5 strategic opportunities your credit union should prioritize (that you haven’t already read!)

This is a bit of a long piece. That’s to be expected, as it’s intended to be a ‘think piece’ which covers big ideas likely to inform significant trends for all of 2023 (and well beyond that). You don’t need to read the whole thing; you could assign it out to your management team and make them read it. However, we’re confident if you spend a few minutes on what follows you’ll be well prepared for what many believe is going to be a tough year for banking, currencies, and consumers.

2023 looks like it might be a tough year for bankers, and bankers’ hours, but it doesn’t have to be a bad one …

Elon musk doesn’t work bankers’ hours, and neither do his followers on Twitter. Some of the best stuff you’re going to read as a financial institution executive is just blurted out into random corners of Twitter, over the weekend, by your (surprisingly informed) customers and community members as they watch their favorite sports-ball game (or perhaps binge-watch the latest mindless series). I’m speaking in terms of my own personal confession, of course …

Anyhow, while the world was watching Tom Brady and the Buccaneers struggle to remain relevant in the NFL during this year’s playoffs on Monday Night Football (there’s a metaphor in there somewhere about hanging on to the way things have always been in banking!), Elon and an average Jane/Joe were engaged in a profound conversation about money – just casually bantering back and forth and airing banking’s dirty laundry and core strategic challenge:

There it is, right there, out in the open, for your institution, your customers, your community businesses and the whole world to see … a titan of the internet and ecommerce blatantly banks on the fact that the vast majority of money has a problem because it’s only data, and it runs on “heterogeneous” (different, old, incompatible, siloed, legacy) databases, many of which depend on 30+ year old technology and language.

Now, we must admit, since our consulting and product development at DaLand CUSO have long been predicated on the simple strategy and philosophy that FI’s need to centralize and control data in a modern core, and then build modern digital operations and channel delivery around and from that data and core, it feels pretty good to see Elon agree! After all, the guy who made electric vehicles a reality while also figuring out how to make rockets land back on earth (reusable and in one piece) is echoing our opinion that banking and money have a product and operational problem – a core problem, a data problem! While we’re confident we’re smart and innovative, we’re not ‘reusable-rocket’ level geniuses …

So, given an actual rocket-level business genius is calling out the problem with money, data, and banking, we’re taking the risk of sharing an informed analysis of five things we think every FI should be paying attention to in 2023; strategic trends and opportunities which directly relate to reality that every FI is going to have to solve for the disruptive reality of money becoming data, and data-money merging with the internet (soon!).

CBDCs (Central Bank Digital Currencies):

In talking about money being mostly stored on antiquated, siloed, data processing systems, there’s no timelier 2023 topic than CBDCs. In November 2022, the New York Fed announced a pilot of a CBDC with banking entities such as BNY Mellon, Citi Group, Wells Fargo, and US Bank. Now, before the “well but!” horses get out of the stable, we know this (initial!) pilot was designed for interbank and wholesale/commercial money movement. Still, as a banking institution executive, and one who manages a vast minority of the market assets/value at that (and are largely subject to the trends set by those who control 80% of the market), it will be crucial to pay attention to how mega-banks are exploring the use of distributed ledgers and digital assets to improve settlement, cost of money movement, availability (speed and affordability) of liquidity in 2023. And perhaps, it’s time to ask some questions about whether retail bank operations and core data/processor tech will be prepared to integrate to a next generation distributed ledger network for bank settlement and liquidity access? After all, as the Fed’s own pilot admits, current banking operations are entirely NACHA/SWIFT/EFT based, largely settling at the speed of days not seconds (mere moments being the new standard of the nascent distributed ledger and digital asset networks).

