3 keys to a successful social media marketing strategy for your credit union

Creating a well-designed strategy is the backbone to any successful marketing or sales approach. With that in mind, we often weave in social media for larger campaigns for clients, and here’s how we do it…

- Set SMART Social Media Goals to Begin With

With any strategy this one should really go without saying… SMART goals are:

– Specific

– Measurable

– Attainable

– Relevant

– Timely (Time-Bound)

Even though these simple rules seem like a given sometimes, I’ve lost count of how many of our new clients have told us… ‘we want to grow Facebook likes.’ First of all this is what we call a ‘vanity metric.’ I’ve yet to meet a CEO or Board Member who really cares about page likes on Facebook. This type of a goal is also WAY to general, and doesn’t include a number of the other characteristics that make strategic goals successful.

Instead, perhaps you could set a goal of reaching and engaging with 20% of your total customer or membership base within the first 6 months of your new social media push. This kind of a goal makes more sense in terms of relevance to your larger business goals and objectives – who wouldn’t want to interact more with your customers? And it’s also specific, time bound, attainable and measurable. So it has the all the hallmarks of a great strategic goal.

- Find Key Progress Indicators Along the Way to Achieving Larger Objectives

When we create a social media strategy for our clients we encourage them to include larger annual account, loan or total asset growth goals. But your Financial Institution can’t reach those goals without lots of other smaller steps along the way. This is why it is essential to make sure you identify some Key Progress Indicators (KPIs) that can be measured in 30, 60 or 90 day increments to ensure you’re heading in the right direction.

For example, if you have a goal of growing your total consumer loan portfolio by $100 million, and one key part of that portfolio is credit card growth, then each month you may want to track new visitors to the credit card information page on your FI’s website.

A SMART goal for this approach might be to increase traffic to this page by 10-30%, depending on the revenue growth goal and your current conversion rate for leads to new customers. Website click ads from Facebook and Instagram are a great way to increase traffic to specific product or service pages on your website.

But if you’re still unsure what your current conversion rates are, as many of our new clients admit, you could also consider tracking credit card applications submitted and have similar goals that are driven by your larger revenue growth objectives.

Again, you can’t open new credit cards without applications, and these types of incremental KPIs will help you understand where you might need to focus your social media and marketing and sales efforts to achieving your larger goals. These kinds of KPIs will also give you clear points along the buyer’s journey you can track, and better understand where you’re losing people throughout the application and sales process.

- Engagement Is the Absolute KEY to Social Media Success

Now this might be one of the most important parts to any successful social media marketing strategy. A lot of people think it’s all about audience growth… how many fans or followers you have. But that really means nothing once you hit an acceptable level that indicates your platform is legitimate. And senior managers just want revenue impacts, but those come later in the process. Those are the long-term goals.

What we have learned over many years of work in this area is that it’s the engagement with people on social media that is KEY to your short and long-term success. Whether you want to grow accounts, engage more with current customers, or reach a brand new market with your business products and services, if you aren’t engaging on social you’re literally just wasting your time. And time is money!

Here’s the proof… Recently we had a customer who, due to pressure from senior management, moved away from sharing content on Facebook and Instagram that was fun, entertaining and engaging. Their marketing team wasn’t thrilled with the change, but against our recommendations they still wanted to try the shift, just to “see what happens.”

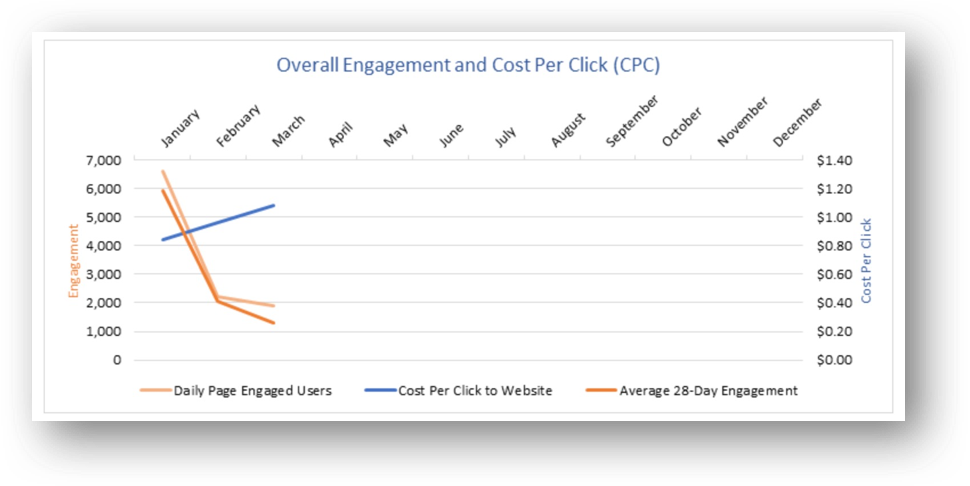

In just 60 days the impact was striking! They saw a dramatic drop in their overall engagement on both platforms, plummeting from roughly 33% engagement each week to only 8% each week! Wow!

Now what you might say is, ‘So what? Who really cares about engagement rates on social media?’ And honestly, this is an excellent question. Digging a little deeper into the results from this shift away from trying to engage, we also saw that the costs of driving traffic from Facebook and Instagram went up dramatically as their overall engagement went down.

So as people were doing less liking, commenting and sharing of their content posted on social, Facebook began to charge them more for sending users to the client’s website. Their cost per click was going up as their overall engagement went down.

For some institutions it can be difficult posting “off brand” content on social media. They just don’t understand how a meme or funny video (see example below) is benefiting their institution in the long run. However, Facebook owns the platform and makes the rules. They are clearly telling businesses they will only organically display content that’s considered valuable by their users, and engagement = value. And when people engage less often Facebook ends up charging you more because they assume users have a lower ‘affinity’ with your page.

It’s complicated, but to play on these networks you have to work within their parameters. And to be successful your social media strategy has to align with the way in which these social networks work, so if you aren’t dedicated to engaging with your audience in a fun or useful way you might as well just give up and go home.