Up, up and?

2020 has been an interesting year to say the least. The mortgage industry has been busier than it has ever been and it does not look like things will be slowing down anytime soon. With interest rates at all-time lows, the surging mortgage volume will continue. In addition to this, COVID-19 has had an interesting effect on the real estate market leading to inventory shortages and home prices surging across the country. The combination of historically low rates and a shortage in inventory has led the real-estate market to experience increasing price trends and multiple offer scenarios.

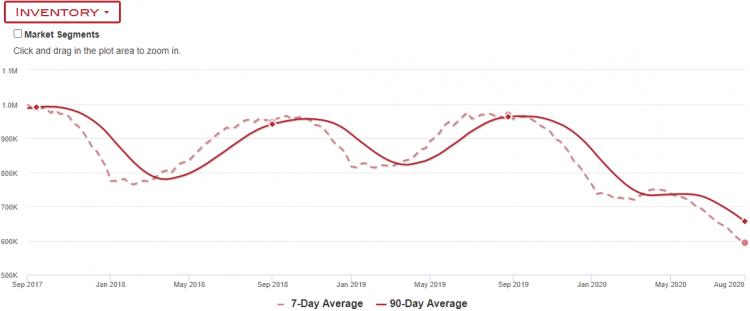

One of the more common issues that arises in such a hot market is how to have your offer accepted by the seller, especially in a market with historically low inventory. According to Altos Research, in August of 2019 there were 969,000 active listings contrasted with 656,000 active listings in August of 2020. That is a 32% decrease in listings in just one year.

As you would imagine, right now is a sellers’ market and a very strong one at that. One strategy buyers use in order to have their initial offer accepted is to submit offers significantly above the list price. This may work, however, it is important to keep in mind, that unless it is a cash offer, the lender will require an appraisal and the appraised value of the property will need to support the contract offer.

When discussing a potential offer with your realtor you should have your agent research the recent sales in the subject market followed by the active and pending listings. When the appraiser starts his or her analysis for comparables, they will have to find a minimum of three(3) comparable sales that occurred within the last 12 months from the effective date (inspection date) of the appraisal. The more recent the comparables are, the better the reflection they provide of the subject market. The appraiser will also analyze sales trends and determine if the market shows a trend increase. If it does, then the appraiser can apply a positive time adjustment to any comparables that have closed more than three(3) months from the effective date. The appraiser will have to show data to support a time adjustment within the sales grid. In markets like this, it is also a good idea to research pending and active sales to gain a better understanding of the current market. If the appraiser has active listings that are at or below the contract price, then it would be hard to show support for the contract price. However, if the appraiser sees the pending and listing sales as higher than the current contract, there may be data to support an increasing market.

When submitting your offer, the best course of action is to perform some additional market research with your agent, as it will drastically reduce the number of potential issues you will face during the purchase process.