Yield metrics are not just for profitability anymore

Much attention has been paid to credit union profitability over the last few years, as yields have remained low and loan growth continues to lag behind the market. While it’s important that credit unions are able to keep an eye on loan yields in general and pay attention to economic conditions that may narrow yields even more in the future, profitability is not the only reason why credit unions should be monitoring various internal yield metrics. With increased attention being paid to equal credit opportunity, or Reg B, by the CFPB (and by extension the NCUA), it is important that credit unions are able to defend their pricing as fair and non-discriminatory.

Since the 1990’s, risk-based lending or pricing has been embraced by many, if not most, credit unions as a way to make more loans available to their members. By adjusting loan pricing and considering additional risk attributes to mitigate the risk of loss, credit unions have been able to deliver loans and lines of credit to members who previously had to go elsewhere to get the same service.

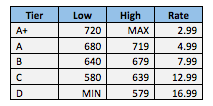

Regulatory guidance for risk-based pricing encourages credit unions to use empirical data to measure risk, as empirical data theoretically avoids the risk of discriminating against an individual for a prohibited reason. As creating empirical risk score models is quite complex, most lenders use a FICO® score model available through one of the three credit bureaus to establish an individual borrower’s credit risk. FICO® models use an odds chart, where higher scores represent lower risk and lower scores represent higher risk. To price loans, lenders then group borrowers based on their individual credit score into pricing tiers with upper and lower risk score bounds. Borrowers with higher credit scores are typically charged a lower interest rate for loans than borrowers with lower scores.

However, there is a growing sentiment among consumer groups and regulators that using the credit score alone is not a sufficient strategy for preventing the appearance of discrimination and can, in fact, put the lender at greater risk of being accused of discrimination. There is some data that supports the theory that minority groups disproportionately have lower credit scores than the population as a whole. FICO® defends their score models as non-discriminatory, stating that they are based solely on non-subjective criteria, such as type of credit, payment history, length of credit experience and a number of other factors. Further, the Federal Reserve Board conducted a study in 2010 and concluded that the factors used in the FICO® score models do not appear “to have a disparate impact across race, ethnicity or gender.” But, is this good enough to prove that your risk-based pricing is not discriminatory?

The answer is no. How the score is used and what other factors are applied to a credit and pricing decision can have an unintentional disparate impact on members of some minority groups — and it doesn’t matter whether the discrimination is intentional or unintentional. For example, the simple criteria that an applicant must have at least six years of credit history to qualify for a loan or preferred pricing, despite their credit score, can discriminate against borrowers under 25 years of age. Likewise, debt-to-income and minimum income criteria could affect applicants at the other end of the age spectrum. While it is entirely appropriate to use a FICO® score as an empirical measure of risk, a lender must also prove a business purpose for pricing differences based on other risk attributes. It’s not that a credit union can’t use them if there is a business purpose to do so, but it must be able to prove it.

The best way for a lender to prove a business case for its lending and pricing strategies is by demonstrating how the risk of loss impacts net yield. It’s also important for the lender to monitor various yield metrics to ensure that their pricing is fair and equitable to all borrowers.

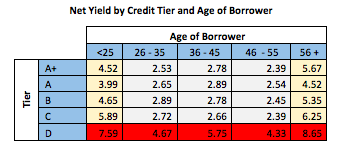

It is often missed that risk-based lending strategies should result in equitable net yields across all risk categories to prevent the appearance of predatory lending or outright discrimination. Often lenders refer to the “higher risk” as the reason for higher Net Yields. This is not correct. Higher risk is a reason for higher pricing, but only to the extent that the additional risk is mitigated. In the chart above, net yields are calculated by credit tier and age of borrower. While all borrowers in the same credit tier may get the same loan rate, other factors used to mitigate risk may impact net yields. In this example, potential issues with inequity in pricing may be revealed when attributes that are not intended to be discriminatory are intentionally so. There is clear evidence in the A+ through C tiers that younger and older borrowers pay a much higher effective price for their loans than other borrowers. And all members in “D” tier seem to be paying more than they should, based on credit score alone.

It’s important for lenders to take a much closer look, not only at Yields and Losses, but also Net Yields in several risk categories, where protected classes of borrowers may be adversely affected by poorly constructed risk models. Therefore, lenders must have tools available for calculating loan portfolio yields, factoring in origination and servicing cost, in addition to loan losses, to have a complete picture of net yields.