The Global South continues to fuel credit union growth

While membership in the world’s 87,914 credit unions grew by 5% to surpass 393 million in 2021, that increase was hardly equal across all 118 countries surveyed for World Council’s 2021 Statistical Report.

In fact, credit union markets in the Global North are growing at a much slower rate than the rest of the world. Membership growth rates are either below the world average or in decline in several countries, including:

- United States 4.2%

- Great Britain 2.9%

- Ireland 2.8%

- South Korea 2.2%

- Canada 0.7%

- Japan -1.1%

- New Zealand -1.2%

- Poland -1.8%

- Australia -2.6%

In comparison, most credit union markets in the Global South are experiencing massive growth—signifying that emerging markets are going to be where the movement’s future expansion lies.

Membership growth rates in several African, Latin American, Caribbean and southeast Asian nations are booming, including:

- Burkina Faso 28%

- Senegal 19%

- Brazil 13%

- Haiti 13%

- Dominican Republic 10%

- Ghana 11%

- Kenya 10%

- Philippines 7%

- Guatemala 6%

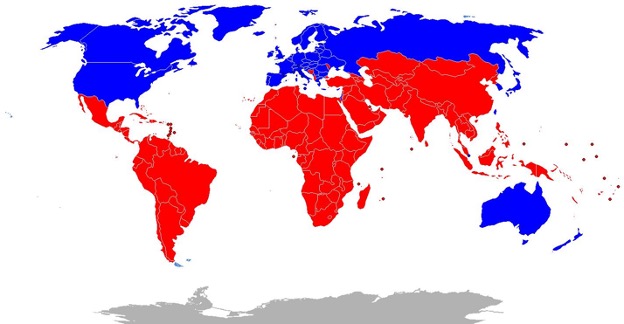

What is the Global South? It is a term now widely used by political and academic institutions to designate less-developed countries (shown in red above) located primarily, in the southern hemisphere.

World Council of Credit Unions (WOCCU) is seeing this growth first-hand. We currently administer a USAID-funded project in Burkina Faso, Kenya and Guatemala, and just finished a pilot project in Senegal in March 2022.

WOCCU works through its International Projects to reach underserved populations, with a specific focus on rural communities, women, youth and migrants. An increasingly important goal is to promote resilient livelihoods, as well as address inequitable access to affordable credit for individuals and small businesses. Credit union members and communities demand resilience-focused credit and other products to weather shocks and realize their full potential.

Digitalization will drive more growth

And while that project work plays an important role in growing credit union membership, we also realize addressing priorities identified by credit unions themselves will be equally as important. So, when 81% of national credit union associations identified digitalization as a top priority in the 2021 Statistical Report, it reinforced that the work WOCCU started with our Challenge 2025 initiative must be accelerated to meet demand.

WOCCU envisions a future where shared solutions through platforms and fintech partners drive greater access, improve efficiency, reduce friction, and enable credit unions to deliver better digital products and services to their members.

Advocating for regulatory reform in the Global North

Equally important, WOCCU also advocates for credit unions in the Global North, which identify stifling regulations as their biggest obstacle to growth and innovation—and regulatory reform as the top priority.

WOCCU’s International Advocacy team works to strengthen its European Network of Credit Unions (ENCU), with Europe often at the forefront of the standard setting that flows down to other countries over time. WOCCU aims to replicate this successful regional approach in other regions to support national-level advocacy agendas.

By continuing to influence international standard setting bodies to create an enabling environment for sound, viable, strong, resilient and sustainable credit union systems, credit unions worldwide can better secure their role as essential providers of financial services that benefit everyone.