2023 auto industry outlook: How it affects credit unions

The automotive industry has been in a unique state in the wake of challenges brought on by the pandemic. Elevated interest rates and the rising cost of vehicle ownership continue to present challenges for members, many of whom are struggling to stay afloat during these uncertain economic times. Only now are automakers beginning to catch up with the inventory constraints that restricted car sales in the last few years, but will it be enough to stabilize the industry long-term?

To mitigate the risks these challenges present, credit unions must understand key factors in auto trends that are impacting their loan portfolios—now and in the future. In this article, we’ll examine the state of the auto industry, identify its potential effect on loan portfolios, and discuss what credit unions can do to minimize loss.

What’s happening in the auto market

Have you noticed car commercials are beginning to incentivize sales again? That is something we have not seen for a few years. As auto makers begin to emerge from an inventory slump, they are eager to move vehicles off the lot—and are sweetening the deal with rebates and special financing for qualified buyers.

Available unsold new vehicles stood at 1.89 million at the end of March, the highest level since April 2021. Charlie Chesbrough, Cox Automotive senior economist, recently stated: “With some brands and segments nearing too-high levels of inventories, we are seeing discounts and incentives increase.”

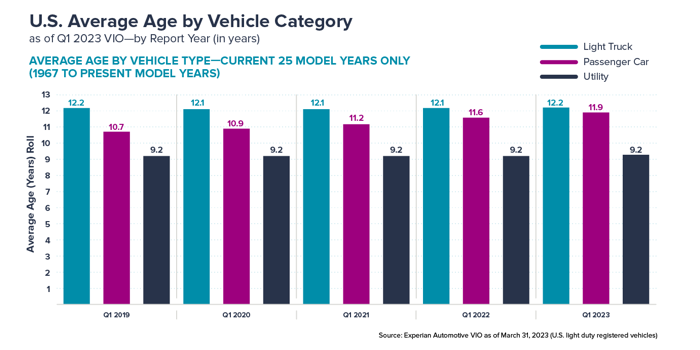

An improvement in inventory is not the only reason some automakers are promoting new car sales. In a Q1 auto report from Experian, metrics show that new registration volumes of passenger vehicles have declined over the last five years, resulting in an increased average vehicle age of 11.9 years. Because consumers are keeping their cars longer, car dealers are left with growing inventories and fewer prospective buyers willing or able to afford the price of a new one.

Why are consumers keeping their cars longer? Elevated interest rates, high car prices, and tighter lending criteria may make auto loans unaffordable for many buyers. According to MarketWatch, the average auto loan interest rate across all credit profiles is 6.58% for new cars. And while prices have dipped this year, the average new vehicle purchase price still exceeds $48,000. Even used vehicle registrations have dipped as low inventory and high prices impact those transactions.

The role of credit unions in auto finance

Relationship trends between credit unions and members are on the rise. According to CUData, the average member relationship totals $25,032, with an average loan balance of $11,196 per member. Although captive finance companies have gained the largest share of total financing, credit unions continue to lead as the largest used auto lender, with used auto loans accounting for 21% of their loan portfolio (new auto loans account for 14%).

Despite the negative effects high interest rates are having on members, the increase in interest income is helping to improve net interest margins for credit unions. Although, loan growth is slowing due to credit tightening and higher member costs, and these higher costs may be contributing to increased loan loss reserves as credit unions anticipate higher loan delinquencies in the near term.

What credit unions can expect the second half of 2023 and beyond

The stage is set for an uptick in car sales during the upcoming new car buying season beginning in Q4 of this year. As the current average age of vehicles suggests, there’s pent-up demand for new vehicles and dealerships have inventory to accommodate. As new loan originations are expected to increase in Q4, credit unions must remain diligent. Interest rates are expected to remain elevated and average monthly payments will stay near historical levels, putting further financial pressure on members trying to survive in this challenging economy.

In the last 12 months, SWBC’s Financial Institutions Group has seen a drastic increase in the number of skip assignments received from our clients. The sheer volume of skip assignments is staggering while the average severity of skip losses has reached historic levels along with the meteoric rise in new car prices. Without the proper coverage in place, credit unions may be on the hook for hefty unpaid loan amounts and no recoverable assets.

Protecting auto portfolios during challenging times

Credit unions have relied on collateral-placed insurance (CPI) to minimize risk on their auto loan portfolios. CPI protects a credit union’s interest in a vehicle should members let their insurance coverage lapse, but CPI alone doesn’t help with all the nuances of recovering lost or damaged collateral. The following challenges can create unique burdens for credit unions:

Skip tracing

When credit unions are unable to reach delinquent members, skip tracing helps track and recover the collateral. However, credit unions are often understaffed or have limited resources when it comes to investigation and disposition.

Damaged repossessed collateral

If repossessed collateral is damaged, credit unions are left with greater deficiency balances. Working with members’ insurance to file damage claims can be a time-consuming process that overwhelms staff and delays the auction sales process.

Product refunds

Members may be entitled to auto product refunds in the event of an early payoff, repossession, total loss, or charge-off. Credit unions are then responsible for identifying the purchased products and providing proof of verified refund amounts in a timely and compliant manner.

Missed vehicle replacement opportunities

Your credit union may not be top of mind for members looking to replace a vehicle after a total loss. When your members are left to navigate this process on their own, you have less opportunity to successfully recapture auto loans.

The end of the year should bring renewed interest in auto sales as consumers feel better about the direction of the economy and interest rates begin to recede. Credit unions should be positioned to take advantage of new auto financing opportunities in their marketplace—and how they can help make the process more convenient for members. As credit unions grow their auto loan portfolios, determining the right risk mitigation strategy will be essential for financial success. To learn more about how SWBC’s financial institution group can help your credit union better manage risk for your auto loan portfolio, visit our website.