The staircase – rising interest rates

Climbing stairs is hard, but effective. It is a unique form of exercise that can have a powerful and positive impact on your health over time – especially if you’ve been idle for a while. Like raising interest rates in an economy, it is important to start slow to maintain your footing. The staircase imagery is useful when thinking about a rising rate environment. Each upward movement by the Fed creates a “step” in the interest rate staircase aimed at taking the economy in a different direction.

Since the Federal Open Market Committee (“FOMC” or “Committee”) met in December, data gathered indicates the economy continues to expand, while strength in the labor market endures. Furthermore, both economic and consumer optimism are at recent highs. The Fed, consistent with its statutory mandate, seeks to foster maximum employment and price stability through a variety of tools. The Committee believes that with gradual upward adjustments to interest rates (“the staircase” in monetary policy), the economy can continue to expand at a moderate pace and the labor markets will continue to strengthen, causing inflation to rise to the 2% threshold.

Recently, Fed chairwoman Janet Yellen commented on the solid state of the job market and economy, stating that the Fed would likely resume raising interest rates over the next few months, with March, May or June on the table. However, she noted a few factors that may influence the Fed’s decision, including global uncertainties and concerns around President Trump’s fiscal policies.

In early March, Wall Street views the probability of a rate hike during this month at 90+%, according to Bloomberg.

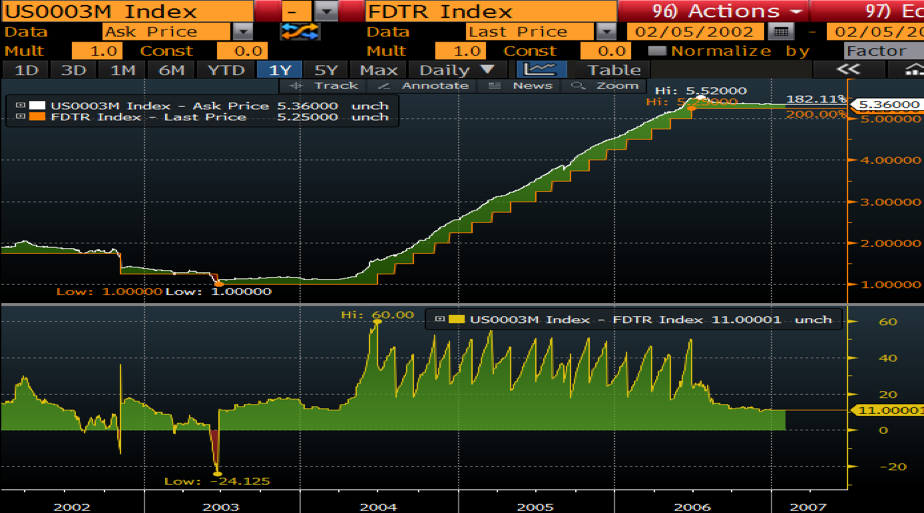

Pre-crisis, 2003, when the Fed began increases throughout the economic cycle, there were 17 increases over a four-year period. During this time, there was one common theme: the market would anticipate the increase well in advance (three to six months) of it occurring. The Fed increases created a staircase comprised of individual rate steps. The market’s response was that of a mountain slope (without plateaus).

Source: Bloomberg

Source: Bloomberg

One can begin to draw conclusions from the past as to expectations during the upcoming period of monetary tightening. By understanding the past, one will be able to devise a strategy on how to deal with institutional investors during the rising rate environment. Institutional investors have a variety of investment vehicles available. In order to attract and maintain institutional investors during a rising rate environment, financial institutions need to maintain a marketable rate-of-return, creating a perpetual position in which the money stays for an ongoing basis.

Building a model that considers deposit interest costs compared to loan spreads will help create predictability and stability in funding. Most banks/credit unions price their loan portfolio off an index plus a factor. By incorporating a similar model into deposit funding, a bank/credit union will mitigate the volatility of interest rate sensitive institutional deposits. Furthermore, it will create operational efficiency by reducing the need to run CD Rate specials and so called “hot money” deposits.

Do you have an effective strategy to maintain footing while climbing the staircase?