New study highlights need for increased credit literacy

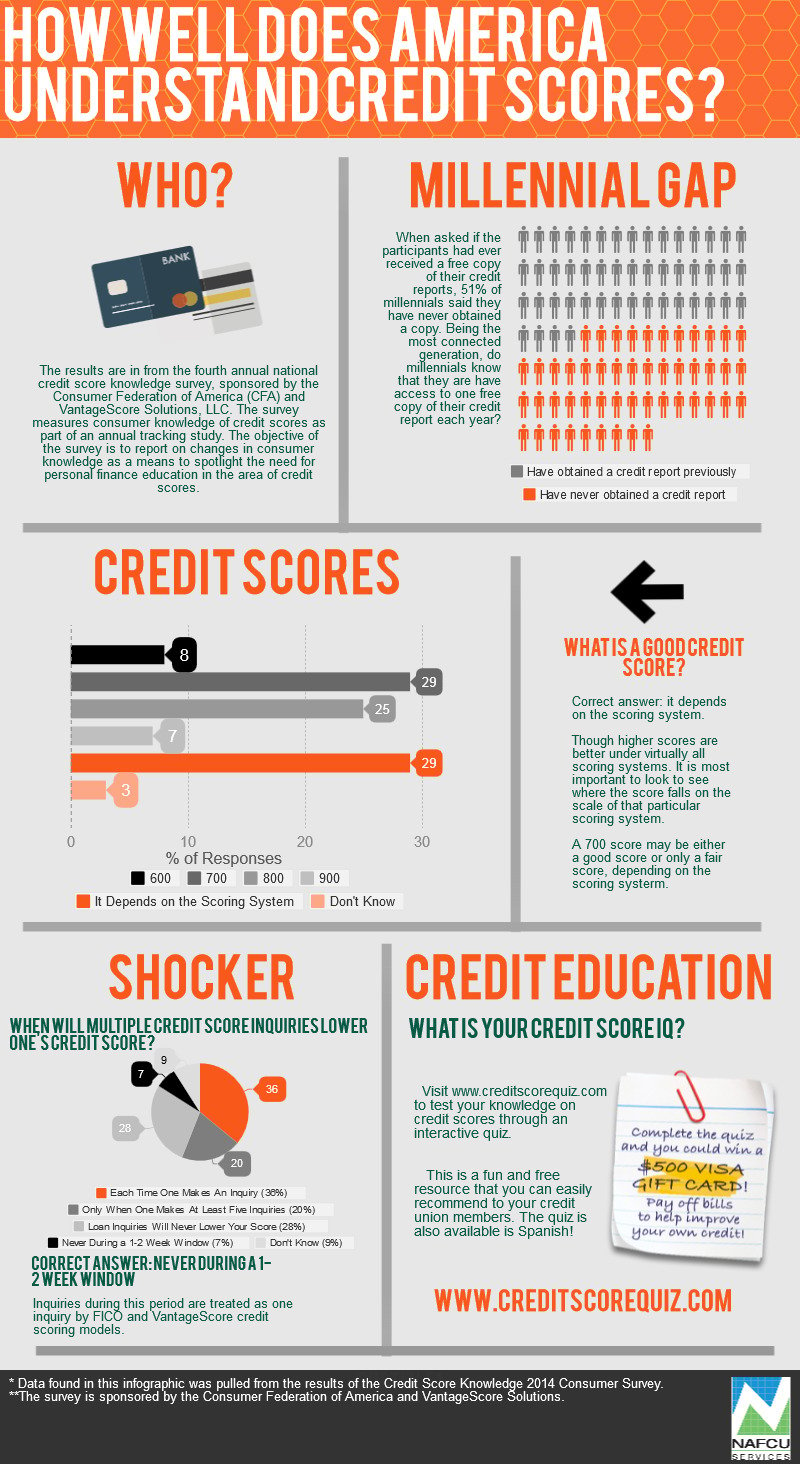

As the availability of credit reports has become more convenient due to the pervasiveness of the Internet, knowledge of credit scoring still suffers. The National Credit Score Knowledge Survey results were released this month by the Consumer Federation of America (CFA) and VantageScore Solutions. Among the surprising findings in the study:

- While 80% of respondents consider their knowledge of credit scores to be good, fair, or excellent—94% of participants do not know which factors are among those used to calculate a credit score

- Only 7% know that neither FICO nor VantageScore will lower one’s credit score if multiple inquiries are made during the same two-week window

- Only 50% of respondents understand the three instances when lenders are required to inform borrowers of the credit score used in the lending decision

- 53% of millennials surveyed don’t know that age is not used in calculating credit scores

- Only 50% of millennials surveyed know that credit repair companies are rarely helpful in fixing credit scores

- 51% of millennials surveyed have not obtained a free copy of their credit report, while 74% of older adults have obtained a free copy of their credit report

Instructions to obtain the full results of the study can be found here. For credit unions, it is in our best interest to guide our members to becoming more credit-aware. While we enjoy the many advantages of being constantly connected and online, we still lag far behind at accessing and understanding our credit reports.

One great resource for all your credit union members is www.creditscorequiz.org. The website was developed by CFA and VantageScore Solutions, displays no advertising, and collects no personal data.

Here are a few helpful tips for your members to assist in raising their credit scores:

- Consistently paying bills on time every month

- Not maxing out, or even coming close to maxing out, their credit cards

- Paying down debt rather than just moving it around, as well as not opening many new accounts rapidly

- Regularly checking their credit reports to make sure they are error-free

For more information and resources to help your members become more credit-aware, please contact CFA and Vantage Score Solutions, the NAFCU Services Preferred Partner for credit scoring.