The quest for deposits

Have we witnessed the end of the quest for deposits?

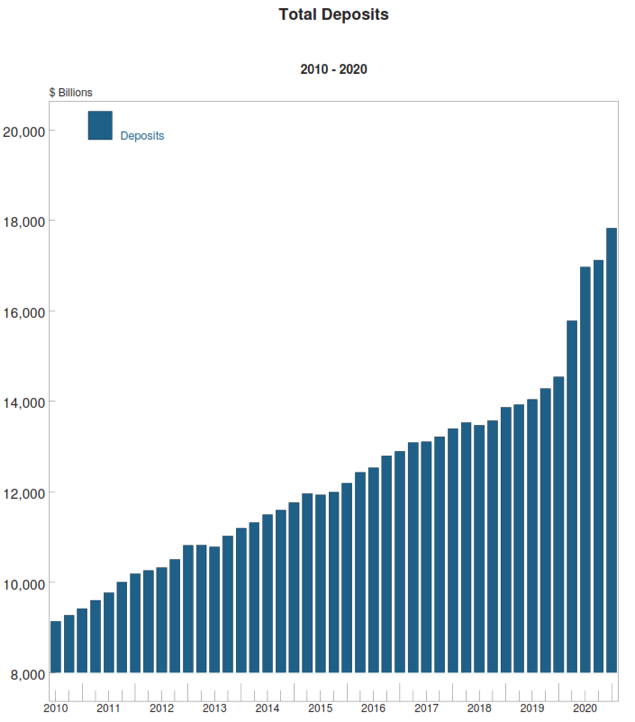

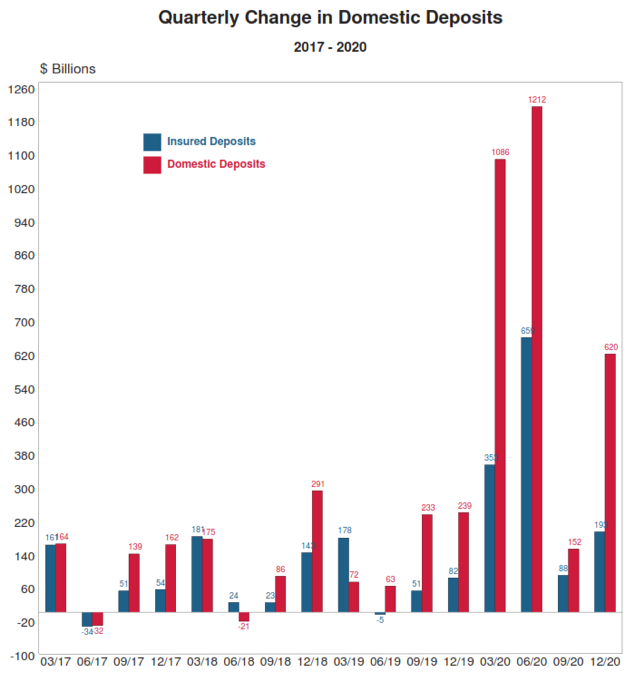

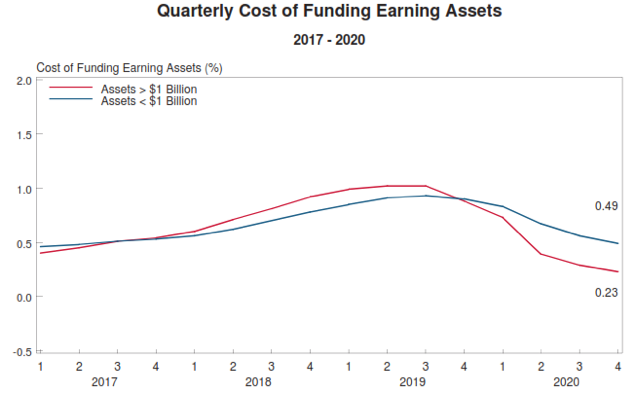

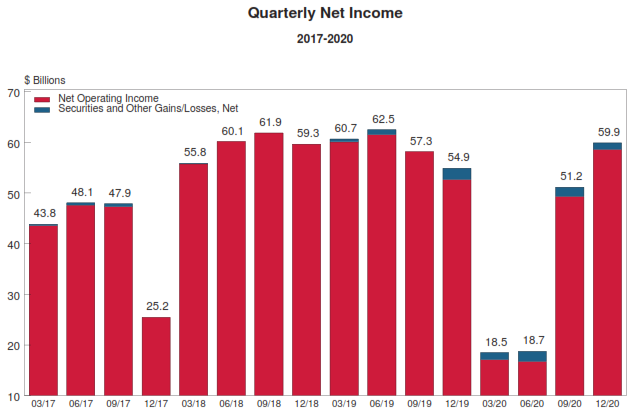

Several metrics superficially indicate that deposit initiatives might no longer “move the needle” for financial institutions. The recent data presented below from www.fdic.gov is striking. We have recently experienced the greatest deposit growth in the history of insured deposits and the interest rates offered now on deposits are still near the lowest in history. The banking industry earnings have rebounded to attractive levels for investors. Mission accomplished? Can we now call off the battle?

The Surge of Deposits

The Cost of Funding

The Rebound in Bank Industry Earnings

Hold on before you decide this is no longer a critical issue for your organization. The dynamics of economics brings clear challenges to the notion that the fate of the industry is now sealed with the future perpetual abundance of low-cost deposits.

Depositors utilize insured deposits for a variety of needs. They have and will continue to value the safety and liquidity of their money in insured deposits. Due to recent factors, depositors have generally set aside their quest for growth via interest rates as they have sought safety for their funds and the confidence that they can access their funds as they desire.

