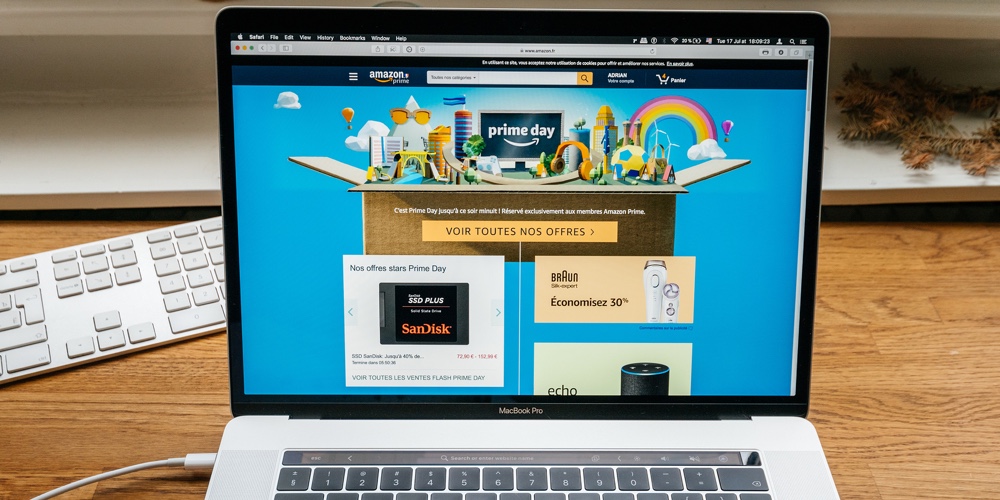

Amazon Prime Day is coming: Will your card be top of wallet?

From July 15th to 16th, consumers around the globe will flock to Amazon to take advantage of the digital retailer’s fifth-ever Prime Day. Promising a “two-day parade of epic deals,” Amazon and its retail partners stand to win big, with transactions expected to reach over $1 billion. Card issuers also win big during Prime Day; last year, the number of Prime Day transactions inside the CO-OP credit card portfolio saw a 41-percent jump compared to the previous year, and we expect the trend to continue this year. (We’ll be sharing the data from this year’s Prime Day in a few weeks – stay tuned!)

Thanks to the rapid rise of e-commerce and the success of online shopping events like Amazon Prime Day and Cyber Monday, the competition for the default card spot on digital transactions has increased significantly. Particularly with Amazon, which leverages its patented “1-Click ordering” feature to allow consumers to bypass the checkout process almost entirely, card issuers, retailers and even Amazon itself are competing to land their cards in the default position. They do this through a combination of targeted campaigns, special rewards and cash-back offers. Target, for example, is offering its closed-loop cardholders an extra 5-percent cash back for online purchases made during the 2-day Prime window. This is on top of the 5-percent they already get.

Credit union card issuers are getting in the game, too. Several of CO-OP’s most progressive credit unions already are offering really exciting perks to Prime Day shoppers. In partnership with our SmartGrowth Consultant Services team, credit union card issuers have launched special rewards campaigns to encourage members to set their credit union card as the default payment, not only in Amazon but other e-commerce retailers, as well.

continue reading »