User story reveals three insights for credit union web design

I design credit union websites for a living, but I’m also a consumer of financial products and services. As a consumer, I want to share a recent story that may change how you think about credit union website design. After sharing my experience, I’ll discuss three web design takeaways that will vastly improve your credit union website.

My Backstory & Need

My family’s finances are often on my mind, which can be overwhelming because there are so many things to consider. I hear about saving for retirement; buying life insurance; saving for the education of my children; investing in mutual funds, stocks, and bonds; and growing my net worth. And the list goes on and on with multiple variations of advice about how to do each and every thing. To understand what I should do, I reflect on financial tips I learned in college and continue to seek wisdom from books, Google searches, my dad, and Dave Ramsey.

To simplify finances, I try to break down financial decisions into steps that I can tackle one at a time. From some source (I think Dave Ramsey), I received a prudent piece of advice: before saving for anything else, create an emergency fund. As the name implies, the purpose of an emergency fund is to prepare for something unexpected like an injury, illness, or job loss. Accordingly, my wife and I saved enough cash to pay for six-months-worth of expenses without any income.

We stashed our emergency fund in a savings account we already had. Since then, our funds have sat in that account earning a measly 0.01% APY. For some time, I’ve wanted to find a better savings vehicle because our emergency fund is a substantial amount of money, but I haven’t made time to do it. Finally, I’m ready to make a change.

My Search for Information

As I embark on my journey to find a better savings vehicle, I know two things:

1. The savings vehicle must be liquid. We must be able to withdraw funds at anytime or it will be useless as an emergency fund.

2. I want a better savings rate. Liquid accounts don’t get a super high savings rate, but there must be something better than our current rate of 0.01%.

First, I want to know what kind of savings vehicles are available, generally. I search Google and discover an article that gives me a third tip to follow: if I’m saving for a short-term goal, don’t put savings in the stock market (e.g., a mutual fund) because there’s a chance of losing a significant amount of money in the short run. The stock market is a good long-term investment, but not a good short-term investment.

I look through some credit union and bank websites to see what savings products are available and I find these options:

- Regular savings accounts

- Money market accounts

- Term savings accounts (e.g., Term Certificates and CDs)

I quickly rule out term savings accounts because they don’t meet my first requirement for liquidity. That leaves “regular” savings accounts and money market accounts. Now I want to make compare my alternatives.

My Alternatives

Now that I know of some liquid accounts that could work for me, I want to compare rates across financial institutions (FIs). So, I search Google and find a resource on GOBankingRates (the link is for credit unions in Utah because that’s where I live). Unfortunately, the information on GOBankingRates doesn’t seem reliable. Furthermore, websites of FIs usually do not compare rates to competitors. FIs probably don’t compare rates because they fear showing that a competitor has a better rate. I can’t say I blame them. Thus, I couldn’t find a good solution for comparing savings rates across multiple FIs. Instead, I resort to bouncing around some credit union and bank websites that I’m already familiar with.

Not only do I want to compare rates across institutions, but I also want to compare across products within each FI. Furthermore, rates aren’t all that matter; I’m also looking for fees and withdrawal restrictions. Here are a couple of pages that help me compare products:

As I find rates, I want to immediately plug them into a calculator so I can see how much I’ll save over a period. However, no website I use conveniently places rates and calculators together; for some reason rates and calculators are on separate pages. I also want to see calculations that include fees so I can see how fees affect savings over the long run, but I don’t know of any calculator for that.

My Decision

Of all the regular and money market savings accounts I find, Ally Bank (ally.com, a branchless bank) has the best savings rate of 1.0% APY. Plus, their savings accounts have no monthly fees. I submit an application for a savings account with Ally and they say I’ll hear back in a few days (which is kind of a let down that I have to wait, but we’ll see what happens).

The Buyer Decision Process

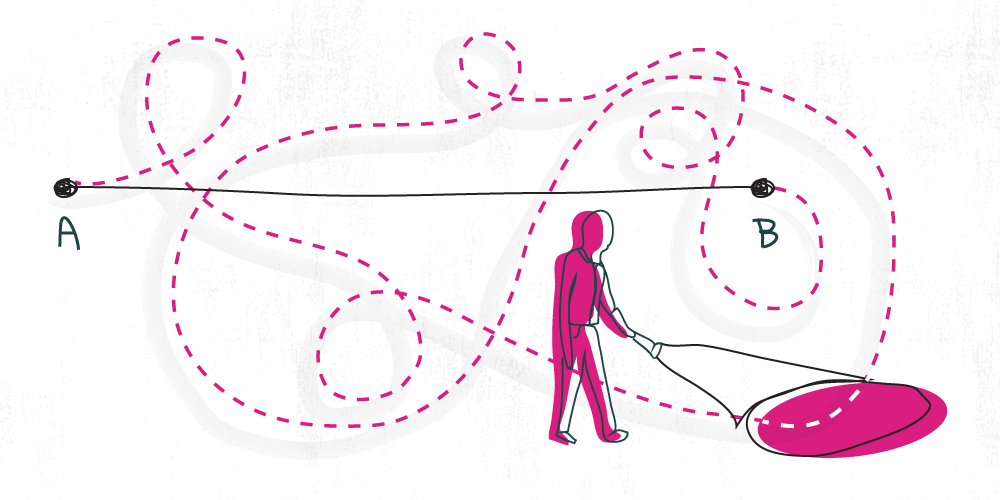

Based on my personal experience as a consumer, I’ve gleaned several insights that can vastly improve a credit union website design. The backbone of these insights is that my customer journey maps perfectly to the well-documented Buyer Decision Process (https://en.wikipedia.org/wiki/Buyer_decision_process):

- Need Recognition. I first recognized a need in my life: I want to earn a better rate of return on my emergency fund because its a sizeable chunk of money that’s currently earning a pathetic 0.01% APY.

