Tips to evaluate loan strategies in a changing landscape

Working with several hundred depository institutions nationally allows our firm to identify trends and provide unique perspectives on the market. In the loan participations space, we’re seeing more participations on a flow basis vs. one-time large pool sales. Efficiency is one of the key drivers behind this trend. As fintech platforms continue to evolve, they are taking on larger roles in both the loan origination and participation process.

As part of an evolving landscape, securitization also has demonstrated a growing acceptance, with two securitization deals completed by credit unions so far with the largest in 2021. Here, we’ll provide some important context and a few tips to help your depository evaluate loan strategies.

Building a Better Balance Sheet

Institutions have a finite capacity to add assets with the goal of maximizing aggregate value. In effect, this means any asset added to the balance sheet comes with an opportunity cost, which can be thought of as value lost from not adding a higher value asset that may be available. For example, a low coupon, high fee auto loan is one common asset with poor return that takes up space on the balance sheet. Using risk-adjusted return on capital (RAROC) model can help shed light on these economic costs.

As part of a balance sheet management toolkit, loan participations can benefit sellers in several ways, including:

- Maintaining loan origination volume

- Reducing risks (interest rate, credit, concentration, regulatory limit to single borrower)

- Access to liquidity

- Realizing gain on sale and, when applicable, ongoing servicing income

Purchasing loan participations can also benefit buyers, including:

- Supplement organic loan growth

- Diversify asset portfolio (e.g., geographies, loan types, and loan/investment mix)

- Manage balance sheet (extend or reduce duration, improve efficiency)

- Remove servicing headache, assuming servicing is retained by seller

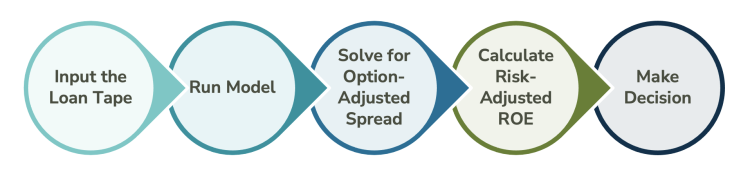

Evaluating potential participation deals effectively includes many components, as shown in the chart below. It’s also important to consider risk-adjusted return on equity (ROE) as that methodology can help provide an “apples to apples” basis for better context when making decisions on where to deploy capital. It also helps your depository determine if it is being adequately rewarded for the risk taken relative to other options. Lastly, risk-adjusted ROE can help you identify less profitable asset classes and evaluate them in a consistent way.

Understanding Securitization Trends, Potential Benefits & Risks

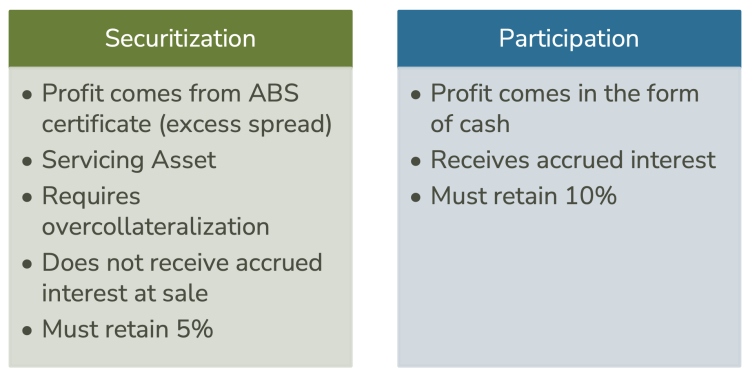

Securitization is another option to consider. It requires a larger size sale to overcome higher fixed costs but allows your depository to gain access to a significantly larger investor pool. Your institution is only required to retain 5% and standardized data and legal docs make future sales more scalable. It’s important to note that available sectors are more limited than participations and therefore only appropriate for certain asset classes.

The objectives of securitization typically include efficiency for highly liquid asset classes, profit, and scale. As the seller of a securitization, you earn your premium through a residual certificate rather than cash up front. There are nuances to this that should be understood before proceeding, along with other key differences from the more common participation route. The chart below highlights some of these differences.

The lead time to securitization exposes the seller to interest rate risk between when the loan pools are being built and when the security is issued. This risk is also present in participations between the moment the loan enters the “for sale” pipeline and is ultimately sold to a participating institution. There are methods to manage pricing risk, including the use of derivatives to help counteract changing market yields, but may not help to offset other pricing factors such as spread changes.

Failure to sell is another risk common between participations and securitization. Whether a conscious decision to halt progress of a transaction, the inability to complete a transaction due to counterparty failure/contract negotiations, or other event, sunk costs including time and expenses can be very costly to the institution. It is best to thoroughly understand the process and requirements of each type of transaction before committing resources across various departments.

Key Takeaways & Best Practices

Regardless of whether your depository chooses securitization or participations, we recommend starting with the balance sheet in mind. Does this help the institution directionally/strategically? Next, develop a consistent decision-making framework (e.g., risk-adjusted, relative value) to determine if you are being adequately rewarded for your risk (credit, liquidity, etc.).

To be successful, you must identify and empower key stakeholders to own the process. Finance, Credit & Legal all have a part to play and ensuring everyone is ready and understands their role will make participations or securitizations go more smoothly. During the evaluation stage, getting the loan data tape and running loan level analytics will help you gain better transparency into true economic value and balance sheet fit. Lastly, always document your analysis, stressed assumptions & decision process when purchasing. Make sure you have something to refer to with future examiners and other stakeholders.

Contact us today to learn how ALM First may assist your institution with evaluating secondary market loan strategies.

Co-author: Kevin Shaner, Managing Director, Loan Transaction Network