Limited pilot or not, CBDCs and digital assets are driving innovation in money away from electronic dollars and toward a digital money-data merged with the internet, and that matters to banking because, for example, “There’s more volatility risk using SWIFT over 180,000 seconds than there is using XRP over 3 seconds,” as Brad Garlinghouse has repeatedly pointed out. Brad makes a good point; apparently such a good point that he was asked to headline at DAVOS 2023 (btw) to share these points with the ‘elite’ bankers and corporatists plotting the future of money and commerce. Perhaps central bankers are figuring out their electronic fiat currencies have foundational (global) problems if they can’t move money as fast, securely, or affordably as other rising and competing currencies. Moreover, maybe bankers are seeing the value in being able to provide liquidity faster during tighter times, and understanding businesses will pay a premium for faster, more secure access to money. If this is the case, community bankers should consider assessing the strategic risks to their wholly electronic dollar dependent businesses and recognize that any introduction of alternative settlement or liquidity movement technology, at any level in the banking system, will be extremely disruptive if you are caught unprepared. It won’t work in 2023 or beyond to simply look to vendors or react to urgent demands for rapid design and deployment of operations as well as urgent initiatives to connect cores, operations, and institutional capital to new, faster, more affordable, settlement and liquidity systems. While we’re at it, CBDCs will drive parallel adoption and innovation in private digital assets. That’s a deeper topic for a different time (Bitcoin, etc.), but it bears mentioning here.

Since we opened with an Elon quote, and we’re big about the idea of symmetry and simplicity, let’s close this section with a similar Elon nugget and concretize this notion of 2023 being the year of digital currency’s impact on banking: “My hope for Bitcoin and crypto in general is that it can improve the efficiency of the information system that we call money; so if the core efficiency of money is improved and the money has less error like government interference or fraud, this will lead to a better standard of living and more power to the individual, which I very much agree with.” (Elon Musk, January 16, 2023)

Digital Retail Operations

We’ve established the ‘theory’ that 2023 will be the year of currencies accelerating their transformation beyond electronic (daily settlement) dollars and thus money moving closer to fully merging with the internet. We’re suggesting 2023 will be the year digital currency (CBDC or otherwise) starts to make its full disruptive impact known on banking (and commerce). Seems a safe bet given Elon’s above statements, and similar comments from titans in nearly every corner of modern industry, including headliners at DAVOS 2023.

So, if we’re right about this trend and trajectory, what does that mean for your retail banking operations? What can your community banking institution do in 2023 (and 2024) to prepare for a world which rapidly advances beyond the present day-to-day speed of money? How can community financial institutions start building products and services to meet consumer expectations that money moves at the speed of the internet (and not just the duck-tape-and-bailing-wire impressions of that which we pass off at the point of sale)?

It may seem like a complex question, but there is an elegantly simple answer: if Elon, The Fed, and others are right, and money is overcoming the costs, risks, and limitations of living as dispersed and ‘heterogenous’ data on legacy banking systems, then the solution to that problem is to prioritize control of homogenous data in a centralized, modern, core; and then build digital operations which don’t assume dollars, checks, and plastics as norms, but instead prioritize the collection of more data, more and new types of money-data, and then use that consolidated and dense data as connective tissue for commerce – including (especially) positioning your institution to be prepared to tie into new distributed networks for value storage and exchange. This doesn’t mean making the next pick for the right ITM; it means asking the question, “how long will we have cash, checks, and plastics,” and starting to design and document retail operations which function without vaults and teller drawers, and back-office operations which settle digital assets processed on distributed ledgers in seconds, not credit cards and checks moving via files over days.

