What NCUA’s proposed rule on derivative use could mean for your credit union

An opportunity for federally chartered credit unions to gain greater flexibility in managing interest rate risk and making profitable decisions.

On October 15, 2020 the NCUA Board of Directors unanimously approved a proposed rule that would ease regulations on derivative use, open the scope of permissible derivatives, and make it easier for Federal Credit Unions to hedge their balance sheet interest rate risk using derivatives. Institutions that already have derivative approval would be subject to the terms and conditions of the final ruling. The proposed rule will be open for comment for 60 days following its publication in the Federal Register. ALM First applauds the NCUA staff and Board for proposing more principles-based regulations on derivatives and our comments will reflect this support.

§703.111 NCUA Approval

If the proposed rule is finalized, the first big takeaway will be the elimination of the preapproval process for certain Federal Credit Unions. Complex institutions with greater than $500 million in assets and a Management Component CAMEL rating of 1 or 2 could begin using derivatives by providing their Regional Director a written notification within 5 days of entering the first derivative transaction. It is important to note that there will still be due diligence needed from an institution prior to engaging in a derivatives transaction. This would include getting the Board and staff comfortable with derivatives, ensuring the accounting for derivatives is squared away, and reporting is handled. Under the proposed rule, these would be best practice measures – not regulatory requirements for approval. The removal of the preapproval process would make derivatives more accessible and provide institutions a useful tool for the management of their interest rate risk.

§703.102 Permissible Derivatives

Next, the proposed rule would remove references to specific product types that are permissible for use, allowing credit unions to use more forms of derivatives. They must be used for hedging interest rate risk and meet the requirements listed below:

- Denominated in U.S. dollars.

- Based on Domestic Interest Rates or dollar-denominated LIBOR (the Board is currently monitoring the LIBOR transition and will make any necessary changes to the final rule)

- Contract maturity equal to 15 years or less.

- Not used to create Structured Liability Offerings for members or nonmembers.

Currently credit unions are only allowed to hedge with interest rate swaps up to 90-day settlement, interest rate caps, interest rate floors, basis swaps, and U.S. Treasury futures. While these instruments can be used to hedge the lion’s share of interest rate risk, a broader suite of instruments is always preferred. For example, an interest rate swaption can be a very effective hedge for convexity risk for credit unions that are heavily concentrated in mortgages. The price profile of a mortgage and a swaption are tightly aligned which makes it effective in hedging mortgages.

In addition to the removal of references to specific product types, there will also be changes to the products and characteristics. There will no longer be forward start date limitations. This will allow for an institution to engage in a derivative that does not settle within 90 days. Also, the new rule would remove fluctuating notional amount limits. This would allow all Federal Credit Unions to use amortizing derivatives.

Another limitation that would be removed with the rule change is the general investment authority as it pertains to Mutual Funds. Under the current rule, any investment companies or collective investment funds that include derivatives in the investment portfolio are not permitted for investment by Federal credit unions. The new rule would allow Federal credit unions to invest in mutual funds that use derivatives for the purposes of hedging interest rate risk. It is important to note that any mutual funds that use derivatives related to equities, credit, or commodities will still be restricted.

§703.103 Derivative Authority

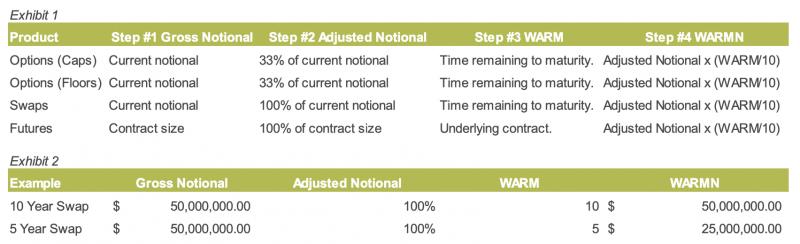

Lastly, the proposed rule would result in an ease on regulations. The proposed rule would remove all limitations that are set forth in the current §703.103. This would remove the entry limits and standard limits authorities as it pertains to fair value losses and WARMN limits. The fair value loss limits are currently stated as 15% of net worth for entry level and 25% of net worth for standard level. The WARMN calculations adjust the notional amount of a derivative to account for remaining maturity and price sensitivity. Exhibit 1 shows how the WARMN is calculated. The current limits stated are a 65% of net worth entry limit for 12 months and 100% of net worth thereafter. Because of this, institutions are restricted on the notional amount of longer-term swaps as they are weighted more heavily in the calculation due to their longer maturity. An example of this is shown in Exhibit 2. The original notional amounts for both the 5-year and 10-year swap are $50 million. However, with the current WARMN rules, only $25 million of the 5-year would count towards the regulatory limit while the full $50 million of the 10-year would count. Removal of this regulation will allow institutions to hedge interest rate risk more effectively as there will not be a penalty for extending liability duration with longer term swaps.

Going Forward

In today’s rate environment, being restricted to the short end of the yield curve due to interest rate risk limitations can cause margin compression. Being limited to one part of the curve restricts institutions’ ability to make strategic decisions regarding balance sheet direction. This can lead to adding products to the balance sheet that are not beneficial to the overall profitability of the institution. In addition, removing barriers to the products that can be offered will ultimately benefit the members of an institution. Another trend in 2020 has been an increase in mortgages on the balance sheet due to low-rate induced refinancing. This could add interest rate risk to balance sheets. We believe using derivatives can be a worthwhile tool for any institution with mortgages on the balance sheet or those simply looking to manage margins in the low rate environment. If the rule is finalized, it would provide federally chartered credit unions with greater flexibility in managing interest rate risk and potentially making profitable decisions.

Co-authored by Shahid Sattar

ALM First Financial Advisors is an SEC registered investment advisor with a fiduciary duty that requires it to act in the best interests of clients and to place the interests of clients before its own; however, registration as an investment advisor does not imply any level of skill or training. ALM First Financial Advisors, LLC (“ALM First Financial Advisors”), an affiliate of ALM First Group, LLC (“ALM First”), is a separate entity and all investment decisions are made independently by the asset managers at ALM First Financial Advisors. Access to ALM First Financial Advisors is only available to clients pursuant to an Investment Advisory Agreement and acceptance of ALM First Financial Advisors’ Brochure. You are encouraged to read these documents carefully. All investing is subject to risk, including the possible loss of your entire investment.