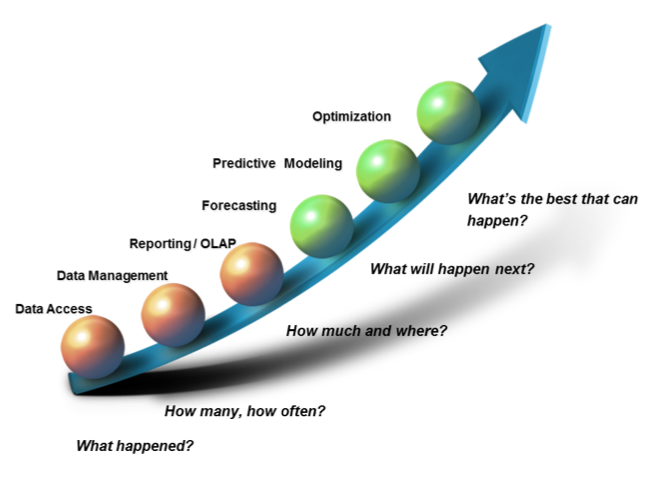

6 steps to analytics and the tools needed

A common misunderstanding with data analytics is how and when the various “tools” are used. Many think that a great data visualization tool (e.g. Tableau) will solve all of an organization’s problems. Often overlooked, however, are the many steps it takes for an organization to get from data ground zero to becoming completely analytically proficient. When it comes to data management and analytics, the order in which you introduce new tools is extremely important. In order to make each step up the analytics curve effective as the last, credit unions must consider the following steps:

- Data Access – The first step in an analytics strategy is simply getting access to the data necessary for analytics. Although this may seem like a fairly easy task, credit unions may find it difficult to get access to the data they are looking for. It may be due to the level of skill needed to the extract the data or due to a vendor’s unwillingness to provide the data. Whatever the challenge might be, data access is an extremely important task in becoming analytically proficient and will need to be tackled right away.

- Data Management – Data management may be the most difficult step in the process of becoming analytically-driven credit union. It is also the most important step. The data management step typically involves a data warehouse or data model. The data model is the foundation of all of the following steps: Reporting, Forecasting, Predictive Modeling, and Optimization. Without a solid data infrastructure, analytics is incredibly difficult (near impossible). The data model is the “middleware” that drives all of the analytics. Although it may not always be visible to the end users, it is definitely the most important part of part of data analytics, just as an engine on a car is the most important part of driving the car.

- Reporting – Reporting, also known as descriptive analytics, is the most simplistic form of analytics a credit union (or any organization) can utilize. While reporting is possible with tools such as MS Excel, it becomes increasingly difficult as multiple data sources and volumes are introduced. Performing trending analysis, from multiple different source systems requires a data warehouse and, more than likely, a more advanced data visualization tool (e.g. Tableau) that can handle larger data sets than MS Excel.

- Forecasting – Forecasting is the process of making predictions of the future based on past and present data and analysis of trends. It allows credit union employees to make data-driven decisions that reflect the predictions of the future and ask “what if” questions. With the ability to more accurately forecast and run various scenarios, credit unions will be able to better serve their members and improve business processes by allowing them to tailor their daily activities to the organizational goals. Data visualization tools (i.e. Tableau) allow credit unions to run many different scenarios and the resulting decisions they could make to prepare for the future. The power to forecast the future through data analytics empowers credit unions to stay ahead of the ever-changing financial services industry.

- Predictive Modeling – The ability to predict the future is one step ahead of forecasting. Instead of running a scenario such as “what if our net interest margin increased by X%,” predictive modeling allows the credit unions to actually increase their net interest margin intelligently. The credit union can look back at years of history and predict future risk of their current loan portfolio and a member’s likelihood to default in addition to what they already know using FICO. Storing historical data is much more complex than simply collecting files and storing them away. The data must be gathered in a manner that prepares it for prediction of the future. Big data tools (i.e. Hadoop) and other relational database tools (i.e. SQL Server) must rally around a predictive model to bring predictive analytics and automated decisions to credit union leaders.

- Optimization – In order to optimize data, credit unions must invest first in a data model and their predictive models. Once the data model is established and has a wide range of data (along with a lot of history), credit unions will be able to optimize their data. Using optimization tools such as Hadoop will be necessary once the infrastructure is in place. As decisions are made around the predictive analytics, patters will emerge and the tool will be able to recognize them (machine learning). As the tool “studies” the history of trends and patters found in the predictive data model, it will optimize decisions based on previous results. For example, if a marketing campaign targeted at certain members produces a new set of data, the tool will bring this data into the data model and optimize the predictions it interprets from the data.

In conclusion, Analytics is a journey. It requires several processes and ordered steps that cannot be skipped. It is often thought that the better the “tool” you have, the better you analytics will be. While this is true, there needs to be an order in which these various tools are rolled out. Data infrastructure or data model is the most important step but is often overlooked because it is middleware. Without it, tools such as Tableau and Hadoop are cannot assist in the part of enterprise data analytics.

Credit unions must use their data to remain relevant in the ever-changing and extremely competitive financial services industry but they must do it right. Jumping into a data visualization or “big data” tool (e.g. Hadoop) without establishing the underlying data infrastructure first can result in a failed analytics program with several unnecessary expenses. Credit unions must first get access to their data and then begin developing the data infrastructure necessary for analytics. Once this is done, credit unions can start exploring more advanced tools (e.g. Tableau and Hadoop).