Delivering insights and inspiring ideas at GAC

As part of the CUNA Governmental Affairs Conference, CUNA Mutual Group brought industry leaders and members together to explore three shifts in today’s American reality.

Our Members Live event – now available to watch in this series of short videos – focused on how the changing faces of work, family and Gen Z are affecting members’ financial needs, and provided credit union leaders a deeper understanding of consumer preferences, attitudes and how they can reach more members in the future.

Workplace and Career Realities are Changing

Today’s American workers have experienced corporate restructuring, consolidation, downsizing and layoffs in recent years, leading many to work for themselves as freelancers. In 2015, a third of the U.S. workforce was freelancing.1 By 2020, this number is expected to grow to more than 40 percent.2

While self-employment has a lot of advantages, it doesn’t come without risk. Many freelancers worry about the rising costs of healthcare, saving for retirement and unpredictable income, which may contribute to 77 percent of hardworking Americans reporting that they could not come up with $5,000 for an unexpected need.1, 3

Learn more by hearing how Ray Liberio and Armand Lockett approach finances as freelance workers.

The American Family is Changing

American family dynamics have changed dramatically in the last few years. A record number of Americans now live in multi-generational households with many of these families caring for both children and aging parents.4 According to the U.S. Administration on Aging, 65 percent of the elderly rely exclusively on family and friends to provide them with day-to-day assistance.5 Single-parent homes have increased significantly over time as well with a third of U.S. children now living with only one parent – up from just nine percent in 1960.5

In addition, there are more than 8.5 million Americans who identify as gay, lesbian, bisexual or transgender.6 These individuals can be faced with unique financial needs, such as the expenses related to starting a family through surrogacy or adoption. A recent survey of 1,800 LGBT persons showed that 62 percent had concerns about being denied a home mortgage for orientation – not financial reasons. 6

Learn more by hearing how Jamesetta Fousek’s family dynamics influence her financial needs.

Gen Z is Emerging

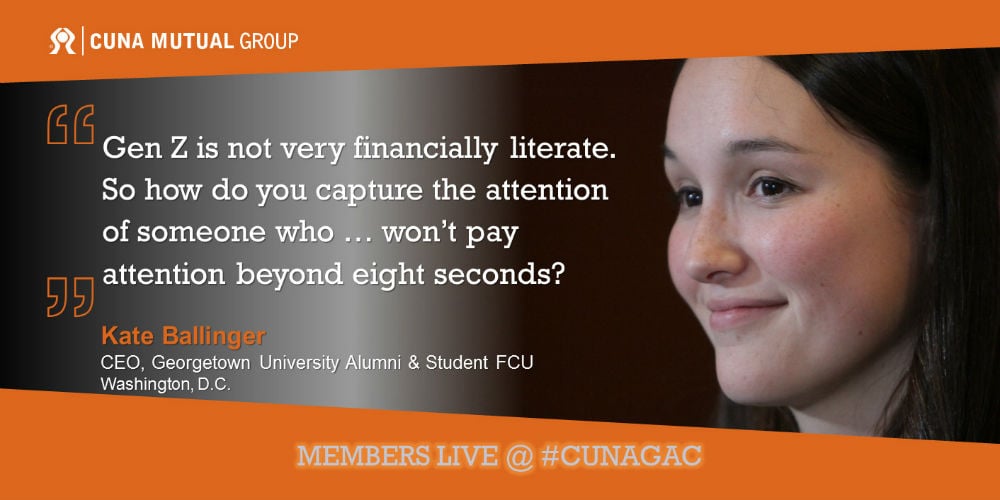

From toddlers to college students, Gen Z is the newest generation and is emerging as a powerful force. There are nearly the same numbers of Gen Zers (82M) as Millennials (83M), and in fact, there are more Gen Zers than Baby Boomers (76M).7 Gen Z already has $44 billion in purchasing power and that is expected to grow.7 These kids – some young adults already – are tech-savvy, independent, mature, and ready to figure things out. They live in a 24/7 “smartphone” culture, and are in constant contact with each other.

Media and market research companies have labeled Gen Zers as screen addicts with limited attention spans.8 A recent article published by the Fast Company suggests something different. While the research says this generation has about an 8 second attention span9 – note that’s less than a goldfish which makes it 9 seconds9 – Gen Zers will tell you that they have an 8-second filter. You’re either interesting in 8 seconds or less … or you’re not.

Learn more by hearing from Gen Zers Kate Ballinger and Katie Berding.

We Can Lead as a Movement

For credit unions, these changes are an opportunity to deepen member relationships by focusing on how best to serve members and their families, regardless of definition, age or career choice, and build an unmatched member experience for today, and more importantly, for generations to come.