Ever wonder why a talented team of executives can still feel like priorities and projects are not getting done fast enough? Or why a team can be giving it 100% and still feel frustrated with their work? Patrick Lencioni has answers for you. Lencioni, author of The Five Dysfunctions of a Team and The Advantage and pioneer of the global organizational health movement, has created a new model – The Six Types of Working Genius – that is going to powerfully benefit organizations, including credit unions, in the years and decades to come.

According to Lencioni, the new model helps individuals “identify their areas of working genius, as well as their areas of life-draining weakness, and puts themselves into a position to tap into their genius more and engage in their weakness less.”

Lencioni and his colleagues at The Table Group created this model in the past four months, and it’s already been tested by thousands. It came out of a desire to better understand why people are drawn to enjoy certain aspects of their work and not others, and where they seem to thrive.

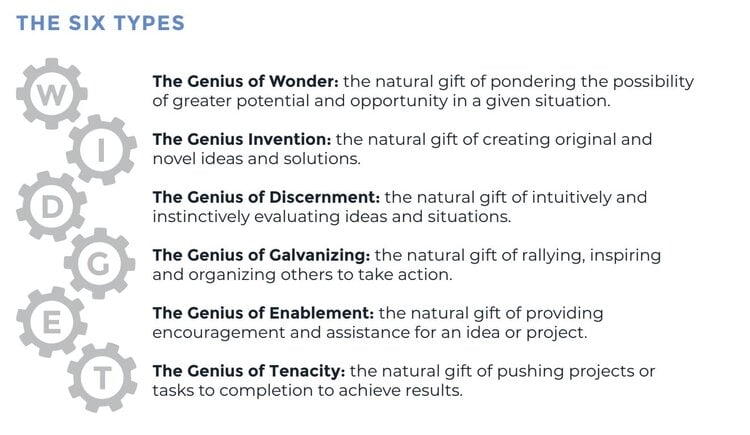

Lencioni explained in his recent live launch event that everyone has:

- Two areas of Working Genius – Two of the six types that come naturally to you, meaning that you are good at them and they give you energy and joy.

- Two areas ofWorking Competencies -- You can do these fairly well, maybe even very well, but you don’t derive great joy or energy from them.

- Two areas of Working Frustrations – These areas are neither natural nor energizing for you, and most likely, you aren’t particularly good at doing them.

Unlike other personality tests, The Six Types of Working Genius focuses on the actual talents and stages required to get work completed: thus, showcasing a potent opportunity for leaders and teams.

For example, if the individuals making up a team have all the Working Genius types represented but are missing one or two, the team may find itself experiencing a gap. Upon learning which Working Genius is missing, they may suddenly understand some of the challenges they’re facing and what they need to do to bridge the gap.

For instance, if no one on the team has the Working Genius of Galvanizing, it’s easy to see how that could impact morale and motivation on key priorities and projects. If there’s no Genius of Invention represented, chances are the organization may be missing out on key innovation opportunities.

Tapping this model can also help individuals understand themselves better and extend more grace to one another. If someone has Tenacity as a Working Frustration, the reason they don’t finish projects on time is likely not personal. They may need to be paired up with someone who does have Tenacity as a Working Genius. If someone has the Working Genius of Wonder and isn’t utilizing it, it’s time to start tapping it.

If you want to take the assessment right away, you can visit The Table Group and Patrick Lencioni’s Working Genius page today.

I still pinch myself that I get to work - day in and out - with Patrick Lencioni and his team as a member of The Table Group’s CAPA Pro. Learning about a new model - such as this – right after its creation, and being able to share new practices with the greater credit union community gives me immense joy, as I believe strongly in “People Helping People.” This will help us all do just that.