March spending trends: Return to seasonality

CO-OP Payments Trends Report (Spending Data from March 1-31)

RANCHO CUCAMONGA, CA (April 13, 2022) — As unremarkable as it may seem, seasonal predictability has been largely missing over the past two-plus years, thanks to the pandemic and its associated economic volatility. The big news this month is that, according to Co-op credit union card portfolio data, consumer spending is returning to historically typical behavior patterns and showing robust increases across every major category.

March’s economic data continued the mostly positive trend of the past few months, as nonfarm payrolls grew by 431,000 in March and the unemployment rate declined once again to 3.6%, barely above the 50-year record low just prior to the pandemic.

Inflation is high, and though gas prices have started to trend down in recent days, they are still at historical highs and expected to remain volatile with Americans paying an average of $4.16 per gallon, $1.30 higher than a year ago.

Economists are expressing concern around a potential recession later this year or into 2023, as the Federal Reserve aggressively raises its benchmark interest rate to counteract inflationary pressures over the next several months. The Fed raised rates by .25% at its March meeting, and has signaled its intention to implement further increases of as much as half a point at its next three meetings in May, June and July.

Here are some key spending trends the Co-op SmartGrowth Consulting Team are watching this month:

#1: Every Merchant Category Grew Month-over-month

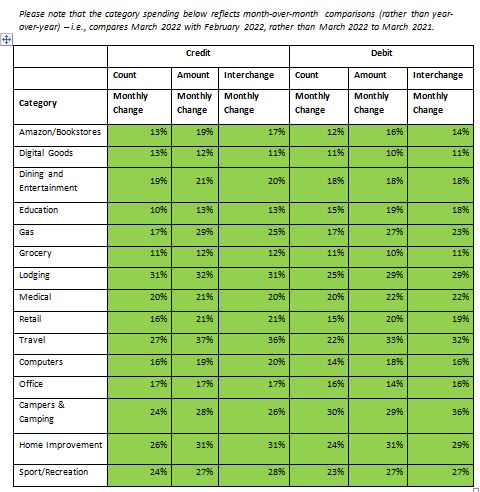

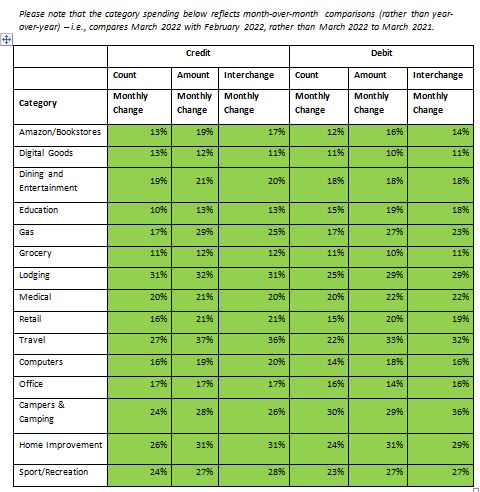

Co-op’s March credit union spending data showed double-digit month-over-month increases in every major category across both the debit and credit portfolios. The Dining & Entertainment, Gas, Lodging, Medical, Retail, Travel Campers & Camping, Home Improvement and Sport/Recreation categories were all particularly strong.

The challenge for consumers – which may be the fly in the ointment for a while yet – continues to be supply chain disruption, coupled with long waits for goods and services due to deferred demand over the past two years.

A case in point is the wedding industry. According to NPR, spending per wedding is expected to jump 15 to 25% this year due to pent-up demand, inflation and higher costs of labor and supplies.

“Spending patterns are stabilizing, and seasonality is back,” said Beth Phillips, Director at Co-op Solutions. “At the same time, consumers continue to feel the aggravation of supply chain demand and the long wait times for receiving goods like furniture, vehicles and home appliances. It will take time for those supply bottlenecks to be course corrected. We’re still battling the pandemic from that standpoint.”

#2: Credit Shows Strong Year-over-year Growth As Well

With the exception of the Campers & Camping merchant category, consumers are spending more on credit now than a year ago. In certain categories, such as Gas, Grocery, Retail and Computers the growth is significant – in the high double – and even triple digits.

Home Improvement is one area where, although month-over-month and year-over-year increases have been comparatively modest compared with categories like Gas, Travel and Computers, Co-op’s SmartGrowth experts expect spending to take off this spring.

“Home prices are still very high, and people are getting priced right out of the market,” said John Patton, Senior Payments Advisor at Co-op solutions. “So rather than try to sell their current residence and move into a more expensive home they may not be able to afford – and potentially lose all the equity they’ve built up over the years in selling and buying costs – many homeowners are choosing to stay on the sidelines and focus on renovation and remodeling projects.”

#3: Credit Balances Are Beginning to Bud

While the pandemic period was marked by relatively conservative spending and a decline in consumer debt, the last few months have seen consumers grow more at ease with once again carrying credit card balances.

According to Co-op credit union credit portfolio data, while balances declined slightly in November and December of 2021, since the turn of the year they have started to grow. January saw 1% balance growth, in February it was 3%, and March saw 5% growth year-over-year.

“As consumers begin to revert to pre-pandemic spending behaviors, they are becoming more comfortable carrying some revolving debt,” said Phillips. “Our assumption is credit balances will continue to slowly build as we move through the year.”

What CUs Should Do Now

With credit balances blooming and the Fed signaling increases to its benchmark lending rate, the Co-op SmartGrowth Team advise that it’s a great time to dust off balance transfer campaigns. Members are getting concerned with rising rates, so reward them with a low introductory rate balance transfer offer while reminding them of the credit union difference of competitive rates, low fees and exceptional service. A well-timed balance transfer campaign will help to grow a credit union’s portfolio balances and burnish its primary financial relationships.

As spending picks up across every major merchant category, rewards become increasingly important. The SmartGrowth Team also advise credit unions to make sure their loyalty rewards program is competitive with the leading programs. And, dig into cardholder data to make sure spending is being incented in the categories members prefer in order to stay top of wallet, and top of mind.

Month-Over-Month Category-Level Spending (Comparing March 2022 to February 2022)

Please note that the category spending below reflects month-over-month comparisons (rather than year-over-year) – i.e., compares March 2022 with February 2022, rather than March 2022 to March 2021.

More information on the Co-op SmartGrowth Consulting Team can be found here.

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.