Evolution of the NOL Could Affect Future NCUSIF Payouts

Credit unions will receive an equity distribution from the National Credit Union Share Insurance Fund (NCUSIF) for the second year in a row, but the prospect for future payouts is uncertain. Much will depend on whether, and how quickly, the normal operating level (NOL) returns to its traditional level of 1.30 percent.

Based on the NCUA’s final 2018 NCUSIF audit, the equity ratio on insured shares stands at 1.39 percent – higher than the current NOL of 1.38 percent. During its December meeting, the NCUA Board approved a decrease of the NCUSIF NOL from 1.39 to 1.38 percent, effective immediately.

The latest figures for the Share Insurance Fund reflect the impact of a number of notable recent events, including: the merger of the Temporary Corporate Credit Union Stabilization Fund (TCCUSF, or Stabilization Fund) with the SIF in October 2017; an increase in loss reserves from $286 million to over $925 million in the fourth quarter of 2017; the announcement of a $736 million distribution to insured credit unions in February 2018; and the failures of several credit unions with concentrated holdings of taxi medallion loans in 2018.

Background on the NOL

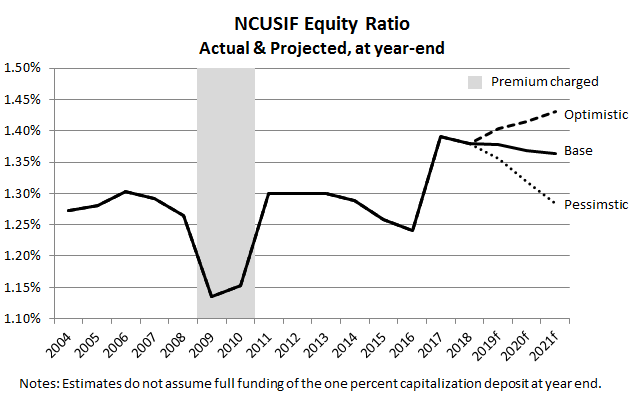

The NOL functions as a ceiling for the amount of equity held in the SIF. If the equity ratio ends the year above the NOL, NCUA must provide a distribution to credit unions in the amount of the surplus equity. On the other hand, NCUA may charge a premium if the equity ratio drops below 1.3 percent and must charge a premium or establish a restoration plan if the equity ratio drops below 1.2 percent. If a premium is charged, the amount of the premium is at NCUA’s discretion, but it must return the equity ratio to at least 1.2 percent and no more than 1.3 percent.

In 2017, NCUA merged the TCCUSF with the SIF and also raised the NOL from 1.3 percent, where it had historically been, to 1.39 percent. The increase in the NOL effectively reduced the amount of the 2018 SIF distribution to credit unions by roughly $1 billion. NCUA justified the increase on the grounds that a higher NOL was needed to absorb the projected loss of equity that would accompany a moderate recession over a five-year period.

Based on NCUA’s forecasts and using the NOL as a starting point, a moderate recession would lead to a loss of equity that would drop the equity ratio to 1.2 percent over five years. NCUA’s selection of an NOL is intended to prevent the need to charge a premium in the event that their scenario plays out. Using the 2017 NOL of 1.39 percent as an example, NCUA forecasted losses equal to 19 basis points of insured shares over the following five years assuming recessionary conditions.

NAFCU Fights for Credit Unions

The increase in the NOL was a key concern for NAFCU at the time that NCUA’s merger plan was proposed and was a major reason why NAFCU ultimately opposed the merger. A 1.30 percent NOL has proven to be adequate for the SIF to absorb the stress of a recession. Since Congress established the NOL as the de facto cap on the SIF in 1984, the NCUA Board maintained it at no more than 1.30 percent until 2018. In raising the NOL to an unprecedented level, NCUA provided no assurances or timeline for unwinding it. NAFCU remains opposed to the increase in the NOL, and strongly believes that the nearly $1 billion of additional equity that currently resides in the SIF due to the elevated NOL could be put to better use by credit unions in the service of their members.

At its December Board meeting, NCUA announced a reduction in the NOL for 2018 to 1.38 percent. NAFCU is pleased that this policy change could potentially mean more funds returned to credit unions in 2019. However, there is still no compelling reason why the NOL should be above 1.30 percent. Moreover, a reduction of just one basis point inspires little confidence that the agency views 1.30 percent as a “normal” NOL to be targeted under typical conditions. Rather, it appears likely that the NOL is permanently unmoored from its traditional level. Read more of NAFCU’s detailed analysis and forecast of the SIF.

Learn Your NCUSIF Distribution

Credit unions can learn the amount of the distribution they will receive from the NCUSIF in 2019 with NAFCU’s updated SIF calculator, which is available for members to download. The calculator reflects the latest figures shared during the NCUA board meeting on March 7, 2019.