- Information Search. I started searching the internet and various websites for information about savings vehicles.

- Comparison of Alternatives. I found some saving account options and started comparing alternatives so I could choose the best option for my family.

- Purchase Decision. I believe a regular savings account with Ally is the best option for my emergency fund, so I applied for an account.

- Post-Purchase Evaluation. I haven’t gone through this phase yet, but we’ll see if Ally meets my expectations.

3 Ways to Improve a Credit Union Website Design

My personal experience going through the Buyer Decision Process taught me three ways to improve a credit union website design:

- Focus on User Goals

- Educate

- Provide Comparisons

1. Focus on User Goals

Users know their goals, but they might not know which products or services will best help them meet their goals. When I visited credit union and bank websites, I came with a specific need and purpose: I needed a better savings vehicle for my emergency fund and I wanted to find the best option. Yet, no website I visited made it easy for me to find the best savings account specifically for emergency funds. That’s because FIs tend to build websites that focus on their products and services rather than user goals.

Instead, imagine what my experience could have been like if I a website were focused on user goals:

I come to a website with the menu options Borrow, Save, Spend, Learn, and About. Since I’m interested in saving, I click Save and a drop-down menu opens. Rather than solely a list of products, the menu asks, “What are you saving for?” then presents a few options:

- Car

- Home

- Retirement

- Emergency Fund

- Special Event

- What should I be saving for? (Which might link to a blog post)

“Perfect,” I think as I click Emergency Fund. The menu then responds to my click saying, “Ok, great! If you’re saving for an emergency fund, then you need an account that will (1) let you withdraw funds anytime without a penalty and (2) reward you with a high interest rate for maintaining a large deposit. For emergency funds, we recommend our Money Market Account.”

As a consumer, I may not know about your products, but I do know one thing: my goals.

Note: Perhaps emergency funds aren’t a common demand made by consumers, but (1) they should be and (2) my point still applies to many other products and services.

2. Educate

We should not assume users know anything about finances. Here are some things I didn’t know at some point in my journey:

- I didn’t know which savings vehicles are best for emergency funds. Studying the options led me to believe “regular” and money market savings accounts are best for my needs.

- I had not considered the cons of using a mutual fund to save for short-term goals. I learned about the cons from an article I found through a Google search.

- I did not know how to use the “raw” savings rates provided by financial institutions to calculate savings growth over a period. Then I learned I should ignore those rates and instead just multiply my deposit by the APY to calculate my annual earnings.

- I still don’t know how much money I’ll earn from my emergency fund over the next five years because no website presented me with a calculator near their rates (and I haven’t put in the effort to find a calculator).

What if a credit union website had educated me about these topics? When a website educates me, it gains my trust and prevents me from leaving to find information elsewhere.

3. Provide Comparisons

Comparison of Alternatives is a crucial phase of the Buyer Decision Process because it’s how consumers choose between your credit union and competitors. To help consumers choose you, (a) show how you’re different or better than than competitors and (b) provide comparison features.

(a) Show how you’re different or better than competitors

Consumers are going to compare your credit union to competitors, so you first need to convince them you’re the best option.

In his book, The Innovator’s Dilemma, Harvard professor Clayton Christensen identifies how people decide among alternatives:

- First, people consider functionality. I.e., “Does this thing do what I need it to do?”

- Second, people consider reliability. I.e., “When I need this thing to work, will it work consistently?”

- Third, people consider convenience. I.e., “How hard will this be?”

- Fourth, people consider price. I.e., “How much do I have to pay?”

As we can see, price is last thing people consider. So, let’s not make the mistake of assuming price is all that matters.

Many credit union services are commodities, which means functionality and reliability often are not differentiators. For instance, an auto loan has the same functionality and reliability no matter which credit union or bank the consumer chooses. Yet, you can still show that getting an auto loan from you is more convenient. When possible, show how you are different or better in terms of functionality, reliability, and convenience before diving into a price war.

Note: You can show how you’re different OR better:

- Different: To be different is to offer something your competitor does not. Example: If a competitor has better auto loan rates, you can be different by being more convenient.

- Better: To be better is to beat a competitor on the same terms. Example: You and a competitor both focus on having low auto loan rates and your rates are lower.

(b) Provide comparison features

On my journey, I found comparison features (like tables) really helpful. Above, under “My Alternatives,” I mention comparison features on ally.com and one on macu.com. These pages had tables that made it easy to compare savings options within financial institutions. For instance, ally.com’s savings comparison page helped me choose their Online Savings account over their Money Market account. Ultimately, easy-to-understand comparisons help users feel good about their choices and satisfied after choosing.

The Key to Better Credit Union Website Design

The three suggestions above came from one core strategy: “Put on the shoes of your users.” I’m convinced this core strategy is the key to better credit union website design.

What credit union web design insights have you learned from studying users?