Inflation & Fiat Currency Instability

Speaking of the wizardry of daily money file magic … our central banks and governments are telling us inflation is coming down, and it’s under control. CPI is ‘down’ to 6.5% in the latest US reports, ‘down’ meaning core consumer prices are up 6.5% compared to 12 months ago. Yes, that’s how fiat works … up is down and down is … good? I think I have that right; anyway, it doesn’t matter because your consumers don’t speak bureaucrat. Their primary financial language is the balance in their checking account. As anyone who has been to the grocery store recently knows that wealth is no longer measured in dollars, it’s counted in EGGS! Who knew omelets would be the status symbol of 2023!? Some of you reading this might even own chickens. If so, we presume you’re preparing for early retirement (j/k). Seriously though, the price of eggs isn’t likely to be the biggest economic story of 2023; so, we wouldn’t suggest divesting any of your FI’s assets into poultry production. It’s our opinion the price of eggs (like so many other things) is not so much a reflection of CPI or avian flu as it is foundational issues in currency supplies, monetary policies, and central bank efforts to stabilize aging fiat currency systems.

For most of Q4 2022 nearly the entire banking world enjoyed a healthy dose of schadenfreude at the spectacle which was FTX and the ensuing “collapse” (and ~400th death) of Bitcoin and crypto. Still, in these early days of 2023, digital assets have taken a substantial turn upward and market cap has returned to an accumulation trend, with balances growing and moving outside fiat and Bitcoin & others turning in weekly “green candles.” Even FTX itself and its fraught FTT token mounted a Q1 comeback with mysterious financial backing, reminiscent of banking bailouts, and today the much-scoffed FTT token is currently trading at $2.20 after bottoming out around $.89. Bitcoin has seen a 28% price rally in January 2023. What’s driving this? We’d argue its popular awareness of fiat instabilities coupled with practical demands for consumers and communities to preserve the fruits of their labor. It doesn’t take a ‘math surgeon’ to figure out that 28% is a better return than -6.5% (and that’s assuming that number is real inflation, and not a master’s class in bureaucratic turd polishing!). As consumers and communities press further into 2023 and continue to confront steeply climbing energy costs, commodities prices, and declining savings balances – as they see further examples that the Dollar (and other central bank currencies) may be forfeiting their most-favored status as stable “assets” – they’re likely to keep exploring alternatives for preserving the purchasing power of the fruits of their labor. Does this sound like a crazy improbability? Remember what we said at the outset of this conversation – some of the most valuable data you’re going to find relative to consumer sentiment and potential banking products is right out in the open on Twitter. It might be worthwhile to type things like ‘preserving purchasing power via Bitcoin,’ or ‘Bitcoin as a store of value’ into Twitter, and look at how many clever Tweets, YouTube videos, and TikTok videos instantly flood your feed bringing you knowledge of everything from Austrian Economics to basics of saving and wealth building! The language of financial literacy is evolving; and 2023 will undoubtedly bring further environmental and social variables which will accelerate the next dialect of financial literacy and the banking lexicon!

Of course, this is the point where the Electronic Dollar Stalwarts will say, ‘but Bitcoin and crypto are volatile and risky!’ – those predictable establishmentarians who wholeheartedly maintain faith in the permanence of our current monetary system and the eternal soundness of current social structures and centralized institutions (despite history filled entirely with examples to the contrary and ample evidence change is the constant). Sure, Bitcoin and crypto are volatile; but apparently so too are eggs, bank savings balances, and the purchasing power of the Dollar (to a degree not seen in any of our lifetimes, nor our parents’ or grandparents’ eras)! Thus, 2023 is likely to see a continuation of consumers looking to new value storage and exchange networks and ‘volatile’ new forms of money (like Bitcoin), as they continue to confront additional and undeniable examples that today’s fiat currencies and centralized monetary policies aren’t inherently providing them with the same ‘risk free stability’ it afforded their parents, or grandparents.

