Unseen credit union competition: “Respond immediately!”

Credit unions aren’t just “cheaper banks”, nor are they “banks owned by the people”. They’re unique community institutions. At least, I still believe this. Do you?

This article dives into what happens after a member closes a loan (auto or mortgage) with you. Specifically, we look at the solicitations they receive. And what your role is in helping your member understand it all.

Who’s Your Competition?

It’s tempting to think that your primary competition and challenge comes from the big banks. Sure, they offer similar products and target the same groups of people (ie. your potential membership). Their marketing efforts present them as a community-focused option. They make it about their customers, not about the money. I’m no expert, but it definitely sounds like they’re competitors.

It’s true. They are. And for many people, you can offer a better option which will save them money. Yet, besides the exceptional record of Wells Fargo, the national banks don’t engage in “slimy tactics” or attempt to steal customers by just-nearly-but-not-quite misrepresentation. On the whole, banks (both community and national) want their customer’s business and aim to gain and keep it through honest means.

However, there’s others with a slightly different agenda. This article looks at competition to credit unions besides banks, and how you can use your existing products, member relationships, and educational mission to beat them at their own game.

Loan Closing & What Comes After

Last year, I bought a new car. Yes, I have a lot of fun when driving.

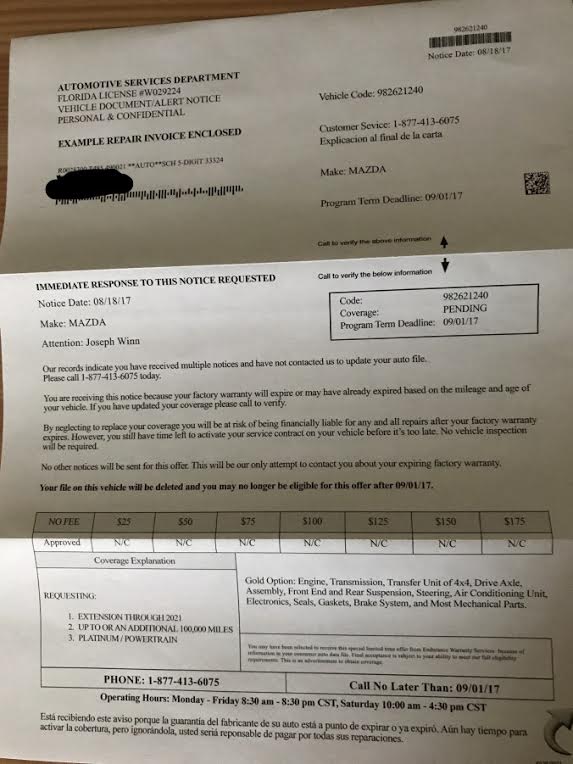

Shortly after, I began to receive letters in the mail much like this:

Real…ish

Packed in official-appearing envelopes (many had that, “fold each side and tear in order” government style design), with names such as, “Automotive Services Department” or some other bogus, yet “maybe they’re real?” title, they appeared in masse. They encouraged, no, insisted I follow up immediately regarding my vehicle’s impending warranty expiration. Never mind it’s a new car, with a 3 year factory warranty included. I COULD BE AT RISK FINANCIALLY IF I DON’T ACT NOW! Of course, the action to take is to get in touch with whomever runs these shady enterprises (they’re not affiliated with any of your VSC providers, trust me) and make sure my car is protected. Much protection, indeed. “Do you cover diagnostic time and taxes?” is a question I would feel obligated to ask if I ever were forced to reach out.

Why mention these letters? Because every time your member finances with you and every time they don’t, they’re getting dozens of mail pieces like this. And this is what they ask themselves: Do I know for certain it has nothing to do with my credit union? Is it a scam? Can I get a better deal from here or my dealer? Is it even something I need? What’s the harm in a call?

It’s unlikely your members will ever ask you any of these questions. But you can bet they’re asking someone, whether it be Google, that helpful voice in their head, or a spouse or friend. You can be there for your members in more ways than you think. And this is what sets you apart.

A Loan Closing Tip

Imagine if at every loan closing (that includes mortgages, because I get things like this for my house all the time), you had a short conversation about potential fraud and things to beware.

“Ok, Jenna, we’re just about done. Are you excited? Because I am! Since we’re here for you across your entire financial life, we want to make sure you’re empowered to spot what’s real and what isn’t. Here are some examples of letters you’re going to get in the mail, maybe even in your Inbox.

They’re not from us.

All of our communications will always include your member number and our logo. These make themselves look really official, and often have scary wording. Crazy, right?

Please look out for these and make sure any future interaction about your financing is with myself or someone else here at ABC CU. I know it may seem silly, but we used to see many members fall for similar scams, and we want to help ensure you’re not one of them!

And as far as vehicle service contracts go, we’d be happy to have that discussion to see if it makes sense for you! Does this make sense?”

Has anyone ever said that to you? What if they did? How would that make you feel? A bit more trusting of your credit union, right? That they have your back, and want to go above and beyond to keep you safe and secure? That’s a credit union I want to do business with and share with my friends and family.

In a future post, we’re going to address GAP and warranty coverage (the legitimate ones) and how they differ (or don’t) between credit union, dealer, and insurance provider. Later on, we’ll educate each other and members on buy-here-pay-here lenders.

It’s About Your Credit Union Mission

Remember, your mission likely includes something about ensuring your members live a financially successful life. Here’s one easy thing you can implement which may make a big difference for your members.