Disparate impact: Why it’s more than just a regulatory issue

There has been a lot of discussion over the last couple of years regarding Disparate Impact and Fair Lending Testing, specifically in regard to the NCUA requiring credit unions to prove they are not treating members differently based upon being a member of one of the protected classes.

Intentional or inadvertent disparate impact is basically when a credit union policy, intended to reduce risk, causes members of a certain class to be treated differently than the whole. For example, a minimum income requirement to get a loan could inadvertently prevent members who are retired from getting a loan, even though they would otherwise qualify. Most credit unions would never even think of treating members differently because of their age, sex or race. But, many would be surprised at the results of a Fair Lending Test. Therefore, it makes more sense that credit unions would want to test for disparate impact to ensure that members are treated fairly, rather than testing simply to meet regulatory requirements.

The issue with validating a credit union’s lending procedure’s fairness is that the information required for establishing whether an applicant is part of a protected class, in most cases, cannot be collected. For example, one may not ask a borrower’s sex or race, and may not even so much as keep a copy of a member’s driver’s license in the loan file. Therefore, how are credit unions expected to test for disparate impact if the very regulations intended to prevent them from discriminating precludes them from testing? Thankfully, there are some procedures that have been used, while not precise, promise to make the process much easier. One of those procedures is called Bayesian Improved Surname Geocoding (BISG), which measures the probability of a person’s race based upon their last name and zip code.

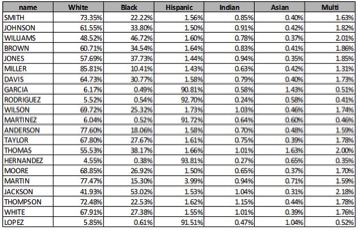

We won’t go into detail regarding the formula here, but will explain how it works. Thanks to the Census Bureau, we are able to know what the probability of a person’s race is based both on their last name and where they live based on zip code information. The Census Bureau actually has a list of the most common last names in the U.S. and the probability of race for each name. The chart below illustrates the information available.

Notice that according to this chart, a person with a last name of Smith has a 73.35% probability of being of White and a 22.22% probability of being Black. Comparatively, a person with the name Hernandez has a 4.55% chance of being white only and a 93.81% chance of being Hispanic. It is much easier to establish a Hispanic or Asian person’s race based on last name alone as the surnames are consistent. However, depending on surname, it is much more difficult to distinguish White from Black. For this reason, BISG uses zip codes to further pinpoint race by combining the probability of both surname and residence. The chart below is an example of the Census zip code data.

The probabilities of surname and zip code are combined using the Bayesian Theorem formula and the highest race probability is assigned to the borrower. Once the race is determined, it is simple then to test the various application attributes to discover disparate impacts.

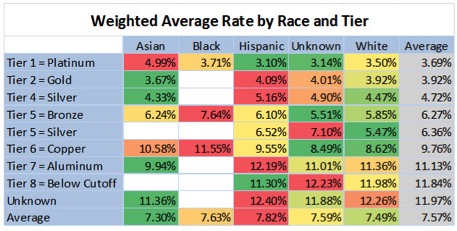

Isolated incidents of disparate impact should not be concerning, however trends should alert the credit union that changes should be made. In the example above, Weighted Average Rates are highlighted as they relate to the average, or control set. It is clear, based on the color coding that both Hispanics and Black borrowers are paying consistently higher than average rates. It is also clear that whites are either charged average or below average rates. What may not be clear is, why? But, at least, at this point the issue has been identified.

Credit unions are supposed to be fair to its members and should not, even inadvertently, treat members differently based on any of the protected classes. For this reason, credit unions should embrace the fair lending test, not just for regulatory compliance, but to ensure that members are treated fairly. While it may be difficult and time consuming at first, the investment will pay off in the end.