Strategic advantage – how do we compete?

As a consultant, I have the privilege of hearing about the strategic plans of a diverse set of credit unions. I’ve noticed a few common themes:

- We have the most loyal members; that is our strength!

- Our employees are far and away the best!

- Because we have the best employees, we offer superior service!

Hands down, these are the top three features of most credit union strategies. But if everyone has the same strengths, are these really advantages? Certainly, if a credit union was lacking in any of these areas, it would be problematic, but I think it’s a biased view of the world.

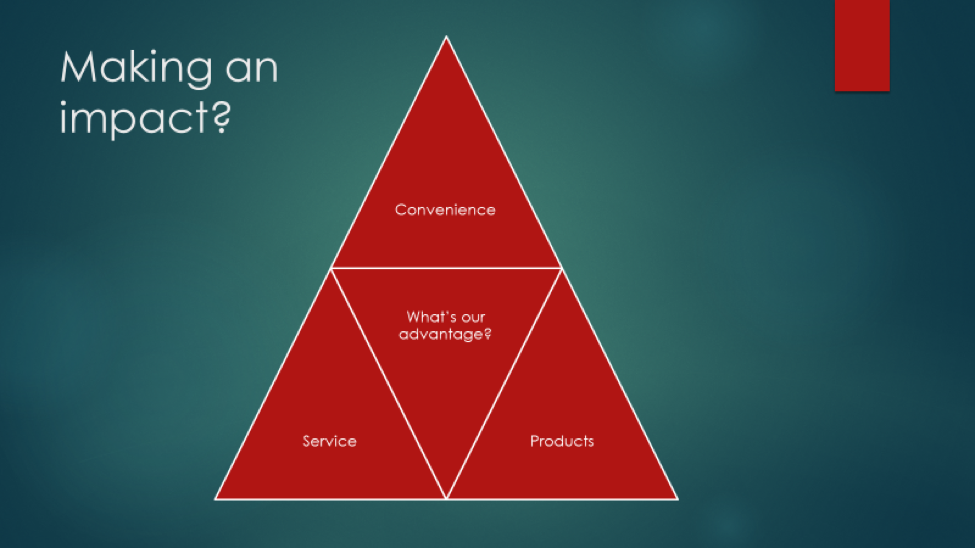

Businesses compete on three basic fronts: convenience, service, and products. Here is an illustration:

Let’s look at some examples.

Notice that price isn’t one of the factors. There is only one “cheapest price” in the market; everyone else must compete in other ways.

Convenience

Convenience comes to mind when we think of a convenience store. Located on the corner in a high-traffic area, we can run in and get a quick loaf of bread or six-pack of beer. We might need a few gallons of gasoline and a lottery ticket right now! We don’t pay much attention to the cost of the items, because we are willing to pay for the immediate fulfillment of our needs.

Think of the rise of Amazon. Many retailers are closing their stores because consumers can go online and order a product to be delivered to their doors the very next day (or even the same day) without going around from store to store looking for what they want. Even better, one can now get free shipping and one-click checkout, along with suggestions for other products, right from a computer or smart phone. Price isn’t much of a factor here.

Products

How about a company that competes on product? Two examples come to mind: Nike and Apple. Think about the amount of resources these companies put into coming up with the next new thing. Are new sneakers better than the last model, or are we kidding ourselves by thinking new is better? Is the iPhone X better than the iPhone 8? Do the “new” features make my life easier, or does the fact that it’s “new” make it better?

Compare these product-driven businesses with your typical credit union. What resources are we putting into “new” financial products? Not much really. We adapt as change comes along, if someone else will test it out first. The Fintech revolution is coming. These companies are dedicated to developing new ways of providing financial services. Do we have enough resources in place to develop products as quickly as they are, or should we be looking for emerging products and finding ways to partner so that we get the best of both worlds?

Service

Finally let’s talk about service. Our cornerstone. What companies come to mind when we think about service? Perhaps we think of department stores such as Nordstrom. How about the Four Seasons hotel? Consumers recognize that high-quality service doesn’t come cheap. But are credit union members really interested in paying more for free checking? Would they pay for a balance inquiry? No, no one would.

Pick your path

So, what’s our strategy? More and more, it appears credit unions are trying to do all these things and falling further behind. A plan should assess whether a credit union is “good enough” in at least two of the categories, and try to be outstanding in the third.

If your organization chooses product, you need to be a leader, not a follower. Partner with your service providers and be willing to be a “beta” site for new functionality. This requires a higher level of in-house technology expertise to implement changes to core systems. Not an easy task, but achievable with added resources placed toward product development.

If your organization chooses convenience, be prepared to have a consistent and active location development team. Facility planners and project managers would be a key success factor here. Most credit union employees have a “day job,” so adding branches would be piled on top of their operational duties. Credit unions with aggressive branching strategies should hire personnel with construction and project management expertise (even if on a project-by-project basis).

Finally, if your organization chooses service, employee training should be where the dollars go. It’s not by accident that the staff of the Four Seasons, down to the hotel maids, regularly greet customers with a smile and eye contact. They go out of their way to “add” to the experience. How about a fruit tray in your room when you arrive? Like the bathrobe? Take it home for free. Companies that compete on service seek out feedback and are hungry for reviews. By constantly improving their delivery, and teaching and practicing human-relation skills, these organizations make a name for themselves. The member should feel happy when they walk in your door, because they know you’ll make them feel special. What can we do to make our members say, “wow, I didn’t expect that!”

Assess your strategy, and align your resources to make it happen.