Credit unions need to get organized now so that they don’t have to reprice all of their overnight funds when they again want to attract greater volumes of deposits as among other things 1) government programs change; 2) more funds migrate to stored value accounts and cryptocurrencies; and 3) the Federal Reserve opens accounts for consumers and begins to disintermediate financial institutions. For more on the Central Bank Digital Currency check out this video.

It is certainly true that competing on rate alone damages the net interest margin. The current exploration in uncharted economic territory demands an updated and agile ability to attract and retain deposits in what very well could be a much different deposit environment post-pandemic. With ever increasing U.S. government debt and a monetary policy promoting near-zero interest rates, being prepared for an economic future that is different than today seems very wise.

The Deposit Value Proposition

Publishing the availability of your services on your website where you offer deposit accounts and real time access to deposit funds is necessary. But, is it sufficient in the coming environment to offer the same ole products and approach as you compete with 10,000 other financial institutions that no longer believe their footprint is bounded by their branch locations?

How will you differentiate yourself to stand out from the crowd? What could you do that sets you apart as every financial institution is exploring the vast inventory of fintech initiatives that promise opportunity in attracting and retaining deposit balances and transactions?

Recently a financial industry professional expressed that they believe they are in the peace of mind and prosperity business. This resonates. Much of what we do can and should be automated to reduce friction for our members and provide convenience and ultimately peace of mind. We help people move toward prosperity where their resources are ample to meet their needs and wants. In all of this, we are creating offerings that simultaneously meet multiple and sometimes conflicting objectives.

A Fresh Opportunity

A conflicting objective for depositors and financial institutions is that depositors want the highest yields with the shortest commitments. Meanwhile, financial institution managers want longer commitments and would generally be willing to pay somewhat higher yields for it. The irony of the situation is that few financial institutions have explored the opportunity to unleash value in this tension.

A new approach to giving depositors more of what they want and simultaneously giving credit unions more of what they want is available now. Consider the barrier for long-term depositors. What is the ultimate agony for those considering the higher yields associated with longer-term term deposit commitments? – The early withdrawal penalty. For years depositors heard “SUBSTANTIAL PENALTY FOR EARLY WITHDRAWAL”.

Now within every financial institution, those who have the responsibility, authority, and accountability to set these penalties must assess the impact of their penalties as protection from the financial consequences from early withdrawal. However, just increasing penalties alone doesn’t adequately deal with the situation. In 2020 some credit unions found that early withdrawal should not be punished because it was advantageous to the credit union. They successfully executed early withdrawal campaigns to incent members to redeem high yield certificates ahead of maturity. Recognizing that early withdrawal dynamics cannot effectively be addressed with a static early withdrawal penalty presents a fundamental enhancement opportunity to you today.

We advise that financial institutions should measure and adjust their approach to create an equitable consequence to early withdrawal. The early withdrawal penalties need to be significant enough to protect the financial institution yet modest enough to maximize the money back for the depositor given the resulting scenarios. Anything less is a compromise in performance that should be considered an unforced error that is unacceptable by all stakeholders including the board of directors, employees, and depositors.

Step 1 – Fortify your standard early withdrawal penalties

How can we expect weak penalties to protect the funding portfolio? When did you most recently study the economic value of your early withdrawal penalties in all the potential scenarios and the value they deliver in terms of revenue generation and defending your net interest margin? Under what circumstances are your current penalties actually aligned with the damage done when a depositor breaks the term deposit contract in order to withdraw prior to maturity? For virtually all credit unions, increasing the early withdrawal penalty is necessary today to protect against the risk of losing deposits booked at today’s rates when interest rates rise.

The magnitude of the penalty should be set to make these penalties much more effective than, for example, a six-month early withdrawal penalty on a five-year term deposit paying 0.8 percent. If, after 12 months, the interest rates available on a four-year term deposit are over 0.9 percent, a depositor would have a financial gain from cashing the original term deposit, paying the penalty and reinvesting at the higher rate. Your management team needs to know and report how much interest rate risk is protected by your penalties in the current rate environment.

Step 2 – Eliminate the burden of excessive early withdrawal penalties

If our penalties are too large or even are perceived by the marketplace as too large, they unnecessarily limit our business development. Do any financial institutions actually realize early withdrawal penalties as a material revenue generator? While the Fintech industry advances in so many niche areas, the structuring of long-term savings programs remains an area that at least for now is available for you to create real value differentials that are material and achievable. The opportunity for you to implement and promote enhanced withdrawal options on your long-term savings offerings that maximize the money back for depositors regardless of whether they hold to maturity or redeem early is likely the next evolution in deposit strategy.

Enhanced withdrawal options enable term deposits to look and feel like mutual funds that have a daily market value with a fixed yield. The process expands the demand for your certificates while delivering more to the depositor. Using the same math that determines the value of other fixed income investments, credit unions can offer a daily market value for certificates. This is a relatively simple calculation based on the current principal amount of the deposit, the fixed rate of the certificate, the term to maturity, and the discount rate set by the credit union that is an expression of what interest rates would be needed to replace the deposit for which we are determining the market value. Effectively, the credit union is creating a redemption market for its own deposits whereby it controls the replacement cost and thus an equitable position. This means that early redemption is calculated using mark-to-market approach rather than an arbitrary static penalty. The process makes the deposits realistically more liquid while even more effectively protecting the credit union.

This gives you a way to win the battle for deposits by being less focused on the blunt force of interest rates and more focused on helping your depositors maximize their peace of mind as you use enhanced withdrawal options to maximize their money back under a variety of early withdrawal scenarios. Creating a better approach to your legacy deposit offerings is an initiative that all stakeholders in the battle for deposits quickly and easily appreciate. There is no better time than the present to enhance this critical aspect of the future of deposits.