A Virtuous Growth Cycle for credit unions

There are a lot of hot topics in the credit union space today, including three that are near (and dear) to my heart: serving the underserved, loan growth, and the ability to attract and leverage secondary capital. When these three things come together, amazing things happen – both to the individuals and communities credit unions serve, and in terms of tremendous credit union growth.

What it looks like

I recently spent several days with my friends at Mendo Lake Credit Union (MLCU) in Ukiah, Calif. MLCU, with $200 million in assets, is a best practice example of a Virtuous Growth Cycle.

MLCU’s Virtuous Growth Cycle began with its strategic focus and commitment to providing loans to its lower-income, Hispanic, and Native American Communities (ask anyone on their team, and they will tell you their “ why”). Over the years, MLCU has become expert at lending to this higher-risk market with lots of success; helped thousands of people improve credit scores and improve their quality of life; become entrenched in its community by securing scores of community partnerships, each committed to serving the underserved; seen higher morale and staff engagement; and experienced the financial benefits of higher net interest margins and high loan deployment. What more could you ask for, right? Believe it or not, there is more that can come from a foundation of serving the underserved: secondary capital.

As part of approximately 2,200 Low-Income Designated Credit Unions, MLCU has the regulatory flexibility to accept secondary capital. Since 2005, MLCU has leveraged its strong lending practices to underserved communities and extensive community outreach to obtain U.S. Treasury CDFI grants for secondary capital. Between 2005 and 2011, MLCU received $4.9 million in grant funding that has been used for capital to leverage growth. With this capital, the credit union has had the resources to leverage growth 166 percent. Today, MLCU is a vibrant, larger – and most importantly, relevant – best practice credit union.

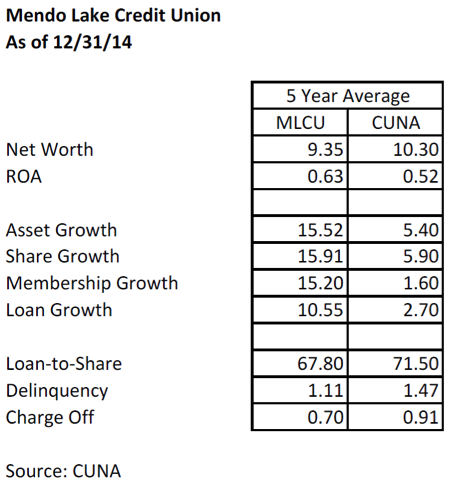

Here’s a look at how MLCU’s-five year annual averages compare to the rest of the credit union space:

Access to secondary capital

Secondary capital access for Low Income Designated credit unions has long been one of the best-kept secrets in credit union land, but that is changing with credit unions of all sizes in pursuit of a better understanding of secondary capital flexibility with the lower-income designations and best practices in serving these lower-income markets. (Click here for more information regarding the designation and secondary capital.)

MLCU accessed secondary capital through U.S. Treasury CDFI grants (Click here for more information regarding the CDFI Program), but there are other sources available for secondary capital through subordinated debt. Secondary Capital Loans are subordinated, long-term (five years or more) debt available to credit unions with low-income designation from their regulator. Secondary capital can count as part of net worth for regulatory purposes, and as such can help growing credit unions achieve the required minimum capital standards.

The National Federation of Community Development Credit Unions is one source for secondary capital loans. The Federation makes Secondary Capital Loans of up to $1 million. (Click here to learn more about their loan program).

Another source of secondary capital loans is credit union to credit union. Low Income Designated credit unions have learned how to approach peer credit unions for subordinated debt. This is a great opportunity for credit union collaboration. The receiving credit union benefits from access to secondary capital, and the investing credit union benefits from higher investment yields and a deeper relationship with the credit union partner.

Why it matters

The Virtual Growth Cycle is important in many ways:

Serving underserved markets support strong purpose and profit. The fact is that underserved communities are growing, ranging from low- to moderate-income blue collar workers to emerging Hispanic/Latino markets. These markets are exploding and represent huge opportunities for fulfilling our core credit union focus. As so many best practices reflect, these communities are a rich source of profitable loans and potential growth. It might surprise you to know how many large credit unions have focused in on these communities to fulfil purpose, profit, and growth. Most of the credit unions I consult with these days are mid-sized and large credit unions.

Advocacy. I was fortunate to hear Jim Nussle, CUNA president/CEO, speak at the CUNA Community Credit Union Conference that was held jointly with the National Federation of Community Development Credit Union’s annual meeting. In his remarks, Mr. Nussle said that it’s time for the movement to marshal a credit union advocacy army. He said that it’s an advocacy army that we need to create in order to change the game.

I couldn’t agree more. Adding my two cents worth, I can’t think of a stronger national advocacy message than the Virtual Growth Cycle at a time when minority populations are exploding and in need of credit and education; millennial populations have more of a debt burden than any other generation; 55 percent of the national consumer base has sub-prime credit; and consumers who haven’t seen real wages grow in a decade. It’s this kind of advocacy that wins the argument for secondary capital access for all credit unions, and that will lift the MBL cap for all of credit unions. After all, it’s the Virtuous Growth Cycle that paved the way for NCUA to approve secondary capital and eliminate the MBL cap for all of the 2,200 Low Income Designated credit unions.

Now is the time for a consumer advocacy renaissance in reaching out to and serving the underserved markets. We all know that this market worked for us in the past (circa 1934) and its working again today in so many markets across the country. Our national and statewide advocates need more stories from us about how we serve our underserved communities. We need more credit unions to get involved in the profitable lending and extensive community partnerships that are available as well. Finally, we need more credit unions to embrace the Virtuous Growth Cycle for the benefit of their members, their communities, their bottom-lines, and greater regulatory relief.