No shortcuts to transformation

Change is inevitable. The world we live in and the people we know change constantly. Businesses are changing as competition intensifies, technology accelerates and information moves at the speed of light. The world has transformed into a global economy, no longer bound by walls, geography or time. We are in an age where busyness is the norm, and we dictate our own realities by the choices we make…daily.

For the community-based financial institution (FI), “the times” have changed them too. No longer can FIs rely on just branches, or just service to meet consumer demands. Today, we live in a world where consumers demand an Omni-Channel approach. Consumers demand automated channels, virtual channels and physical branches to meet their needs.

Branches today are still about convenience and market density, but each branch can and does fit a different purpose. Starting with the largest of all facilities, the cornerstone branch, which includes main offices, these large format facilities plays a different role than others.

Today’s main office sets the tone for the company’s culture and identity. Call centers in these facilities are also changing. With the advent of Interactive Teller Machines (ITMs), community-FIs can serve their customers 24-7-365, which means the call center is staffed with Universal Bankers who can be a one-stop-shop for the customer’s needs.

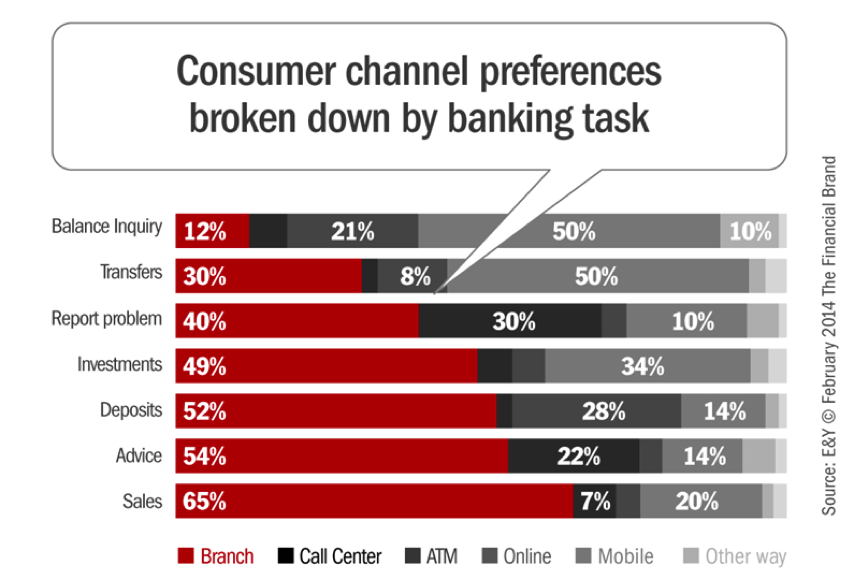

After all, building relationships are at the heartbeat of the Universal Banker model. Surveys show that 65% of sales occur in a physical branch, so the days of relying on a relationship built across three feet of mahogany are over. Today, banks are challenged with differentiating themselves and some are more aggressive than others in their use of technology, retail concepts and design to facilitate a more engaged consumer experience.

Market research, customer concentrations and analytics now dictate how FIs should design their branches to relate to their markets. If the model is best supported by a teller line, then stick to that plan. If a more engaging environment, powered by technology is indicated, boldly adopt that plan.

The cost and time to implement branches has also given rise to the Micro Branch. Micro branches today still include storefronts and in-store branches, but can now also include mobile branches, freestanding facilities, and “pop-up” branches. The key component of Micro Branches are their size and flexibility as well as their cost.

In the end, banks and credit unions are faced constantly with decisions on how to serve their customers, communities, and employees. Change is inevitable just for relevancy, but the FIs that are changing with a plan achieve specific results.

Based on FDIC data, one Southeast Bank grew organically from $1 Billion to over $3.5 Billion in the last five years by making branching decisions around a business case. Another FI grew its assets by 37% in the Carolinas over a seven-year period embracing technology and universal bankers. Still another near the Great Lakes moved its loan to deposit ratio from 88% to 92% in less than two years by implementing a more engaged branch culture. The bottom line is the bottom line – changes driven by a well-devised plan and business case succeed.

In today’s ever-changing environment, financial institutions are faced with two opportunities for performance improvement:

1) Their existing footprint

2) Moving into new markets

The FIs that flourish marry business planning and execution into a seamless model driven by a business case.

So, as you face the New Year and beyond, start making decisions and then take bold action. Over time, those actions lead to transformation…there are no shortcuts.