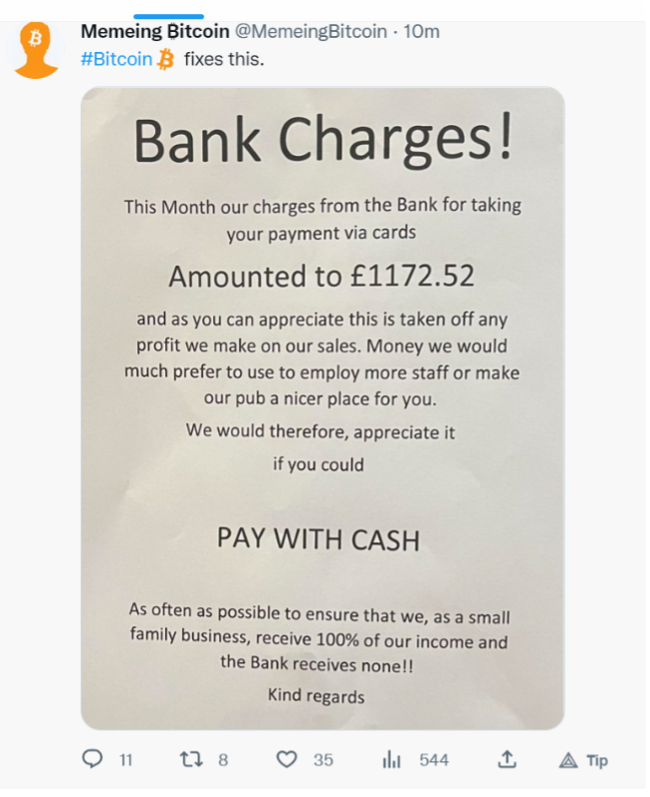

Community Partnerships (i.e., Local Merchant and Small Business Advocacy)

Although this conversation has focused largely on your banking institution and impacts of big 2023 trends on your consumers and their currency, local banking institutions shouldn’t overlook the opportunities 2023 is likely to present to partner with local business/merchants to help them adapt to the future of money as a streaming phenomenon while providing practical commercial banking products to help them remain competitive in uncertain (but certainly challenging) times. For example, if you’re on a modern core and have good control of your data, your institution should be able to easily (and profitably) build an operation to provide valuable financial products to local businesses, to bolster their competitiveness. In tight times, when Dollar values are fluctuating faster than bi-weekly pay schedules, your community retailers will be strengthened if they can offer their employees bank accounts which let them get paid when they clock out, alert them when they’re getting into ‘low cash mode,’ offer them instant liquidity to make it to payday (without pounding their credit score or requiring collateral deposit), allow them to get paid early if they need to make a critical purchase before inflation drives something out of their affordability range (like the eggs they need for that omelet they want to make their date this weekend!).

2023 will provide you with ample examples of businesses needing to be more efficient with how they handle money, including payroll, commercial deposits, and liquidity. Further, the strategies of companies like PayPal, Square, CashApp, and Mastercard/VISA should be clear indicators that merchants will be looking to tap into consumer capital in a world of declining Dollar dominance by offering/supporting ‘crypto’ payments. Which begs the question; where are those businesses and their employees going to keep the deposits for those goods exchanged for crypto or benefits paid in crypto!? Right now, the answer is simple: PayPal, Square, or VISA/Mastercard.

The economic and technical pressures and innovations of 2023 are going to influence security, efficiency, and affordability across the board – impacting all forms of commerce. Merchants and businesses will need partners to bring them up to speed on digital currency, crypto payments, liquidity on demand, etc. Learn to speak these languages in 2023 if you want to keep competing for those commercial accounts! One thing’s for sure; the local businesses and merchants aren’t going to let a legacy banking system’s love affair with a particular fiat currency keep them from engaging their customers and moving merchandise. VISA, PayPal, Square and others seem to get that…thus their 2022 investments and press releases!

Accelerating/Investing into Your Core & Control/Extension of Data

Coming all the way back around to where we started this brief excursion into the probabilities of 2023, recall that Elon (and DaLand) believe money and banking (products and operations) have an inherent problem as a result of their disparate and legacy data structures. As we’ve noted throughout, 2023 is likely to present all of us in the banking sector with some clarity around the future state of money; and we’re all but certain (ok, some of us are certain) that the future will be one where money, data, and the internet merge. Money is undergoing an evolution to a streaming phenomenon, it’s transcending the physical and morphing into the same realms music, movies, media, travel, communications, and countless other industries have ventured (or perished) before us.

