Why DEI has been a focus for World Council of Credit Unions since our inception

I serve an international organization that has been a bridge across borders, across oceans and across ethnic, racial, cultural, and religious identities for nearly fifty years. Since the death of George Floyd, we ask, “have we done enough to address diversity, equity and inclusion?” Maybe not, but we also look at what we have done, what works and what we can do more of. Often, the first steps in overcoming distance, prejudice, or tension are achieved by building familiarity and understanding. We do that by engaging more—in our work, in our education, and in our home—with that which is different from us.

The World Council of Credit Unions continues to build lasting bonds across borders and across cultures. One of the ways we build a more diverse and inclusive culture is by building bonds through exchanges and shared experience: ‘una viventem’—living and working together.

The World Council has been involved in international inclusive initiatives since its founding in 1971. Its project work has provided technical assistance and training for credit unions in more than 90 countries. Credit unions and credit union systems today exist in 118 countries, many of them begun by the World Council.

Inclusion of Diaspora

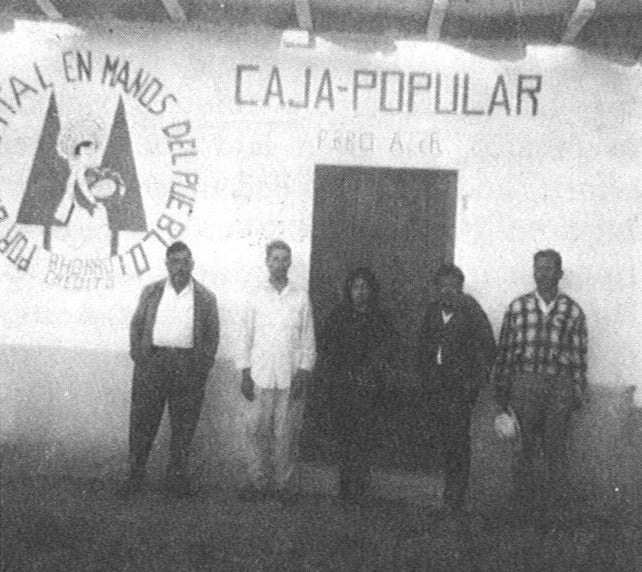

In 1971, the Texas Credit Union League was the first U.S. league to support a World Council program in Mexico—which strived to build a credit union system there and make it self-sustaining. During the first two decades of this century, both the Texas and California leagues partnered with the World Council again to take the Mexican credit union system to a new level, and to bring back to U.S. credit unions advice and support on how to better attract and serve the growing Hispanic market.

After Hurricane Maria hit Puerto Rico in 2017, Massachusetts’ credit unions partnered with World Council and Inclusiv to support Puerto Rican credit unions recovering from the hurricane and again to bring home advice on how best to serve the Puerto Rican diaspora in their mainland home communities.

Helping Credit Unions Reach the Underserved

During the 1990s, the World Council developed its model credit union building approach, which emphasized sound institutional framework and savings-driven growth. The program accelerated credit union growth and outreach in Latin America and went on to be used to establish and strengthen credit unions in Africa, Asia and Europe. The first and second decade of the millennium saw a constant exchange of volunteers, trainees and best practices across oceans, from Latin America and the US to Africa. The model credit union program was about building resilience in credit unions. And once again in the post COVID-19 world, we find African and European credit unions dusting off their MCUB guidelines to weather the crisis.

International programs have always been about taking service to the underserved. On the foundation of sound financial management and policies, credit unions have been able to address those left out or injured by prejudice or racism around the world. At the end of apartheid, African American volunteers from Louisiana worked with credit unions in South Africa to extend services into the townships. Credit unions in Maine trained credit unions from Rwanda as they reestablished services to Tutsis and began mending Rwandan society back together. Credit unions in California adapted methodologies developed for Mexican credit unions to provide services to agricultural field laborers.

Today, Minnesota credit unions support the World Council in establishing credit union services for immigrants in Turks and Caicos, while Peruvian and Ecuadorian credit unions work with the World Council to extend services to refugees fleeing from Venezuela.

Engagement programs have mobilized volunteers to help credit unions serve those at the bottom of the pyramid: youths with no future in Guatemala, immigrants in Colombia, orphans in Kenya, and abused girls in Kurdistan.

Today’s mobile technology allows credit unions to take services more deeply into remote areas to the poorest, to the most marginalized indigenous populations, to women and to young people where they live and work. U.S. credit union volunteers who have participated in many of these programs across the globe have not only contributed to them, but have also come back with insights and commitment on how to engage the most vulnerable members in disadvantaged communities by going directly to them with services.

Championing Gender Equality

In the 1980s, the World Council noted that credit union membership fell short of reaching many women. It worked with credit unions across the globe to develop products and delivery strategies that responded to the market and mobility challenges women faced in many cultures. Female membership reached parity with male membership, but we observed still few women in senior membership or in the boardroom.

Led by women credit union professionals, the Global Women’s Leadership Network (GWLN) was established in 2009 to tackle our industry’s gender gap by providing a peer network with professional development, coaching and networking support for women in credit unions. Today, GWLN has 120 sister societies in 27 countries around the world, dedicated to helping women take leadership positions in the credit union system.

It provides the opportunity not only to access and develop women’s leadership in the credit unions systems but, as in many countries around the world, also to empower female entrepreneurship in the communities they serve.

In these tumultuous times, many of us ask: “have we done enough?” and “can we do more?” to address diversity, equity and inclusion. We invite you or your colleagues to join us virtually or in person, when safe, for volunteer engagement, or participation in GWLN or World Council Young Credit Union Professionals’ (WYCUP) events. There remains much to do to enhance DEI worldwide. Credit union people are cooperators; we work together to continue building bridges.