Does Instacart know me better than my credit union?

Credit unions have a long history of providing superior member service, especially compared to the other players in the financial services industry. But as our culture evolves beyond a demand for excellent service and moves into a focus on experience, credit unions are faced with much steeper competition. Consumers expect the same level of streamlined, intuitive, and personalized digital experiences from their credit unions that they have come to love from behemoths like Amazon, Uber, Spotify, and even grocery delivery company Instacart.

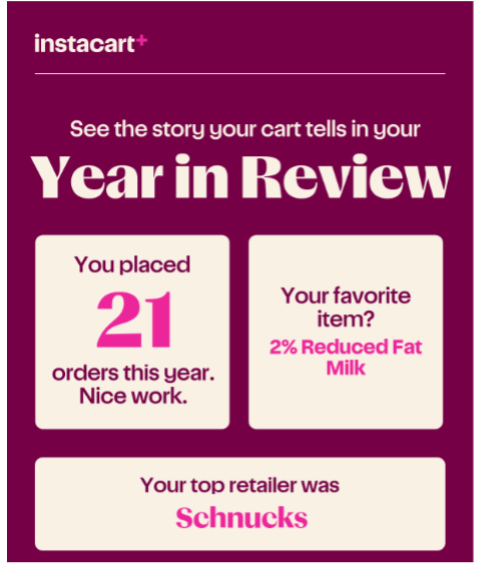

As a long-time champion of the credit union industry, I am acutely aware of experiences and always searching for connections to the credit union space—especially when those experiences include strategically placed data. So, in December of 2022 when I noticed an email from Instacart with the subject line “Added to cart: Your ’22 Year in Review” my interest was piqued.

Warm, Fuzzy Feelings…from an email?

I love a good reflection, so I eagerly opened the email (which was buried amongst hundreds of neglected unread emails still waiting for their time to shine.) I enjoyed reviewing the number of orders I had placed, where I had placed them, and my “favorite item” which is apparently 2% milk. While fun to see a quick review, this data didn’t particularly surprise me. After all, I was the one who placed the orders so I had a good sense of the frequency, location, and items included.

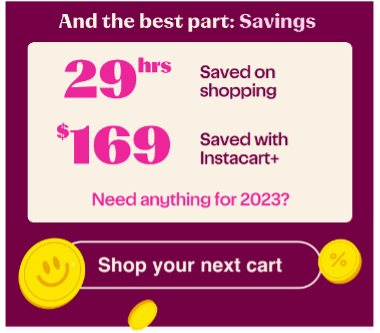

What really delighted me was the next section in the email. They had translated my behavior into actual, tangible value. Instacart had done their homework and calculated the average time it takes to shop an order in store and calculated that time savings specifically based on my transaction history! Seeing that Instacart had saved me 29 hours gave me such a warm, fuzzy feeling. As a busy working mother of two young children, time is my most precious asset. So knowing that Instacart gave me 29 hours—more than a full day—back to spend however I chose, rather than wandering the aisles in the grocery store, was huge for me. And it’s a strategic move for Instacart as well. When my subscription comes up for renewal in a few months, it will be a no brainer.

How does this translate to credit unions?

When reading this email from a grocery delivery service, my mind went straight to my relationship with my credit union. Instacart represents a sliver of my life: grocery shopping. My credit union certainly has much more data on me and should know me much better than Instacart. What if they used their data to show me the value I am getting out of being a member? Below are just a few quick examples of ways they could do just that.

- Dividends Earned – Growing deposits continues to be top of mind and many credit unions are offering highly competitive rates. In order to protect and even grow your deposits, consider sending each member an email personalized with their dividends earned in the past year. To go a step further, you could translate the total into things your member could have purchased with their earned dividends! Dollars could be translated to anything from cups of coffee to tanks of gas or even larger items like a car payment.

- Interest Saved – Credit unions typically offer the lowest interest rates for credit cards, consumer loans, and mortgage loans. Consider scanning your market to find the average interest rate for each of your loan products. Then you can use the data you have on your members to pull the types of loans they have and their actual interest rates, and calculate their savings compared to the market average.

- ATM Fee Refunds – Do you offer refunds on other financial institutions’ ATM fees? Use your data to calculate the total number and dollar amount of fee refunds and an average amount of time it would cost the member to drive somewhere else to find an ATM if they did not enjoy that perk. You can then send your members personalized emails showing the dollars and hours they saved.

When you are working through the logic and messaging, it’s important to be aware of your audience. When translating your dollars or time estimates into other items, consider what will resonate with different segments of your membership. If a member doesn’t have an auto loan, it won’t make sense to brag that your dividend payments covered a car payment. Also, not all calculations will result in significant savings and in some cases, there may be no savings at all. Sending emails to these members would likely have an adverse effect. Determine an appropriate threshold and only send messages to members who have met or exceeded that amount.

Gathering the data to make this happen

No doubt your credit union is providing immense value to your members, so taking the opportunity to highlight that value is an excellent way to generate loyalty. As with many projects that leverage data, it can be overwhelming thinking about where and how to get started. The first step is deciding what you want to do and then you can work on a plan to make it happen!

One way to choose what to tackle first is to consider the data available to you. Credit unions who are bringing data from multiple sources into a single location will have many more options than credit unions who have not yet leveraged a multi-source data warehouse. Lodestar Technologies has both the technology and the talent to help you harness the power of your data and develop an actionable strategy to put it to use. Learn more at lodestartechnologies.com or contact us using the form below.

Please select a valid form