Credit unions need to embrace analytics to improve their member’s experience

There continues to be an increasing availability of data with the potential to drive improvements in the member experience and overall revenue growth for credit unions. In spite of the availability of member data and a new generation of lower cost data management technologies, credit unions continue to significantly lag behind their for profit competitors. These new capabilities have the potential to significantly transform the effectiveness with which credit unions market to their member base. The real challenge for CU management is how to develop these new capabilities in a culture that resists this change and in many cases sees it as a challenge to their credit union mandate.

As member’s service preferences evolve the necessity of being able to identify the effectiveness of these various service platforms becomes a critical component of a successful marketing and member service strategy. Members in increasing numbers are moving from traditional media and service platforms to more digital, online and mobile platforms. This trend increases pressure on CU management to better understand the dynamics behind this shift and to adjust marketing and member servicing strategies accordingly.

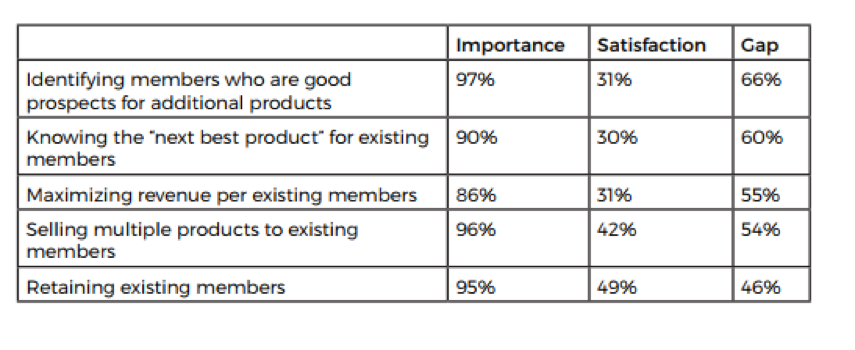

The chart below from a recent study titled, “The State of Data Technology in Credit Unions” conducted by the Filene Research Institute, illustrates the gap in the perceived importance of member data and analytics capabilities and their “satisfaction” with their current competencies to carry out these functions.

In the illustration above, the gap number is dramatic. Senior management is acutely aware of the importance of these activities and are clearly dissatisfied with their ability to cost effectively acquire new members, adopt new data driven marketing techniques, and their ability to improve the member experience through needs based cross-sell to existing members.

The sizable gap between the importance of these activities and the ability to effectively implement them is a warning that credit union management must begin to take seriously. How can they continue to effectively compete with their bigger, better funded competitors? It’s simple, do what you’re doing now…just better.

Credit unions have managed to become integral to their member’s banking needs; by offering local, personalized, value-based, hands-on service. In this type of environment, members primarily drive the interactions/transactions with credit union associates. CUs need to be ready to come to these member encounters armed with data and ready to provide pro-active needs based cross-selling.

Effective cross-selling is an ongoing process that matches members’ specific banking needs with the appropriate CU product/service delivery. The ability to match member segmentation with specific banking behaviors supports identification of the appropriate next product sale. By cross-selling a suitable product – one that fits the lifestyle and financial needs of your member – your CRM program simply improves your ability to deliver on the programs you already have in place. To be successful your data analytics must support the culture and goals of the organization.

Since members use many different service platforms to interact with their CU it is important that your CRM messaging be consistent across all platforms. If you are beginning to use a member database to deliver direct marketing to targeted member audiences you now not only have the ability to better control your messaging, but to test various messaging as well. This can help your marketing team to determine what specific content works the best with various member segments.

The upside sales potential of data driven CRM programs can be a source of significant growth for credit unions. This past year we have seen initial single product member households range from 32% to 36% for some clients. This data is developed from the first time member based analytics offered by EmpowerYourAnalytics.com. Targeting these one account members can benefit credit unions in two ways;

- Provides a low cost way to grow deposits and loans balances

- Increases customer member by increasing the number of accounts per member

Of course these single account members are not a homogeneous group; age, income, account opened date, product type and usage patterns can all be important data in creating a predictive index for creating an appropriate product cross-sell by defined segment.

Embracing your analytics not only means being able to collect member data (inside & outside the CU) and analyze it, but to be able to inject these new found insights into the decision making apparatus and marketing implementation processes of the credit union. It’s critical to your success that your advanced analytics is not a functionality that you purchase and hire people to manage.

Integrating this new data-driven functionality into all your decisions helps you to maximize the value of your data. This happens by helping you make smarter decisions and as a result creating more effective marketing. Helping you do what you do…just doing it better.

If it is such a critical element to the future growth of credit unions, why do so few CUs fail to embrace their member data analytics? The short answer is; “it’s complicated and expensive.”

In a credit union, individuals in the leadership team wear many hats, and for the most part no one just wears the marketing hat. So the first challenge is the lack of expertise in-house for collecting, analyzing and making actionable these new member insights. This inexperience also makes it difficult to evaluate a reliable external resource to shepherd you through designing and implementing an advanced analytics functionality. It is important when selecting a data analytics partner to help you design and implement a data strategy, to interview several potential vendors, ask the tough questions, talk with some of their current clients and make sure they are a good fit for your culture and ultimate goals.

In my experience it is not just the lack of expertise, but the lack of available resources in general. Small credit unions have been facing years of tight operating margins. It’s no surprise that over the years this largest single expense (salary & benefit) have slowly been cut as a percentage of overall expenses.

Expense many times is another fundamental reason why credit unions are reluctant to roll the dice with an advanced analytics solutions. In general terms, the average $400mm CU has anywhere from 45,000 to 50,000 individual accounts. This is a rough cut number based on averages and these accounts can represent 15,000 to 20,000 member households.

With many of the larger analytics packages being offered by the bigger Fintechs, set-up costs can be as much as $50,000 with monthly fees expected to be $2,000 to $5,000 per month. This is much too large an expense to be spread over only 15,000 members, making an acceptable ROI unattainable.

With all these challenges, how do credit unions begin using data to improve the member experience and drive improved revenue growth?

From discussion with our clients, smaller CUs are looking for an advanced analytics solution that can deliver on several levels:

- Provides a strategic perspective, it begins the longer term process of building an integrated functionality that maximizes the value of the CU’s member data.

- Offers an educational component, increasing internal expertise.

- Value based pricing. A product that starts at the base line for working with data analytics and offers the flexibility to grow and conform to the specific needs of the institution.

- A means to validate the business case. This means verifying that the additional expense for implementing advanced analytics increases marketing effectiveness to the point that it reduces the acquisition cost per new member or product cross-sold.

- A member database provides the tools to identify segments of members, their relative value to the credit union and the development of predictive measures defined by segment/product to make this information actionable.

Being able to fully embrace your data analytics includes all the attributes above. Our experience is that the most successful case studies show CUs launching their new functionality in an incremental manner – learning and validating at each step. This methodology increases the chances of success in that each credit union can progress at their own speed and configure its data analytics program specifically to its unique needs.