Active or passive funding strategy – Tug of war

The Fed is still on course to raise interest rates 25 basis points in June. This would be the second rate increase in 2017, despite a GDP reading of .7 percent year over year, and inflation running below their stated goal of 2 percent. Other recent data points include solid job gains and a declining unemployment rate under 5 percent.

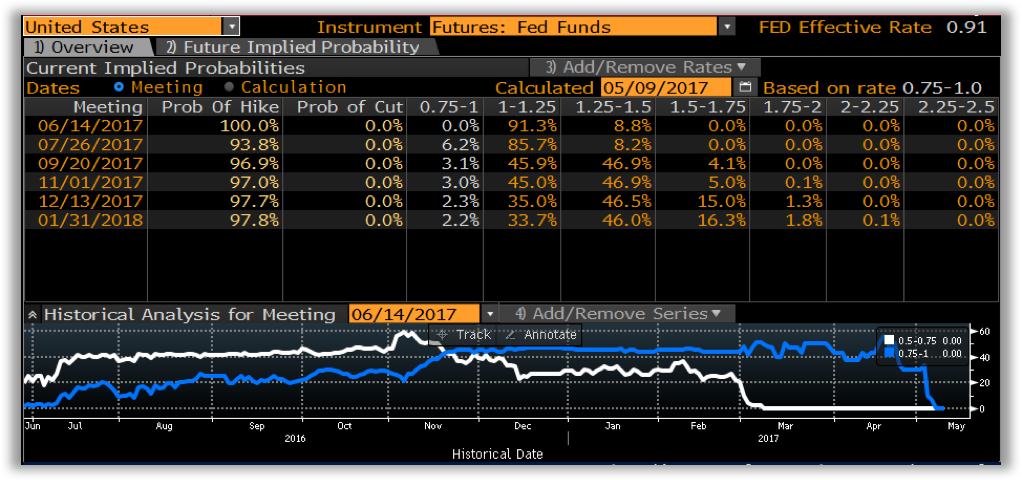

Bottom line – the implied probability of a June 14th rate hike is now 100% (as of May 9, 2017).

With this in consideration, what impact will a rate change have on your institutional MMA and DDA depositors? Based on your current pricing model, do you anticipate an increase, decrease or stability amongst this group of depositors? What is the end goal; funding stability through an active model or funding volatility utilizing a passive model? These are important questions to address early on in a changing/volatile rate environment. Your pricing strategy will predicate the level of funding stability.

For example, envision pulling on a rope from both sides (tug of war). On one side, there is pricing strategy, and the other is funding stability. Depending on how hard either side is pulled, the amount of resistance will determine your stability. In a changing rate environment, if you’re experiencing decay, (whether rapid or persistent) you’re out of equilibrium in your pricing.

Although the FOMC meeting is next month, market based rates have continued to ramp up in anticipation of this rate hike. The greater the probability the Fed will increase rates, the greater the impact it will have on other fixed income investments. The below graphic illustrates the spread differential of one month LIBOR to Fed Funds. Investments such as overnight repo, FHLB advances, agencies, treasuries and commercial paper increase in yield leading up to the Fed increase.

What does this mean to you? Your institutional investors are actively being solicited (pulled at) by competing fixed income investments through investment advisors, broker dealers and other financial institutions. If you are deploying a passive pricing strategy where you are in a holding pattern until after the Fed movement, then you need to assume that you’re not in equilibrium. You will begin to experience some decay amongst a percentage of your instructional depositor base. With each Fed modification to the overnight rate, your depositor base is continually being solicited, (pulled at) which will lead to an eventual acceleration in the decay rate. Back to the rope example, the greater the force out of equilibrium, the greater the impact on the shift. The rope scenario is dynamic, as is your decay rate.

What is the end goal: an active or passive pricing/funding strategy? Typically, financial institutions hold between 60 to 80 percent of the liabilities and non-duration accounts. If one is looking to reduce reliance on institutional investors, a passive strategy may be acceptable. If not, the passive strategy may end up costing more with heightened volatility than an active market-based strategy.