If your credit union has over $100M in assets, your website should be generating millions of dollars. That’s why it’s important for credit unions to invest in their websites, especially during the COVID era when people are relying on digital channels. So, do you know how much your website is worth? We built a calculator so you can find out.

Have you ever seen that video of Bill Gates playing The Price is Right with Ellen? It’s pretty hilarious how bad he is. He has absolutely no idea how much basic items like laundry soap or rice-a-roni cost. Of course, he doesn’t need to know—he’s got people to do his grocery shopping for him.

But if you’re not a multi-billionaire, then knowing something’s value is essential. Especially if you help run a financial institution. All organizations that need to turn a profit to stay in business, including “not-for-profits,” need to know how much money their assets are generating.

This is a lead capture form on Altavistacu.org. Forms like these help credit unions generate profits.

I’m guessing you know which of your physical branches are the most successful. You know where most accounts are opened, which branch receives the most loan applications, and which branch is struggling. But what about your biggest branch, your digital branch? Are you as clear on the value of your website?

We built a handy calculator that can help you quantify the profits generated by your website. With the right data, you can see what your website is worth and where to improve it.

How to calculate the value of your website

To calculate how much cash your website generates, you’ll need to enter the lifetime values of your products and their conversion rates into our calculator.

Lifetime Values

The lifetime value (LV) of a product is the total profit your credit union earns over the life of the loan or account. (Sometimes credit unions don’t have profitability data for every product. If that’s your case, you can calculate revenue instead of profit, which would still give you valuable insights.)

Conversion Rates

For conversions, you’ll want to enter these numbers for all of your loans and accounts:

- Number of pageviews

- Number of click-throughs (clicks on your calls to action)

- Leads captured

- Applications completed

- Applications funded

You can get this data from your website analytics, origination system, and core system.

This auto loan page has a clear call to action to “apply now”. As part of your conversion data, you want to track clicks on buttons like this.

With this data, you’ll also be able to calculate the value of an application, lead, pageview, and session, which is extremely valuable for conversion rate optimization and digital advertising.

Getting the data you need to make these calculations might take a little work, but it can help you make improvements worth millions. For instance, we ran the calculations for one of our credit union clients in California and discovered their website helps them generate over $5M per year.

How the calculator can help you generate more profits

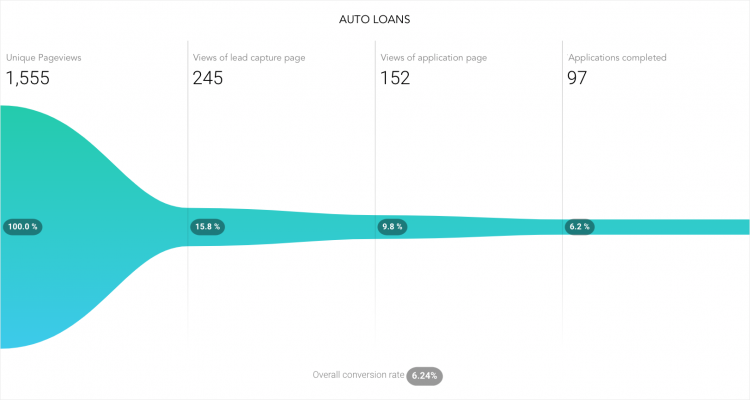

If you know the value of your website and where it could be better, then you can calculate the value of improving it. For example, let’s say your credit union profits $3,000 per auto loan, 50% of applications are funded, and your conversion funnel looked like this last month:

1,555 views → 245 clickthroughs → 152 leads capture → 97 apps. completed

With those assumptions, every time someone clicks the “apply” button on your auto loan page, your credit union makes $600. But only 15.8% of people are clicking “apply”. So, if you run some a/b tests and can increase that clickthrough rate by 50% (to 23.6%, which is reasonable), then you would increase profits by $73,500 per month ($882,000 per year). Now that’s bringing home some bacon, and that’s just for auto loans.

Try out the calculator yourself. You’ll probably be surprised by how valuable your website is (or should be).