March spending trends: The spring spending boom is here!

CO-OP Solutions Payments Trends Report (Spending Data from March 1-31)

RANCHO CUCAMONGA, CA (April 13, 2023) — March payment activity roared like a lion, as spending increased substantially across all merchant categories despite mixed economic trends.

Nonfarm payrolls grew by 236,000 for the month, in line with consensus expectations of a slowing hiring pace. Unemployment still ticked down to 3.5%, indicating strong labor force participation. In addition, the unemployment rate for Black Americans fell by 0.7%, reaching a historically low level of 5%.

Despite these job market gains, the pace of layoffs has begun to accelerate, up nearly 400% in March as compared with a year prior. In addition, the Labor Department reported that job openings fell below 10 million in February for the first time since early 2021.

The Federal Reserve raised its benchmark interest rate another quarter point in March, to a range of 4.75-5%. This was lower than the 50-basis point hike that was expected before the recent failures of Silicon Valley Bank, among other institutions, which had sent equity markets tumbling earlier in the month.

Overall, Co-op spending data reports that March 2023 transaction volume was higher across both the debit and credit portfolios versus March 2022.

Co-op’s SmartGrowth consultants are closely watching the following key spending trends this month:

- Spring has sprung!In March,virtually every debit and credit category showed double-digit growth from March 2022 spend to March 2023, reflecting a strong seasonality effect. The biggest gainers included Campers & Camping, Entertainment and Home Improvement. Golf Courses led the way with a 42.9% increase in debit and 36.7% rise in credit. Overall, debit transactions were up 13.8% for the month, and credit was up by 14.5%.

“Consumers noticeably increased their debit and credit spending in March,” said John Patton, Co-op Senior Payments Advisor. “Whether that means more expenditures on dining and entertainment, booking a trip for later in the season or hitting the links for a round of golf, the improving weather has given people a case of spring fever.“

- Everyday spending to face declines.Despite big gains across most categories in March, the longer-term outlook for consumer spending is less rosy.Retail sales slipped in February by 0.4% compared with January’s levels, and durable goods spending fell even further.

“Retail spending is going to continue to feel pressure as we move deeper into 2023,” said Patton. “People will reserve their in-person shopping for more ‘experiential’ visits – such as new releases of goods, shoes and apparel, and the opportunity to have unique, in-store experiences. For everyday items, consumers are tightening their wallets, and will continue to look for deals online, as well as delivery and curbside pickup for convenience.”

- Credit balances continue to rise.U.S. credit card debt declined by 17% through the first two years of the pandemic. But in the last quarter of 2022, it reached nearly $1 trillion, a record high, per the New York Fed. Just as concerning, thepercentage of credit card accounts that are more than 90 days delinquent has begun to rise, reaching over 4%.

After the first two months of 2023 had the first balance declines since January 2022, March credit portfolio balances increased 1.13% from February’s. In addition, credit balances continued to grow in March 2023 and were up by 14.86 over March 2022.