All banking products and operations will need to be rebuilt as ‘digital operations,’ and that doesn’t mean offering current products and services through electronic channels and platforms, the way a member logs in to check account balances as an alternative to visiting your branch or calling your contact center. It means building digital data and money branches; designing data collection and utilization centers (not contact centers). Building digital operations will mean an institutional strategic shift past picking X, Y, or Z vendor b/c of price or app design, and rather prioritizing strategies and initiatives with the singular goal of ensuring your institution can store and process more, and more efficient, money data – whatever form that takes in the future (CBDC, Bitcoin, digital securities, digital commodities, etc.). Building digital operations will require an understanding that your institution will either control data, which is money, or it will outsource storage and control of that data to someone else (and that vendor will, by default, control the financial relationship whether they are a ‘bank’ or not in the traditional sense of the word).

Whether your strategy guides you to plug into CBDC settlement networks for a competitive edge in liquidity and funds availability, or it leads you to prevent deposit outflows by letting members vault digital financial assets at your local institution, or inspires you to help local businesses offer ‘buy now, pay later’ or ‘get paid early,’ if you want to actualize any of these likely crucial product offerings you’re going to need a modern, safe, and efficient place to store said money-data with, and an ability to interface without friction to new decentralized value storage and exchange networks. Your institution won’t be able to do that on a 30-year-old platform running an antiquated database (or databases). In a world rapidly moving toward digital cash and nearly instant settlement, data will be the connective tissue to customers, businesses, and industries. Banking operations will need to assume money lives on the internet and moves wallet to wallet, as opposed to lives in vaults and trades hands through tellers, armored trucks, plastic cards.

The paradox of community banking in the future will be to remain relevant, to maintain the position of trusted local partner and valued steward of local wealth, by relinquishing the ‘special’ position as point of entry to archaic banking data systems and ancient payments networks. Consumer and communities will move beyond these constraints, more obviously and indisputably in 2023; so too must banks if they want to remain a part of the community. Thus, you’re going to need a modern core and a core partner who prioritizes these concerns (frankly, one who has already made inroads to doing something about them or at least architecturally anticipated them, instead of primarily acquiring and selling SWIFT, NACHA, and EFT bolt-ons as their business model for the past 20 years). You can’t get more from the core without putting more into the core; and that requires a special core, and a sound strategy which embraces money-data merging with the internet. Fortunately, there are firms out there prioritizing these things and able to partner to execute these urgent strategies and actualize the accompanying crucial, multi-year change management and operational builds.

End of the Beginning

It’s easy (tempting even) to look at the impending probabilities of recessions and global banking crises in 2023 and prepare financial plans and ‘strategies’ to stop or slow investments and ‘wait out the storm.’ However, significant extra-industry data and current banking industry events suggest 2023 might be the worst year in the history of banking (not a hyperbole) to abandon the affirmative playbook for control of data in modern cores, innovation to prepare for digital money, and building operations which look beyond the exclusive electronic dollar business and associated banking retail operations – precisely because tectonic events in economies, banking, and money industry are likely to drive ‘the powers that be’ to rollout paradigm shifting plans and products which will be wildly disruptive if our community financial institutions have not at least modestly contemplated such probabilities with a modicum of corporate energy.

No doubt, devout disciples of the SWIFT, NACHA, and electronic $USD paradigm will surely laugh at these suggestions for strategic preparedness and planning in 2023 (those who presumably believe everything will always stay as it currently is with money, forever, despite that never being the case for any technology, society, or civilization ever … in all of history). Some of you won’t; some of you see the connection between the price of eggs and the emergence of new networks for storing and moving money, and you (like your consumers) see Elon (and others) making a lot of ‘sense’ when the cents aren’t adding up the way they once did.

Always here to help …