Why your members don’t need you

by: Austin Wentzlaff

Consumers, particularly millennials, are becoming less interested in meeting actual people to solve their problems and more interested in doing it themselves. With the rise of the internet, information is readily available to all. This allows consumers to search and find solutions to meet their needs in a matter of seconds. This is a tremendous opportunity for consumers but it is also a serious challenge for retail institutions. This is especially true for retail financial institutions such as community banks and credit unions.

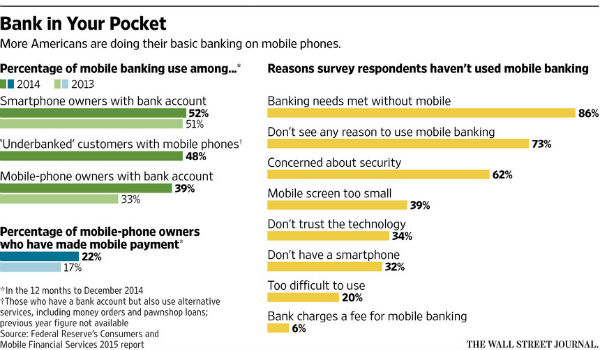

Federal Reserve Study

A recent study conducted by the Federal Reserve has revealed that more and more people are using their mobile devices to carry out their basic banking needs. The Federal Reserve’s 2015 Consumers and Mobile Financial Services Report shows that there are more smartphone users than ever before and, consequently, more people carrying out their banking needs with their mobile device. This “pocket bank” allows users to check balances, deposit checks, and even transfer money to friends (P2P payments) and other institutions (mobile payments). The convenience of mobile banking has unmeasurable benefits for consumers but what does the shift toward mobile mean to retail financial institutions?

continue reading »