3 reasons to choose a CRM that’s purpose-built for financial services

When choosing a CRM, there are no shortage of options in the marketplace. But buyer beware – some of the players may not have the essential functionality your credit union needs to succeed with your CRM implementation and adoption.

Why’s that? Well, think of the complex workflows that underlie many of the routine member interactions performed at your credit union every day. Horizontal CRMs often can’t do a very good job of supporting these complex and unique business processes. On the other hand, when you consider a CRM built for your industry, from the ground up, you’ll find that everything from UIs to process flows have been designed with you in mind.

Do you want specifics about how CRM for community financial institutions can support your credit union? Here are 3 areas in which CRM that’s purpose-built for credit unions just can’t be matched by a generic CRM solution.

1. Ready-to-Use Interfaces and Data Visualizations

There’s a certain set of data your staff members need to see to give good service. This is different from, say, what a real estate professional or a manufacturing sales rep needs to know about their customers. Things like share of wallet and next best actions probably won’t be displayed optimally unless you pick a CRM built around the necessity of being able to review finance-specific data.

Equally importantly, there is data your front-line staff should not see, but your compliance personnel need access to. The same goes for your branch managers, lenders,and so forth. Purpose-built CRM will have role-based permissioning with roles predefined for specific community finance jobs, so dictating who sees what data is easier.

2. Cost-Saving Integrations

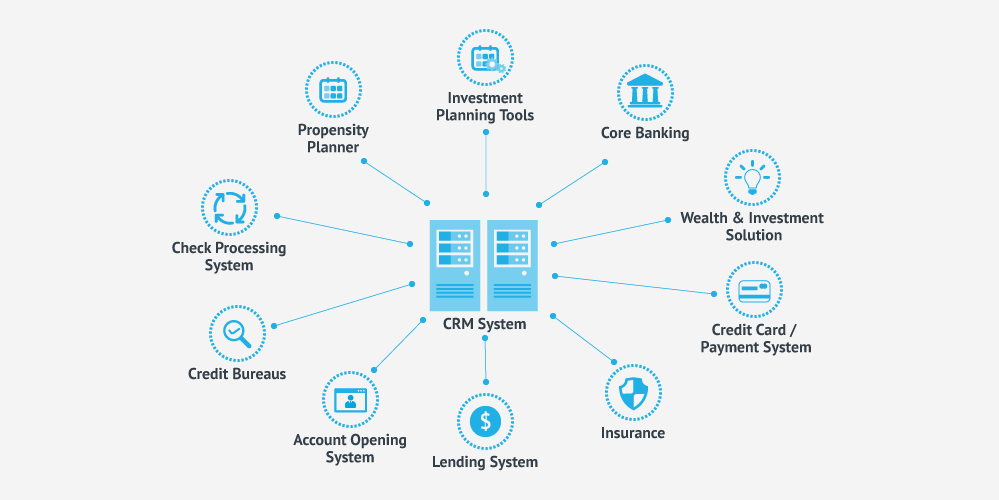

Your credit union relies on links to external service providers for essential data like credit scores, investment planning details, and title and lien information. If you choose a CRM without pre-built integrations to these providers, or one built by an organization that doesn’t have much experience in making these connections, you can wind up paying a lot for customization.

Then there’s the matter of your back office – or back offices, if your CU was formed through a M&A process. CRM can act as a bridge between these siloed data sources – but only if you have an experienced partner to help you integrate your architecture correctly.

3. Core common workflows and processes built on best practices

When you work with a vertical vendor specializing in community finance, you get access to process flows and interaction types designed after years in the field, and based on best practises derived from many earlier engagements.

This means you don’t have to reinvent the wheel – you can start with these standard workflows and then do some configuration, as required, to get a perfect fit for your CU.

As a customer of a vertical-specific technology provider, you will likely also get access to educational client conferences and customer advisory boards. At these events you can share your successes with CRM, learn from other successful peers, and workshop further optimizations in an environment that is only focused on your industry, not on needs of the largest clients from each industry a horizontal vendor serves.

When you are dealing with complex, enterprise-wide software like CRM, expert vendors and a knowledgeable, accessible, industry-focused peer group can make the difference between success and failure.

CRM from a Specialist

When you select a CRM built just for community finance, you should expect a solution that fits the way you do business easily, with little customization. Throw in built-in compliance with the rigorous standards and regulations governing your industry, and you’ll have a lot of happy stakeholders across the credit union. CRM without extraneous features is also streamlined and easy to use, making it the natural choice to ease your credit union towards its goals of enterprise-wide adoption, and a CU full of proficient CRM users and advocates.

For more practical CRM advice based on our 20+ years of experience in the field, download our free eBook “How to Plan a Successful CRM Project: Doxim Quick Guide for Credit Unions.”