The power of semantics in credit union analytics

A common language forms a bond between humans and strengthens their ability to cooperate. Credit unions must agree on common semantics to establish powerful business analytics throughout the industry.

Language is very powerful tool. The ability for people to understand each other forms one of the strongest bonds known to man. The credit union industry has remained strong through the power of collaboration. However, new challenges have been mounting against the industry such as big banks and fintech competitors, stricter regulations and the increasing complexity of products and channels. Therefore, being on the “same page” is more important than ever. Currently, credit unions are speaking different languages and trying to collaborate. This results in miscommunication throughout the industry which depends on unity for strength. The ability to communicate easily and effectively is the foundation of credit union analytics.

Data Sources

Credit unions use a vast array of databases (many of which were designed for purposes outside of the credit union industry). On top of that, databases must be designed for ease of storage, international data standards, and tight budgets and timelines. This results in confusing database languages that are only understood by the most experienced users which creates more confusion between IT and business (which do not need any more reasons to misunderstand each other). Data elements (stored on disparate databases) have different meanings throughout a credit union and the industry. These database silos cause disunity within a credit union. If a single credit union is not able to agree on the semantics of their databases, the credit union industry cannot be united.

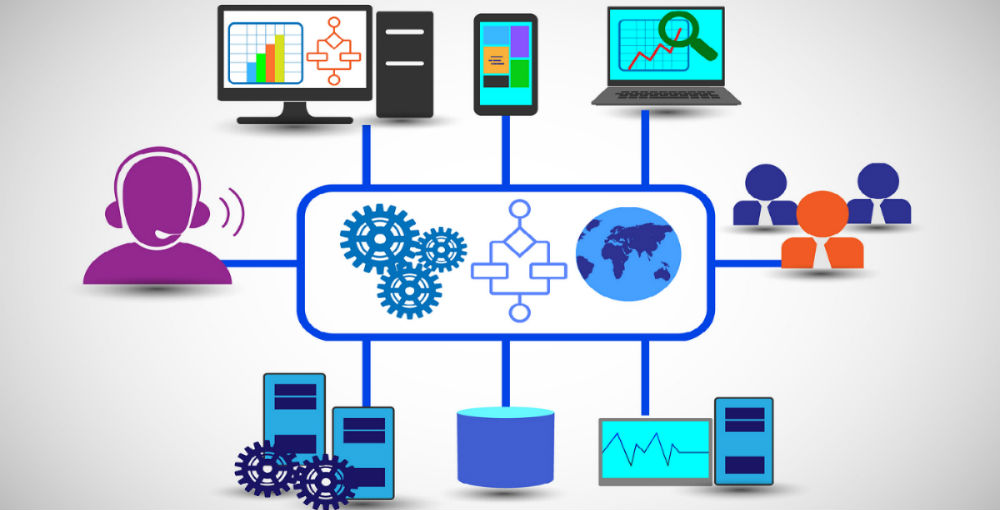

Data Integration

When credit unions attempt to integrate their databases, many think it will be as easy as routing data from each database into a common location (based on a few database keys). However, when they attempt to roll out the database integrations, they quickly realize this approach will not work for the business. Data integration must be done with the end in mind. If data is integrated without a Common Data Model (CDM) in mind, confusion will be multiplied. The CDM must be designed for the credit union’s long-term goals and for the ability to establish common semantics throughout the credit union industry.

Common Data Model (CDM)

In order to begin forming common semantics, credit unions must establish a CDM that span across all their data and is indifferent to vendors. The Credit Union Financial Exchange (CUFX) has established industry standards for database integration using standard business terms that span across databases regardless of vendor. This initiative is strengthening the unity of the credit union industry. CUFX has established common semantics to foster a common credit union language. For example, one credit union might call the application id for a loan, loan appl id, while another might call it ln applic numbr. With a CDM, credit unions can all agree to call it loan application Id and thereby establishing a common term for this data element. As business users begin speaking the same language they will bring greater unity to their credit union and the industry as a whole.

Semantic Layer

Once the CDM has been adopted, credit unions must establish a semantic layer to develop their reporting and analytics. As Joy Mundy, from Kimball Group, explains in her article, “The semantic layer provides a translation of the underlying database structures into business user oriented terms and constructs”. The semantic layer provides an environment for quick report development and analytics. Common semantics (developed into a format that is easy to consume) will give credit unions the ability to develop insights and share them across the industry much more effectively. If one credit union discovers a pattern in their data, they can develop an app that displays the information intuitively and share their insights with other credit unions to cooperate at a deeper level than ever before.

Cooperative Analytics

Once a common semantic layer (using a CDM) has been implemented throughout the credit union industry, credit unions will truly excel in cooperating on analytics. They can continue to strengthen communication by agreeing on industry standard business terms and definitions for all their data. Cooperation requires a common language to flourish and is essential to foster the collaborative spirit on which the credit union movement was founded.