New PPP tool connects small business with small-asset lenders

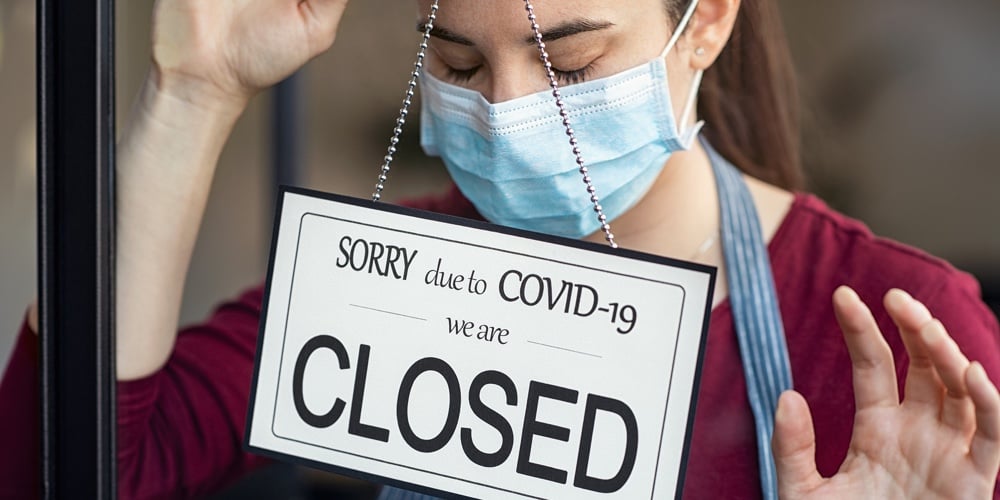

The Small Business Administration has launched a dedicated online tool for small businesses and non-profits to be matched with Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs) and other smaller asset size lenders in the Paycheck Protection Program (PPP).

SBA’s Lender Match is an additional resource for pandemic-affected small businesses who have not applied for or received an approved PPP loan to connect with lenders.

The forgivable PPP loan is emergency relief assistance aimed at sustaining businesses and keeping employees on payroll. Lender Match does not accept Economic Injury Disaster Loan applications.

Within two business days after entering their information into the Lender Match platform, a borrower receives an email from lenders who have been matched with them. The borrower can see lenders’ requests for them to begin an application. Borrowers are then able to begin the application process directly from the email they receive.

continue reading »