guide your short- and long-term decisions.

Compassionate Care for Members in the Near Term: Respond and Sustain

As we continue through the near-term in the Respond and Sustain phase of COVID-19, credit unions have the opportunity to demonstrate an outsized impact. With over 26 million Americans unemployed or furloughed, many are struggling to stay afloat and pay their bills while they wait for the dust to settle. Credit unions can respond by dovetailing their products and services with government stimulus and private-enterprise assistance to bridge gaps experienced by the most vulnerable within their memberships.

For example, as more members turn to credit as a method of self-help when cash runs out, card-issuing credit unions will want to make proactive enhancements or changes to their credit products. Offering a zero-percent for six months credit card, for example, is a way for a credit union to help members who are facing short-term losses in income. Other programs that cards teams may consider include skip payments, interest and fee relief, zero-percent for six months offers and credit line increases where prudent. CO-OP Full-Service Credit-client credit unions are activating options like these through three portfolio relief programs launched in March.

Credit unions should also think about ways to support members’ evolving spending behavior. A travel rewards card, for instance, may have been a hugely attractive offering in 2019, but likely misses the mark in a big way for members confronting the “new normal” of 2020. Already, we’ve seen several of the major brands alter their rewards offerings. American Express Platinum cardholders, for instance, may now use their Uber credits for food delivery instead of rides.

Credit unions should analyze spending patterns monthly (if not weekly) to see where members are spending and adapt their card products and rewards offerings accordingly. For instance, within the CO-OP Credit Portfolio, online bookstore purchases, namely Amazon, surged 45 percent in the first two weeks of April. That’s a great opportunity for a credit union to consider running a spend-and-get campaign with Amazon in order to secure top-of-wallet.

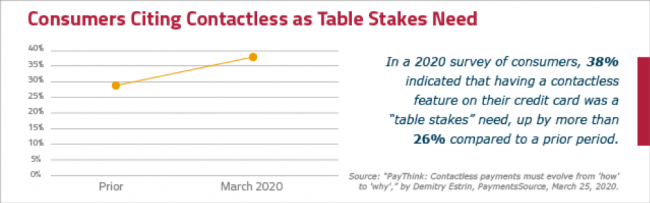

Now is also the time to supplement your plastics with enhanced digital features your members demand. Contactless payments, for example, have seen a surge in adoption over the last few weeks as consumers have grown increasingly concerned with traditional methods of in-person payment, including cash and dipping or swiping their card at the point of sale. At the same time, the rise in COVID-19-related scams and payments fraud has made mobile card controls and alerts an important part of the digital banking experience.

Finally, in a briefing letter to clients, Filene suggests credit union memberships may actually grow coming out of the pandemic, as they did during the Great Recession. As more consumers become frustrated with the lack of financial support and empathy exhibited by Big Banks, credit unions will be in a strong position to build deeper relationships with new members. It will be critical that your digital experience is ready – from support channels to ATMs, branches and digital apps.

Helping Members Thrive in the Long Term: Recover and Transform

Many economists agree the impending COVID-19 recession will be painful, but short-lived. Depending on several factors, not the least of which is the government’s ability to come through on stimulus packages for employers, the recession could be over as quickly as it started. Preparing now to help members make financially healthy decisions once recovery begins will be an important component for credit unions to contemplate.

Credit unions would be wise to make strong investments in data analytics and/or partner with providers that can bring this competency to the table, either through research and analysis or open source API connections to data. With expected changes in the way members live, work, play, shop and finance their dreams, it will be critical to have real-time insights that can inform credit union moves. As an example, understanding which categories of discretionary spending are rebounding the fastest can factor into rewards program transformation and other payments strategy enhancements.

Data will also provide insights into the long-tail impacts related to unemployment. As individual, family and business members recover at different rates, some may need specialized products to supplement income or revenue changes. Along with these products may be a need for highly personalized “fin-touch” programs that pair the best in human ingenuity and empathy with the best in high-tech solutions to solve financial problems. To help you get to the bottom of the necessary data to help you make these product and service choices, CO-OP will soon be unveiling the Insights Center, a new self-service reporting and business intelligence tool.

The New Normal: Developing a Plan for Integrating Digital Engagements

Many financial industry analysts predict the day-to-day of distance banking will have a strong influence on how people bank in the future. Credit unions will want to watch their members closely to understand which aspects of the virtualized banking experience are sticking around. Is the increased adoption of things like virtual tellers, mobile banking and remote deposit capture waning, or as experts predict, staying put? Developing a plan to further integrate all digital engagements into one, clean, trustworthy and secure module for convenient banking is likely to become a high priority during the Recover and Transform phases of credit unions’ response to an evolving consumer marketplace.

Having a strong data-driven decision engine can also keep credit unions acting in the best interests of local communities. Recovery from the pandemic and its associated economic consequences is expected to happen at different rates across different locales as reduced consumer spending and rising vacancies in some areas will be more dramatically felt than others. Las Vegas, Orlando, New Orleans, Honolulu and Oklahoma City, for instance, were recently named by Brookings Institution as five of the largest high-risk cities. The institution predicted Provo, Durham-Chapel Hill, Hartford, Albany and San Jose to be the economically safest of the largest U.S. cities. Because the re-opening of America will happen at different rates, credit unions will want to keep a close watch on local trends throughout each of EY’s phases of the pandemic impact, from Recover all the way through Transform.

It’s clear to see the coronavirus pandemic will have a significant impact on the credit union industry and its members. However, challenging times create an opportunity for financial cooperatives to live out their values and seal their purpose in the minds of the communities and people who depend on them. Through bold, decisive action that puts the well-being of members first, credit unions will prove that doing well by doing good is not only a defining strategy, but a viable one, as well.

To help credit unions prepare for what’s next and stay true to their essential role as the compassionate banking alternative, CO-OP is offering the Credit Union Strategic Investment Assessment Powered by CO-OP and backed by EY NextWave™ . The Assessment was announced last month as a benefit to institutions registering for the in-person THINK 20 Live conference planned for August 17-20 in Dallas Texas. Due to the interest in the Assessment as a strategic planning tool amid the COVID-19 pandemic, CO-OP is now enabling credit unions to participate in the Assessment for just $1,200, without registering for the conference. To register for the Assessment, visit co-opfs.org/strategicassessment.