Women’s rights – is banking next?

I’m going to go totally off the rails.

This was my first thought when I started writing this piece on June 24th. If you live under a rock or don’t remember what happened that day, it’s the day I and every other female and persons with ovaries in the United States became government property with no rights to our bodily autonomy. Six people on the supreme court said so.

Since my birth, I have been excluded from certain things based solely on my gender. But throughout my lifetime, I (and the female gender) have slowly gained access and equality to more and more things. This is the first time I have actually lost rights because of my gender and reproductive organs.

I’m still processing the depth of this action and how it will impact me personally as well as my family (including my teenage daughter). What a time to be a parent to a teenager who can reproduce!

I’m also processing what it means for my workplace, my employees, my members, and my community. What will this ruling mean and how will it be executed in my state and every other state?

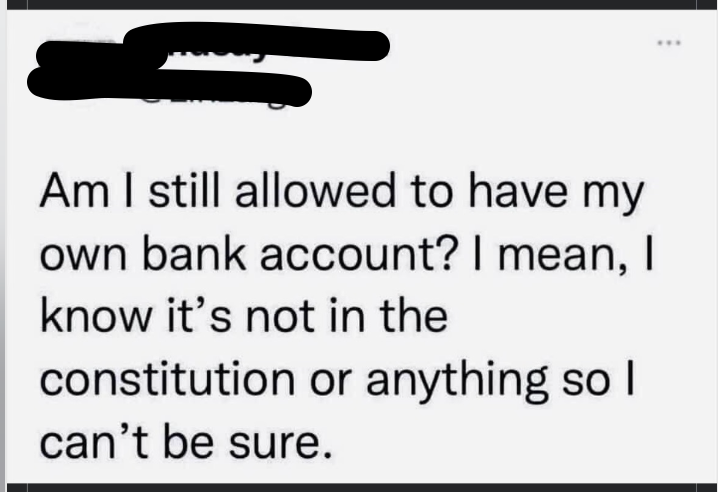

I saw this tweet. And it got me thinking.

In my lifetime, women were not allowed to have credit. The Equal Credit Opportunity Act of 1974 changed that. Women were gaining more rights and autonomy over their lives. It was a good thing!

But now, are women and persons with ovaries at risk of losing the rights to a bank account or financial services?

I know you’re laughing now. I was too when the thought first popped into my head. But I kept thinking. I put on my regulation and compliance hat. It’s not my favorite hat, but I roll with it.

Rights typically are not taken away by repealing existing laws and regulations. If the people in charge don’t want you to have a right, they make it hard for you to access or use the right. Put up as many barriers as possible, and ta-da, you are limited. They can achieve their goals incrementally until they can fully take away the right.

Many of my friends and colleagues have asked if we plan to do anything new at the credit union. Will we create additional products and services to help our staff and our members deal with the new barriers that now exist for women and families?

The one question I have not been asked is, “Will you continue to bank women and people with ovaries?” Or “Is this the start of effectively killing banking for this population?”

You are aware of the power of data, the brokering of data, and what the government and other entities can do with data. And as financial institutions, we are required to do lots of regulatory and compliance tasks with member data every single day.

Now, let’s imagine that some sort of law or regulation pops up that requires financial institutions to monitor and track “reproductive” transactions on our members’ accounts. We would be tasked with outing our members to the authorities to comply with whatever law exists in the respective state.

Some states are creating penalties and criminal codes for those “aiding and abetting” anyone who seeks reproductive care that includes abortion. By providing a banking account or credit card to your member, will financial institutions be part of the “crime”? Will we face fines? Will we be forced to close accounts? Will we face class action lawsuits for aiding and abetting women’s healthcare?

Are women the new cannabis? Sorry, we can’t bank that! It’s too much of a risk.

But most importantly, will women be so fearful that their banking transactions will be monitored that they choose to delete their bank? We’re already deleting period tracking and health apps to avoid potential sharing of our personal health data. Why would we trust banking? They’re tracking us, too. What does this do to our stability in our communities and our nation?

So again, I ask, “Is this the beginning of the end for women’s access to banking accounts?” When you hear “it’s not about the babies,” this is what it means. It’s about power and control and disenfranchising people who simply want to live freely and equitably. What will you do to ensure the continued safe and secure banking for all people? What if the government mandates that you give up your member data? It’s time to think about our new world, our new America with fewer rights and freedoms, and be prepared for the battles yet to come.