CUSOs: People helping the people who help the people

What is a CUSO and why should I care?

CUSOs (Credit Union Service Organizations) are corporate entities that are owned by either federally chartered, federally insured, or state-chartered credit unions—they are part of the credit union movement and share the same cooperative spirit as credit unions do. The CUSO concept has been around for about 50 years. Today, there are nearly 1,000 registered CUSOs in the U.S. (992 as of Dec 31, 2020 according to the latest NCUA data). Many CUSOs are owned by more than one credit union and the profits generated are returned to their owners and/or represent investment equity on the credit union’s balance sheet.

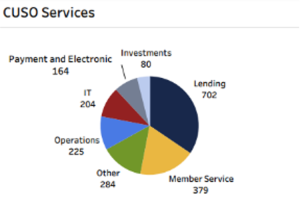

You may be familiar with a few of the larger CUSOs—like PSCU or CO-OP, for example, who serve many credit unions, but there are many smaller CUSOs that focus on specific products and services, for example IT, or credit card portfolio management, or mortgage underwriting and servicing. Large or small, CUSOs were started to provide special benefits just for credit unions.

Why are CUSOs important to credit unions and the credit union movement?

CUSOs care about the credit union movement because they are part of that movement–they focus on and understand the unique needs and practices of credit unions. Through the cooperative framework, credit unions can access CUSO services without having to spend precious resources to develop them within their own credit union—tapping into a “shared services” model.

Rather than focusing solely on profit, CUSOs focus on the economic well-being of credit unions and their members. The cost for services is typically lower from a CUSO than on the open market and your ability to work collaboratively as true partners is normally much greater in a CUSO than in other for-profit businesses. Many credit unions are already benefiting from CUSOs, saving time and resources that can be applied more effectively for the benefit of its members.

Why you should consider outsourcing certain tasks to a CUSO.

Today, small- and medium-sized credit unions are finding it more difficult to stay on top—providing members with competitive products and services and controlling expenses across the organization. Credit unions succeed by making good loans, attracting deposits, and keeping members happy. Everything else are core business functions that all businesses require. Traditional back-office functions, while key to running the business, are “table stakes” for any credit union. Since all credit unions need them and they are the same in how they are performed, outsourcing these common activities to a CUSO can help create economies of scale, access more experienced talent, and focus on what credit unions do best—helping members with their financial health and well-being.