Trends 2024: Is record-breaking pace of bank branch closures easing?

The once-critical role of the bank branch in deposit generation and customer service may be in its final days, superseded by consumers' preference for digital channels. But the multi-year tide of branch closures may be ebbing, as many banks hit their practical limit.

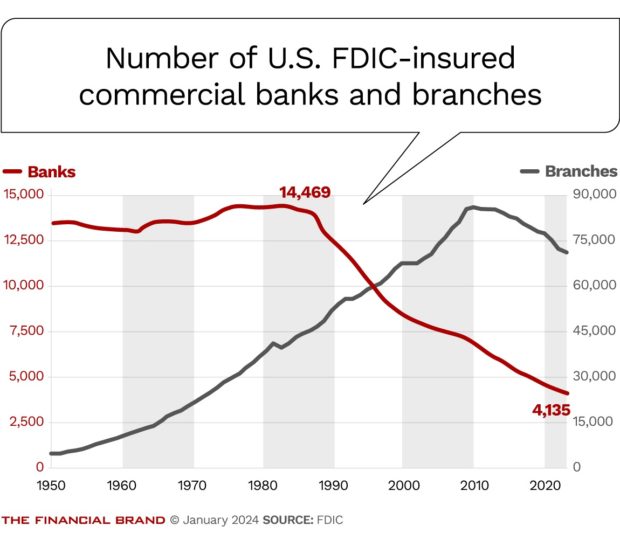

Reality check: The last time the number of physical bank locations actually increased was 2009: the same year Barack Obama took office and the swine flu pandemic had us washing our hands (not for the last time). Since then, there’s been a steady decline in the total number of branches: there were an estimated 100,000 bank branches in the U.S. in 2009.

Now, there are less than 72,000.

The pace of closures has not been uniform the past decade and a half, however, with the overall number of branches experiencing a steep decline during the pandemic’s toughest years.

The pace matters because it’s both a reflection of banks’ operational efficiencies and their perception of untapped opportunities among consumers as well as small- and medium-sized businesses. It’s also indicative of how banking itself has changed, as more businesses and consumers forgo in-person services, increasingly making use of online banking capabilities instead.

continue reading »