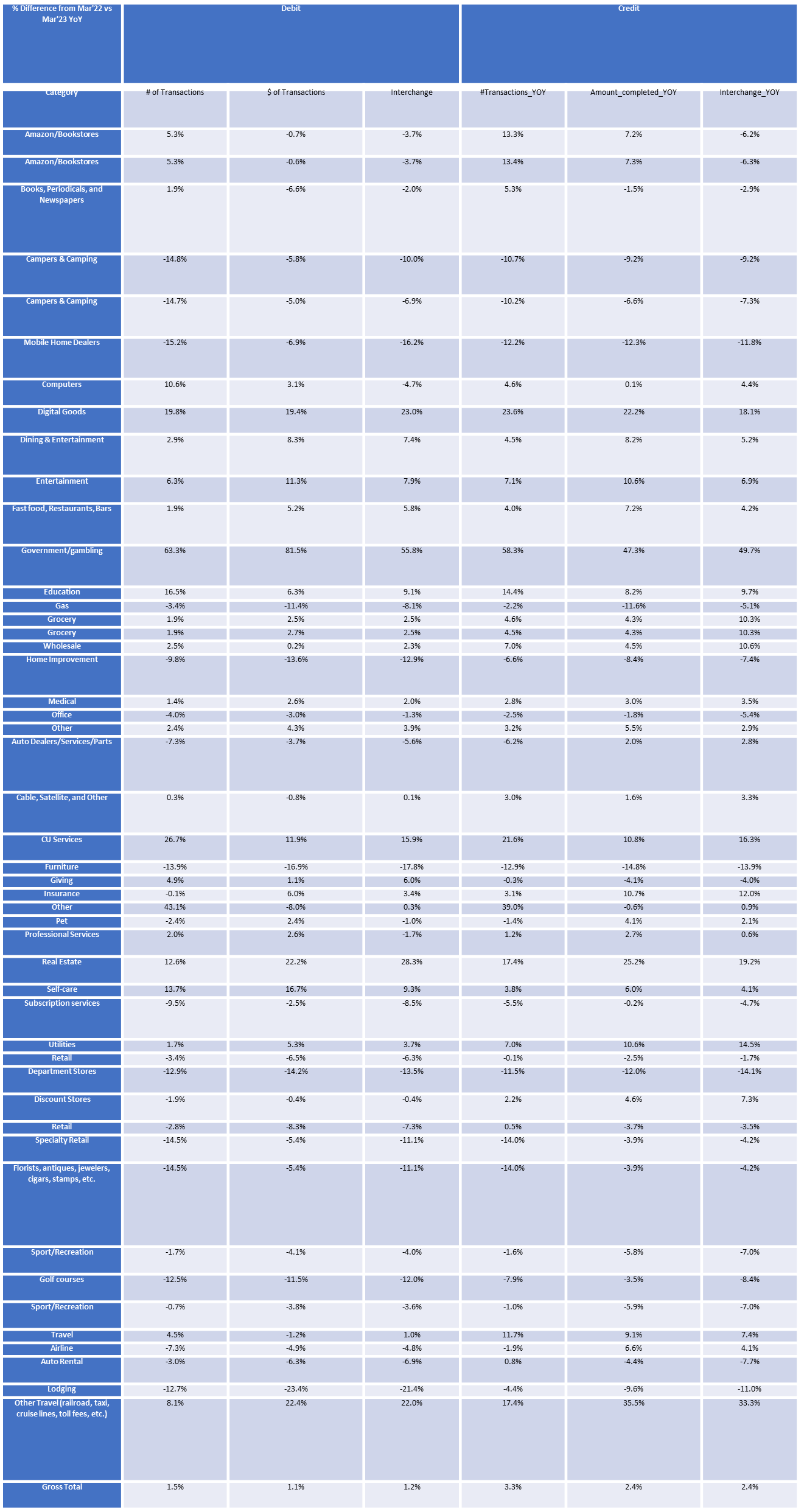

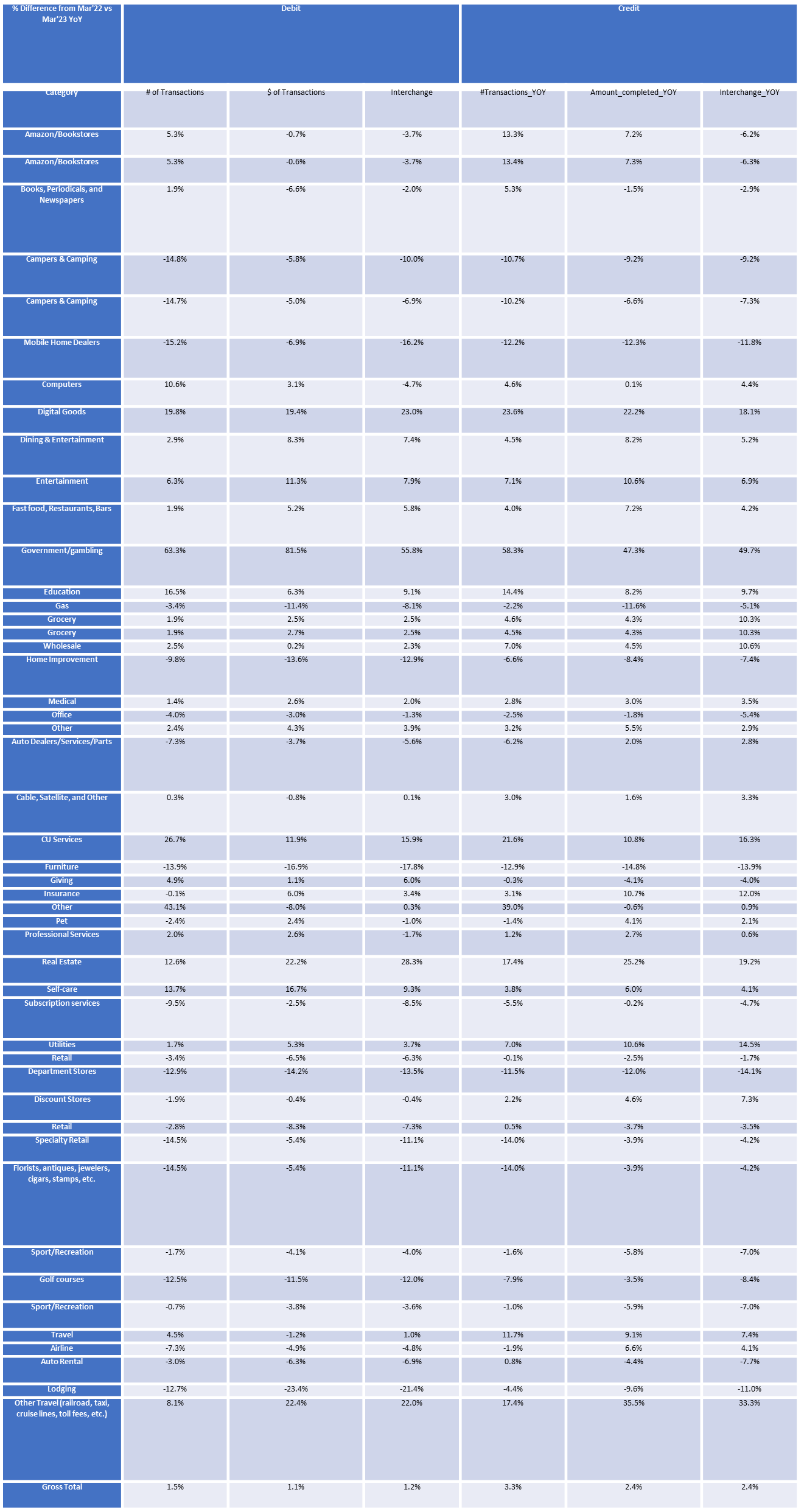

Year-Over-Year Category Level Spending (Comparing March 2022 to March 2023)

About Co-op Solutions

Co-op Solutions is a credit union-owned financial technology platform built using an industry-leading ecosystem, and whose mission is to connect credit unions to the technology, strategic partnership and scale they need to best serve their members and grow now and into the future. Co-op Solutions partners with credit unions to unlock their potential so they can compete; does the hard work of innovation, creating a one-stop opportunity to help credit unions grow; and offers knowledge and expertise in a world where everything must be integrated. Founded in 1981, Co-op Solutions services 2,650 credit union clients, processes eight billion transactions annually, and manages a nationwide ATM network of more than 30,000 and a 5,700-location shared branch network. For more information, visit www.coop.org.